Janus Henderson: India - country at a crossroads

Following a recent research trip to India, Sat Duhra, Co-Manager of the Asian Dividend Income Strategy with Mike Kerley, shares his thoughts on the key challenges currently facing the world’s most populous democracy.

19.07.2017 | 08:44 Uhr

At a glance, the Indian stock market is one of Asia’s top-performing markets, and would normally be associated with a strong macroeconomic backdrop and robust corporate earnings. Fundamentally, however, the picture is quite different.

Bad loans rising

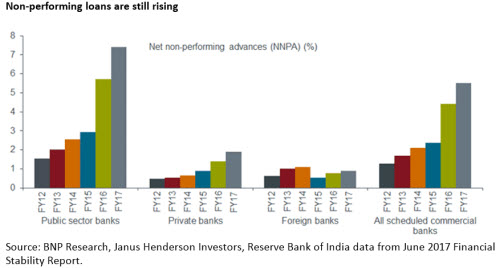

Bank asset quality is a major concern for us. According to the Reserve Bank of India’s (RBI) latest fiscal stability report, around 12% of Indian banks’ assets are stressed (non-performing loans/ require restructuring). As the banks’ non-performing loans (NPLs) are still increasing (see chart), this means there is less support for a private sector capital expenditure-led recovery. In this environment, fiscal consolidation is unlikely as the government continues to heavily support economic recovery. Reform in this area is not sufficient as the government does not have the budget to bail out public sector banks, which would require approximately US$90 billion, and private investors are unlikely to be able to provide the necessary level of equity.

Non-performing loans are still rising

Source: BNP Research, Janus Henderson Investors, Reserve Bank of India data from June 2017 Financial Stability Report.

Note: SCBs or scheduled commercial banks are banks included in the Second Schedule of the RBI Act 1934 and comprise public sector, private sector and foreign banks.

Politics prevail

Additionally, the political agenda continues to be a key driver of fiscal policy in India.Agriculture only makes up 15% of India’s economic activity, but supports over half of the population. A recent series of announcements by various state governments to waive some farm loans has prompted farmers to stop repaying their loans. The farm loan waiver was also a political consideration as it helped Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) win the recent Uttar Pradesh election.

Moreover, there is tension between the government and the RBI, which is displaying real independence, as the choice of the new central bank governor suggests that Modi is having a hand in steering the central bank towards the government’s quest for lower interest rates.

Slow pace of reforms

Another crucial factor weighing on India’s outlook is the disappointing pace of reforms that was promised during Modi’s appointment in 2014. The banknote demonetisation decision in 2016, which, despite early reservations,ended up being fairly well received. The move seemed to have established Modi’s reputation as a champion against corruption. But while one of Modi’s key strengths has been his adaptability, it has also been a hindrance to sustained reform.

There is no avoiding the stark statistics in India today. There are, for example, only 39.1 million tax payers out of a population of 1.3 billion, and more than 12 million new jobseekers entering an overcrowded workforce every year, according to the Asian Development Bank. While the central government has addressed some of its earlier priorities, eg reforms in terms of deregulation, foreign direct investment (FDI), bankruptcy and government service tax (GST), the onus is now on the all-powerful chief ministers of individual Indian states to pick up the baton and address labour and land reform to ensure sustainable growth.

Portfolio implications

Given these views we currently have no exposure to India. The remaining position in telecom group, Bharti Infratel, which had performed well, was sold. The stock’s valuation now appears less attractive to us given the emergence of higher risks including the threat of new technologies, the fact that industry consolidation has impacted potential growth prospects, and organic growth has disappointed given operators have been rolling out their own telco towers.

We also exited Infosys earlier in the year. Quarterly results had been lacklustre as clients reassessed plans for IT spending, but the real negative was the US H1-B visa reform bill. The bill aims to crack down on companies unfairly hiring foreign instead of US workers. Indian IT workers employed by IT outsourcing companies like Infosys to work in the US make up the majority of US H1-B visa holders. While Infosys is a quality company, we think the visa issue will continue to overhang on the stock.

In summary, the current combination of economic issues, rising bad corporate debt, the slow pace of reforms, a less than supportive political agenda, coupled with stretched valuations in a period where earnings are being downgraded and macroeconomic fundamentals are weak, have led us to look for more attractive investments beyond India. Currently the portfolio is instead more heavily weighted to countries such as China, South Korea and Taiwan.

Note: Stock examples are intended for illustrative purposes only and are not indicative of the historical or future performance of the strategy or the chances of success of any particular strategy. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Diesen Beitrag teilen: