Janus Henderson: Three reasons for slowing economy

A host of indicative data suggests a slowing in the rate of economic improvement. James Ross, Fund Manager of European equities team at Janus Henderson Investors, about the reasons.

22.03.2018 | 12:08 Uhr

Our investment strategy focuses on holding businesses that are capable of generating high, predictable and consistent returns over the long term. This approach does not lead us to invest heavily in areas such as early-cycle capital goods, mining, chemicals or the like, traditionally seen as more economically sensitive or ‘cyclical’ areas of the market. The period from mid-2016 to the end of February 2018 has been characterised by the extreme outperformance of these more cyclical areas. This outperformance has been largely caused by the improvement of economic data ahead of expectations.

Our investment strategy focuses on holding businesses that are capable of generating high, predictable and consistent returns over the long term. This approach does not lead us to invest heavily in areas such as early-cycle capital goods, mining, chemicals or the like, traditionally seen as more economically sensitive or ‘cyclical’ areas of the market. The period from mid-2016 to the end of February 2018 has been characterised by the extreme outperformance of these more cyclical areas. This outperformance has been largely caused by the improvement of economic data ahead of expectations.

In recent months, however, we have been picking up on indicators that suggest to us that this period of expectation-beating economic improvement may be coming to an end. Partly for this reason, we have shifted the portfolio further away from cyclicality and have allocated an even higher proportion of the fund to what we see as high quality/high return businesses with more defensive characteristics.

What is the evidence?

It is our premise that valuations on more economically sensitive stocks are extremely stretched when compared to more defensive areas, looking at current price-to-book (P/B) ratios. We consider the P/B ratio to be more useful than the price-earnings (P/E) ratio at this point, given that many cyclical companies are showing above-average and potentially unsustainable margins. This is historically significant, with cyclicals being this expensive relative to defensives only once since 1995.

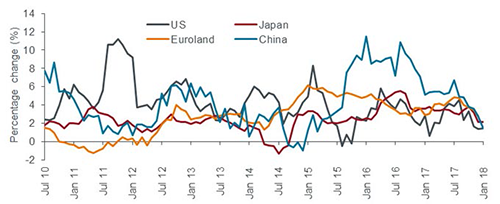

A host of indicative data that we have reviewed in recent weeks suggests a slowing in the rate of economic improvement, with our views summarised here. First, money supply trends, which have proved to be a decent lead indicator for economic activity in the past, are pointing to a moderation in global growth over the next few months, as chart 1 shows:

Chart 1: Money supply data indicates slower growth

(Source: Thomson Reuters Datastream, as at 28 February 2018. M1 is a standard measure of money supply that includes physical money.)

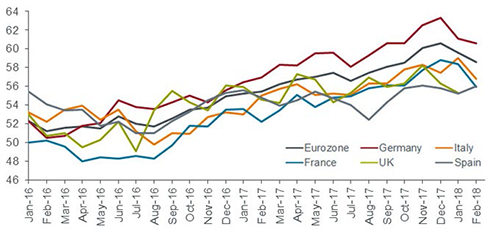

Second, global purchasing managers’ indices (PMIs), commonly seen as a good indicator of current business conditions, are suggestive of a tempering in growth after a very strong couple of years. As chart 2 shows, this is not specific to any individual region but seems to be global in nature:

Chart 2: PMI data has moderated at the start of 2018

(Source: Bloomberg, as at 28 February 2018. Includes flash estimates for February 2018. PMI data is on a scale, with anything over 50 indicating economic expansion, and anything below 50 indicating contraction.)

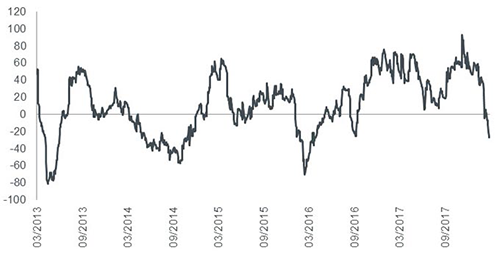

Third, economic updates have fallen short of expectations, as shown by Citigroup’s Citi Economic Surprise Indicator (CESI), with recent data on the single currency area (see chart 3) indicating a move into negative territory:

Chart 3: Recent economic updates have disappointed

(Source: Bloomberg, as at 13 March 2018. Citi Economic Surprise Index - Eurozone. This index shows how economic data is progressing relative to consensus forecasts from market economists. Below zero indicates that economic updates have disappointed relative to expectations.)

What changes have we made to reflect this?

While we have focused here on larger ‘macro’ indicators, we spend far more of our time at a strategy level looking at fundamental stock-level research. The quality of the companies themselves remains the primary determinant of whether or not we invest. Our style has always been to focus on high quality, dependable businesses. Changes we have made to the portfolio more closely align us with this core focus.

The most significant change that we have made recently has been to reduce our exposure to financials, trimming our weighting in banks and selling our position in the French insurer AXA. These moves take us from being heavily overweight in financials to almost in line with the index weighting. We maintain that financials represent an area of less-expensive cyclicality, but we feel that now is the time to reduce our exposure to what is a consensually overweight sector.

We also sold the entirety of our positions in Atlas Copco and Infineon as well as trimming back on some other more cyclical areas. Atlas Copco, which makes air compressor equipment for industrial uses, is a great company and one that we were hesitant to sell. But since Tim bought the position in late 2015, the company has re-rated. In addition, the company’s margins are relatively high versus history. If there is a cyclical softening, then the market could materially de-rate this stock. Infineon, which makes semi-conductors for automotive and industrial end markets, is also a very well positioned business and one that has been a very good investment for the fund. However, the company has rarely been as expensive, and earnings before interest and taxes (EBIT) margins have rarely been as high. We felt it was right to take profits.

These sales reduced the fund’s cyclical exposure significantly, constituting sales of around 10% of the fund overall. Capital raised from these sales was reallocated into high quality, companies with what we see as more defensive qualities, split between allocations to existing holdings in the consumer staples, healthcare, IT and telecommunications sectors, and two new positions – Unilever and SGS.

It is certainly anti-consensual to invest in ‘bond proxies’ in this environment, but it is our premise that Unilever, a company that has generated consistently high returns on capital, while also growing revenues, margins and cash return to shareholders, has very little likeness to a bond. The stock is also priced at what we see as an attractive entry point, following recent falls. SGS is not a cheap stock by standard P/E metrics – but for good reason. The testing industry has very high barriers to entry and decent structural growth opportunities, which enables companies such as SGS to generate consistently high returns on capital. The company is focused on organic growth and tends to run a very conservative balance sheet.

Diesen Beitrag teilen: