Morgan Stanley IM: China - Smoke and Mirrors

Chinese stocks are likely still underowned by local and global investors but their superficially low multiples do not represent a compelling reason to go overweight China until policy measures sufficient to solve its debt deflation problems are implemented.

08.11.2024 | 06:30 Uhr

Bottom Line

The shift in China’s policymakers’ tone has been dramatic, but actions so far represent only a modest step in the direction of what will ultimately be required. Chinese stocks are likely still under owned by local and global investors but their superficially low multiples do not represent a compelling reason to go overweight China until policy measures sufficient to solve its debt deflation problems are implemented – fade the stock rally.

Since the PBOC announced a rate cut and other stimulus on Sept 24th, two questions on investors’ minds have been: 1) will they do RMB 2, 5, or 10 trillion of fiscal stimulus? And, 2) chase or fade the rally in Chinese stocks? To answer these questions, it is important first to diagnose the underlying problem and to identify the proper solution.

The Problem

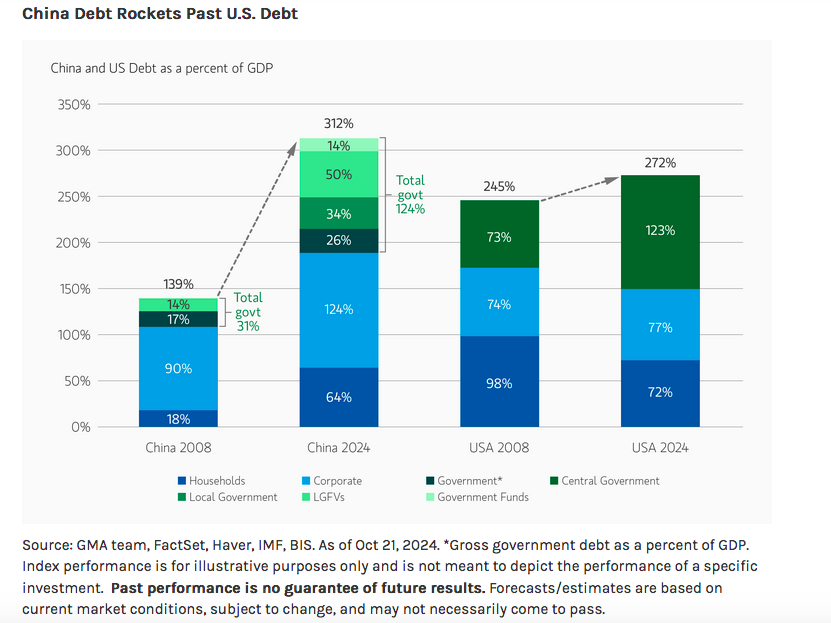

China is suffering from debt deflation, the result of a debt-fueled fixed investment bubble. The original sin was setting excessive GDP growth targets (6-8% in the 2010s and 5% today) that were aimed at transforming China into a first world economy, without regard for its underlying capacity (China’s labor force and population are declining). To meet growth targets, massive investment funded by debt has been directed at the property, manufacturing, and infrastructure sectors: investment averaged 43% of China’s GDP over the past decade (versus 32-36% at the peak of Japan and Korea’s investment bubbles in the 1980s and 1990s). The result is overcapacity and one of the world’s largest debt loads at more than 300% of GDP – see Display 1.

The property market has been in contraction for three years (home sales and starts down 50-70%). Investment in infrastructure and the “New Three” industries1 helped to offset this, but are coming under pressure: local governments have fewer resources to invest in infrastructure and New Three capacity in China is already more than twice global demand. Households, under pressure from job losses, wage cuts and the hit to their wealth from property price declines have curtailed spending. Bank lending has been steadily decelerating due to lending officers’ caution and a lack of demand from overindebted households, corporates and local governments. The net result is the Chinese economy has been in deflation for seven out of the past eight quarters.

Diesen Beitrag teilen: