Schroders: Black Monday - what we can learn

It has been 30 years since Black Monday, the biggest one-day fall in stockmarket history. We look at what happened, how today’s markets compare to 1987 and the lessons it can offer to investors today.

17.10.2017 | 09:32 Uhr

On 19 October 1987 global stockmarkets came crashing down amid worries about a slowing global economy and high stock valuations. The concerns were compounded by a computer glitch.

In the space of 24 hours stockmarkets in Asia, Europe and the US suffered falls of up to 23%.

It was the biggest crash in living memory. In the US, the Dow Jones fell 22.6%, destroying the previous record one-day fall of 12.8% set during the Wall Street Crash of 28 October, 1929.

However, with the help of central bankers stockmarkets recovered. Five years after the event stockmarkets in the UK, Europe and the US were rising by as much as 15% a year.

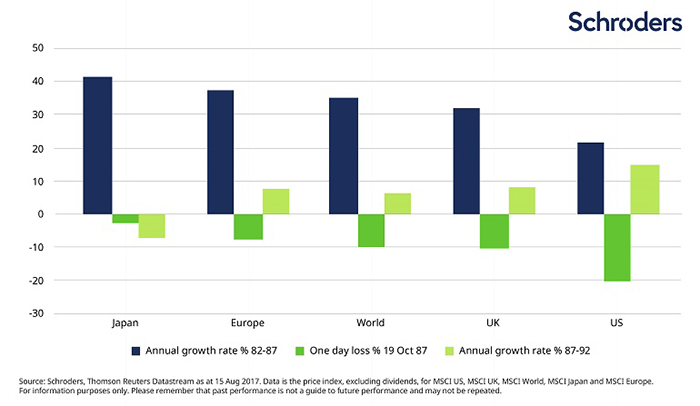

The chart below illustrates the performance of stocks before, during and after Black Monday.

● The blue column shows the annual rate of return for stocks in the five years leading up to the crash.

● The dark green column is the percentage change in stocks on Black Monday.

● The light green column is the precentage change in stocks in the five years after Black Monday.

Below we relive what happened and the lessons it can offer to investors today.

What happened?

In October 1987 stockmarkets were in the midst of a five-year bull-run. The global economy had recovered from the recession and stagnation that had blighted the 1970s. Credit was expanding, house prices were rising and investors were in bullish mood. But things were about to turn sour.

A great storm was on its way to cripple the UK. Appropriately enough, Michael Jackson’s Bad was on the verge of topping the US billboards charts. At the cinema Fatal Attraction was a box office smash just as investors’ love affair with the stockmarket, albeit briefly, was about to end.

In the space of 24 hours on 19 October, global stockmarkets went into freefall. Yet few could put their finger on the exact reasons why.

In the years since, investors have blamed worries surrounding a turn in the fortunes of the global economy and rising inflation. Others have pointed to rumours of an interest rise in the US and political tensions between the US and Iran that were threatening to spill over.

There has been much conjecture.

What can’t be argued with is the fact that there was a collective panic across markets.

Losses were exacerbated by new computerised trading floors that were ill equipped, at the time, to prevent the collapse from spreading.

It came after a period of sustained gains. Most stockmarkets in developed countries had been growing at more than 30% a year in the five years up to Black Monday – gains that have not been repeated since. It took valuations to record highs.

As stockmarkets plunged and investors panicked, central bankers took action: interest rates were cut and the Federal Reserve “encouraged” banks to continue lending to ensure the flow of money wouldn’t dry up.

Those policies worked. In the five years following the crash, stockmarkets made a strong recovery.

US stock prices grew by 14.7% a year. UK and European stockmarkets rose at rates of 8% and 7.6%, respectively, while global stockmarkets as a whole posted annual gains of 6.3%. The Japanese stockmarket was the notable exception - a banking crisis left investors facing annual average falls of 7.2%.

What can we learn from it now?

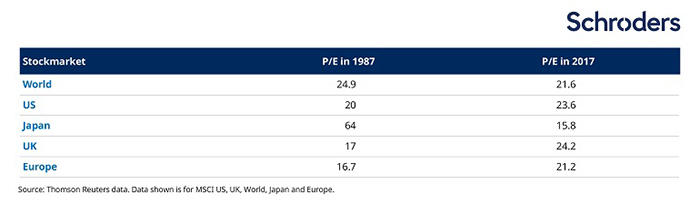

While high stock valuations can contribute to a fall they are not necessarily the catalyst. As the table below illustrates, valuations in the US, UK and Europe are higher now than they were in 1987, yet stockmarkets continue to hit record highs.

How stockmarket valuations compare

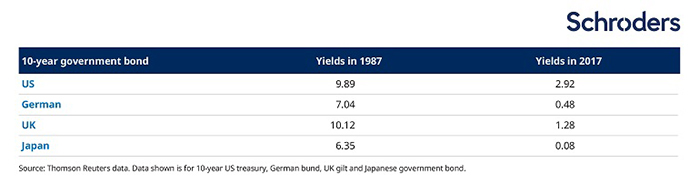

In 1987 there was a more obvious path for investors to take to protect their money. In government bonds they could still find a healthy return as well as the required protection for their investment.

The yields on 10-year government bond yields in developed countries such as Japan, Germany and the US were as much as 9.9%.

In the UK, the figure was 10.1%. Today, the highest yield, among those countries, is 2.9% for US bonds. In the UK it is 1.28%, while Germany and Japan are closer to zero.

The path to protecting your money now is not so obvious.

How government bond yields compare: 1987 and 2017

View from the fund managers

Matthew Dobbs, an equities fund manager who was in London at the time of Black Monday and is today Head of Global Small Cap, said:

“It is easy to understand why investors might be concerned about investing in stocks now. Stockmarkets continue to reach new highs and equity valuations are similar now to what they were in 1987. But there is big difference today: the risk-free rate is very different.

“What I mean is that that the yields on bonds and interest rates in banks, where there are fewer risks to losing your investment, are now very low compared to the dividend yield on the stockmarket, which is around 4%.

“So, where would you put your money? If you don’t have it in stockmarkets then you’re not paid much for having it in the bank and not paid much for having it in the bond market.

“Despite that I still don’t think too much money is going into stockmarkets. People are cautious towards stocks because of what happened during the global financial crisis of 2007 and 2008. Although it was 10 years ago it still feels like it happened quite recently.”

Andrew Rose, equities fund manager, recalls the surreal atmosphere in London that surrounded Black Monday.

“It was an exceptional time for the stockmarket. We hadn’t seen anything like the performance in stock prices before and we haven’t seen anything like it since. And it coincided with one of the greatest storms the UK has ever seen, which bizarrely ended up contributing to market falls.

“The storm happened on the Thursday night before Black Monday. There was hardly anyone in the Schroders’ London office on the Friday or anywhere in the City.

“Matthew and I were in work because our tube line was running. Anyone coming in on overland trains had no hope. Fallen trees were strewn across roads and rail lines.

“With markets closed it meant that investors had to carry their positions throughout the weekend because they couldn’t square them on the Friday. But traders had bought portfolio insurance – a mechanism that automatically sold investments into a market when the price hit a certain level.

“Investors thought it was a free lunch and losses would be limited. But everyone was a seller and no one was a buyer when markets went into freefall on Monday morning. The automated mechanism of selling at a certain price failed. In fact, it exacerbated the issue.

“Ironically, if they hadn’t taken out this sort of insurance then markets might never have fallen as much as they did.

“At the time you felt it was the end of the world, but looking back it was just a blip. The UK and the US stockmarkets rebounded strongly in the late 80s and throughout the 90s.

“Could it happen again? Procedures are now in place to prevent stockmarkets falling so far, so fast. There will always market peaks and troughs but over the long term, stocks have delivered superior returns.”

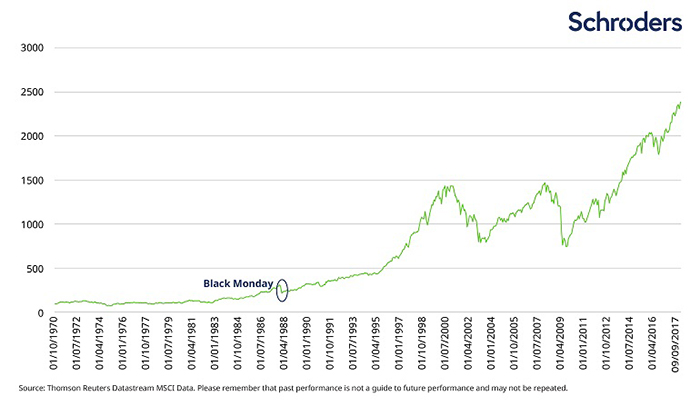

The market blip that was Black Monday

The chart below reflects the fluctuations in the US stockmarket since 1970. It illustrates how Black Monday registered as barely a blip in the long term and how resilient stocks have been over the last 47 years.

Those who invested after Black Monday would have seen $100 turned into $1,135 without considering the dividend income paid out. That high return was achieved despite remaining invested through the dotcom crash of 2000-03 and the global financial crisis of 2007-09.

MSCI USA: 1970-2017 and the blip that was Black Monday

Die hierin geäußerten Ansichten und Meinungen stellen nicht notwendigerweise die in anderen Mitteilungen, Strategien oder Fonds von Schroders oder anderen Marktteilnehmern ausgedrückten oder aufgeführten Ansichten dar.

Der Beitrag wurde am 15.10.17 auch auf schroders.com veröffentlicht.

Diesen Beitrag teilen: