BNP Paribas AM: Equity markets - another rise

As 2018 begins, the environment still looks promising for equities. Even so, investors may be troubled by doubts on both the economic scenario and monetary policies. This could re-stoke volatility.

10.01.2018 | 10:50 Uhr

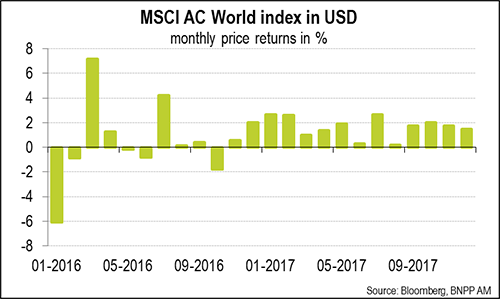

Global equity markets posted further gains in December, with the MSCI AC World index in US dollars (+1.5%) up for the 14th consecutive month. The MSCI Emerging Market index rose by 3.4%, driven by a rally in the indices of oil-producing countries, especially in Latin America.

West Texas Intermediate (WTI) gained 5.3%, hitting a high since mid-2015 at more than USD 60/bbl. Oil prices were driven higher late in 2017 by isolated factors that temporarily dented supply, while OPEC and its partners announced in late November the extension of their output-reduction agreement.

Commodities in general got a boost late 2017 from the solidity of the global economy. Investors were reassured by the bright outlook for global growth, which was reinforced by the US’s adoption of the tax cut package against a backdrop of still-modest inflation, which is giving central banks some leeway in not rushing the process of normalising their monetary policy. Equity volatility remained under control.

Global equities gained 21.6% in 2017 (MSCI AC World), their best performance since 2009.

Graph 1: Global equity markets have risen for 14 consecutive months through December 2017

European equity markets are lagging

Eurozone markets took a hit late in the month as the euro moved back above USD 1.20. This caused investors to overlook the latest improvement in economic activity surveys, which showed that growth is still very solid, along with the ECB’s accommodative tone pointing to a long period of stability in key rates. The EuroStoxx 50 turned down on 19 December and ended the month 1.9% lower than at the end of November.

Graph 2: The euro appreciated versus the US dollar in 2017

US and Japanese equity markets ended 2017 on a high note

Despite a little more tentativeness late in the month, the major US indices finished December close to the records they had set a few days previously. The Dow Jones 30 gained 1.8% and the S&P 500, 1.0%, driven during the first half of the month by the prospect of tax cuts being approved at last by year end. These expectations, in fact, drove the markets more than the actual passing of the law on 22 December.

The equity markets shrugged off the 13 December key rate increase, as it was clear that the Fed will continue to pay close attention to the impact of its decisions on the financial markets and has no plans for pre-emptive rate rises at a time when inflation is showing no signs of acceleration. Given the pace of growth, monetary policy that is still quite accommodative, the corporate tax rate cut, and measures facilitating the repatriation of profits made outside the US, investors are bullish on the environment for the first months of 2018.

Japanese equities continued to rally in December (+0.2% by the Nikkei 225, +1.4% by the Topix), driven by a weaker yen, the economic upturn (which is driving corporate earnings prospects), and the Bank of Japan’s ongoing ultra-accommodative monetary policy.

Graph 3: European equities are lagging their peers

Fixed-income markets and central banks

- A flattening of the US curve

There was no particular reaction on the long end of the curve and the two-year yield continued to rise, briefly exceeding 1.90%, as the 13 December rate hike had been fully priced in and as the Fed confirmed that it intended to undertake three 25bp rate hikes in 2018. The spread between the T-note 10-year and two-year yield narrowed to 52bp, a low since October 2007.

- 2018: the year of rising European yields?

Mario Draghi’s comments during the press conference after the 14 December Governing Council meeting were much the same as in late October. Although the ECB acknowledges the heathy state of the euro zone economy and has upgraded its growth forecasts, it intends to stick to its accommodative monetary policy for many months to come. However, investors are fairly certain that the ECB has used the last of its quantitative easing ammunition. The fixed income and forex markets are likely to be driven by the theme of a possible shift in ECB monetary policy, on top of the reduction in monthly securities purchases beginning in January.

Graph 4: Changes in US and German 10-year sovereign bond yields

A supportive environment for equity markets

As 2018 begins, the environment still looks promising for equities. In reaction to the solid prospects for the global economy and proactive economic policies, analysts have revised their earnings forecasts upwards, while government bond yields are likely to remain low. This combination should push equities up further despite valuations that are stretched in absolute terms, particularly in the US. Even so, investors may be troubled by doubts on both the economic scenario and monetary policies.

Any sudden pick-up in inflation would likely make them wonder why central banks are being so cautious about phasing out non-conventional policies. This, in turn, would hit both the bond and equity markets, which have been driven in recent years by inflows of liquidity. While everything suggests that the new Fed chairman should stick to the current line, he could emerge as a source of uncertainty, at least in the initial months of his term.

And while everything looks quiet for the moment on the political front, nervousness could re-emerge in reaction to geopolitical events (e.g. the US’s attitude vis-à-vis North Korea and the Middle East) or if issues currently hanging in the balance in Europe (Brexit negotiations, the formation of a governing coalition in Germany, developments in Catalonia, and legislative elections in Italy) appear to be dragging on for too long.

This could re-stoke volatility, but, even so, the outlook is bright, given solid macroeconomic fundamentals and a pro-business environment in the US in the wake of the corporate tax cut.

Diesen Beitrag teilen: