Henderson: Abenomics boosts Japanese stocks

Yunyoung Lee, Japanese equities manager, discusses the positive impact of Abenomics on Japan’s economy and stock market. He sees a positive impact on Japan’s economy and stock market. Japanese smaller companies have stronger investment potential due to their domestic bias and less research coverage. US/Japan relations under US President Donald Trump appear more promising than expected.

10.05.2017 | 10:28 Uhr

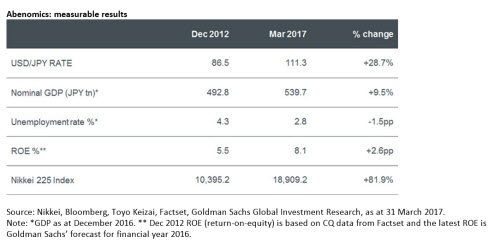

It has been more than four years since Shinzo Abe was elected Prime Minster of Japan, ushering in the era of Abenomics, based upon the ‘three arrows’ of monetary easing, fiscal stimulus, and structural reforms aimed at injecting new life into the moribund Japanese economy. Throughout this period we have been monitoring the progress of these policies and can now conclude that they have produced positive results. Abenomics’ positive scorecardIn our view, Abenomics is delivering quantifiable positive changes to the Japanese economy and its stock market. The first wave of monetary easing has seen the US dollar/yen exchange rate rise by almost 30%. Nominal GDP, meanwhile, has risen 9.5%; the unemployment rate has fallen from over 4% to under 3% and the return-on-equity of the Nikkei Index has increased from 5.5% to 8.1%. Investors in Japanese equities seem to have a favourable view of Abenomics too with the Nikkei 225 Index up 82%. (All figures relate to the period since Abenomics was introduced ie. December 2012 to March 2017).

Abenomics: measurable results

Source: Nikkei, Bloomberg, Toyo Keizai, Factset, Goldman Sachs Global Investment Research, as at 31 March 2017.

Note: *GDP as at December 2016. ** Dec 2012 ROE (return-on-equity) is based on CQ data from Factset and the latest ROE is Goldman Sachs’ forecast for financial year 2016.

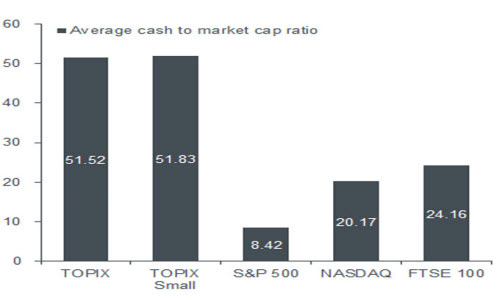

Meanwhile, corporate governance measures, including the introduction of a Corporate Governance Code in 2015 to more clearly align management with shareholder interests, have also had a measurable effect on shareholder returns, either through share buybacks, which reached a record high in 2016, or dividends, which have been steadily rising since 2012. Change is afootNaturally, cultural change takes time. Japanese corporates continue to hoard cash. The average cash-to-market-capitalisation ratios for the TOPIX and the TOPIX Small indices are at over 50%, compared with less than 10% for the S&P 500, under 20% for the Nasdaq and just over 24% for the FTSE 100 (see chart below).

Japanese companies’ cash balances higher than global peers

Source: Bloomberg. As at financial year 2015 for cash; July 2016 for market capitalisation.

But we think a greater proportion of that cash will be transferred to shareholders in due course. Smaller companies are playing their part in this improvement in cash returns. We know this because when we speak to senior management of the companies we invest in, there is a constant emphasis on the importance of return-on-equity for their shareholders. One such company is Tokyo Steel Manufacturing. Through a combination of technological innovation and a sound, debt-free financial footing, the company has one of the highest productivity levels in the global steel industry. It is also an example of a company that has significantly boosted its return-on-equity, increasing its dividend in line with its move into a net cash position in 2015. We believe the company provides a compelling investment opportunity given the combination of a more favourable global economic backdrop and reforming Japanese corporate culture.

Under-researched potential

In order to get a handle on smaller companies in Japan, investors need to do their own proprietary research − this is where as fund managers we can add significant value. Smaller companies in Japan receive far less research coverage than their larger counterparts. Analysis from Quick and Nomura shows that small and mid-caps receive less than one analyst coverage count on average while large caps on average have more than seven analyst coverage counts.

Domestic bias

Another key reason to invest in the asset class is the fact that this relatively underexplored and under-researched sector also has the least foreign exchange and trade impact. The domestic sales ratio of Japanese small caps – that is companies in the TOPIX Small Index – stands at 83% while overseas sales account for around 17%. In the mid-cap space, 72% is domestic sales versus 28% overseas. But for companies in the large cap TOPIX 100, overseas sales represent only 43% of total sales and domestic sales are around 56%. (Source: Bloomberg as at financial year 2015).

Risk can turn into opportunity

A key concern for Japanese investors is the uncertainty around US President Trump’s new administration and how it will affect the US/Japan relationship. Yet the reality is that policy decisions taken in Washington DC could be highly beneficial for some selected Japanese companies. For instance, crane maker Tadano, which also operates in the US, could be a winner should President Trump follow through on his promise to unleash a wave of infrastructure spending. On this potential, we have added the company to our portfolio. While President Trump’s protectionist stance is a worry for trade and manufacturing, we think Japan’s cyclical recovery will be able to counter the slow process of increasing protectionist measures. Moreover, the concerns and negative sentiment around Trump may have been overblown. At a meeting in February, Prime Minister Abe and President Trump issued a joint statement to reaffirm their “unshakeable alliance”; the two leaders appeared to have made some progress on major economic and security deals.

In the meantime, we continue to stick to our process of finding value opportunities and potential catalysts in the Japanese smaller companies space. Our substantial experience of investing in the asset class reconfirms our belief that a focus on fundamental analysis can identify stock opportunities that are capable of delivering improved earnings growth and share price appreciation.

Note: references made to individual securities are for illustrative purposes only and should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Diesen Beitrag teilen: