Janus Henderson: Why is Europe a destination of choice for equity income opportunities?

With investment strategies capable of delivering attractive income streams in high demand, Alex Crooke, Head of Global Equity Income, and Ben Lofthouse, Portfolio Manager, explain why Europe is currently their favoured region for dividend-paying companies.

11.07.2017 | 15:08 Uhr

Europe currently offers compelling equity income opportunities and there is notable exposure across our portfolios. This positioning is a reflection of our bottom-up, dividend-seeking, valuation-driven process aimed at identifying companies with attractive cash flow characteristics and the ability to grow dividends. It is an approach that affords us the flexibility to invest anywhere in the world, and incorporates analysis of all dividend-paying markets.

Our European positioning is not based on a macroeconomic view but reflects valuation and yield opportunities at a stock level. We run screens for all regions and sectors and, currently, our analysis is firmly pointing to Europe and the UK as offering the most interesting opportunities. There are two main pillars of support for this view:

1. Favourable forecast dividend yields

The 2017 forecast dividend yields in both the UK and Europe ex UK are currently 4.1% and 3.1% respectively. These are significantly higher in aggregate than the 2.0% dividend yield available from the US market or the 2.1% available from Japan (see chart 1). This is due largely to a preference of US companies for share buybacks over dividend payments.

Chart 1: Forecast global dividend yields

Source: Citi, as at 7 June 2017. Note: DPS = Dividends per share, EM Asia = Emerging Asia. Dividend per share growth forecasts. Past performance is not an indicator of future performance. Yields may vary and are not guaranteed.

At a sector level, our analysis show that European healthcare, financials and telecommunication companies are all looking significantly cheaper from a valuation basis than their international peers, and in general have higher yields than their US counterparts.

2. Valuation gap

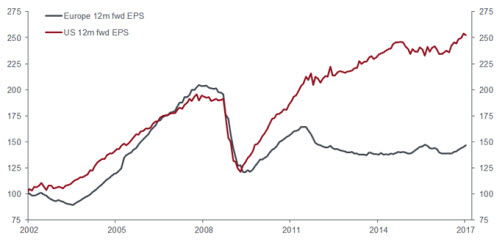

European valuations are also currently more attractive than those available in the US. In addition, European earnings have lagged those of US companies, with European 12-month forward earnings now 25% lower than those of the pre-Global Financial Crisis (GFC) high. In comparison, US 12-month forward earnings are 34% higher than the last cycle peak resulting in a significant divergence since 2008 (see chart 2). Eurozone and UK earnings growth forecasts for 2017 significantly outstrip comparable US earnings growth expectations offering the potential for European companies to close the divergence. The low valuations also mean that there is the potential for more activism in Europe and the opportunities for improvements in operational efficiencies and ultimately the return on equity. Recent evidence of this includes bid approaches for Akzo Nobel and Unilever, and activist interest in Nestlé.

Chart 2: A divergence in fortunes

Source: Datastream, IBES, data rebased to 100, March 2017. Notes: Consensus 12m forward earnings per share (EPS) estimates for MSCI Europe ex-UK and MSCI USA.

Macroeconomic support

While the make-up of our portfolios is informed by opportunities at a stock level, we are of course mindful of macroeconomic drivers impacting stocks. On this wider measure there is currently strong support for Europe, with the region benefiting from upgrades to economic forecasts after a number of years of downgrades. Corporate earnings have also seen 2017 estimates revised upwards. Indeed, the recent earnings season was one of the best for a number of years in Europe, with over 60% of companies beating EPS estimates and EPS growing 24% year on year, based on data from the Bloomberg European 500 Index. Post the shock of Brexit last year, the political situation has also shown signs of stabilising with populist parties failing to gain traction in recent elections in both the Netherlands and France. This improving macroeconomic and political backdrop, combined with more attractive valuation levels, has seen Europe start to come back into favour with investors.

Risk considerations

Our focus on delivering strong risk-adjusted returns means we are ever mindful of potential risks to our views. One of the main detractors of an allocation to European equities in recent years has been the perception that this is a region of structurally low-growth where there is little appetite for economic reform. Structural issues have undoubtedly held the region back, with European GDP growth significantly lagging that of the US post the GFC. Critical, therefore, to future success will be the ability for labour reform and a willingness to incentivize business investment.

At a monetary level, the European Central Bank was much later than the US Federal Reserve in reacting to a persistently low growth and low inflation environment. The European banking system meanwhile is much further behind in the recapitalisation process than its US counterpart. Significant bad loans remain and although there are signs that the process of dealing with these bad loans has finally begun, there is still some way to go. However, in our view the European financial system is in better shape now that at any point since the GFC.

Dial out the noise

In the short term, European headlines will be dominated by the German elections in September, the timing around the ECB starting to taper its monthly asset purchases, Italian banks, Italian elections in early 2018 and Brexit negotiations. While these events will create a significant amount of noise, as bottom-up stock pickers we remain focused on the opportunities at an individual stock level. These opportunities and the outputs from our screening approach support our conviction in the portfolio’s European positioning.

We do, of course, continue to find attractive opportunities elsewhere, particularly within select US and Japanese companies that demonstrate a strong dividend culture. The attractive valuations offered in Europe, however, coupled with strong balance sheets and an improving economic environment, in our view, merit a significant weighting to income-generating equities within the region.

Note: The stock examples are intended for illustrative purposes only and are not indicative of the historical or future performance of the strategy or the chances of success of any particular strategy. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Diesen Beitrag teilen: