NN IP: Bulls gasping for breath

Markets are going through a soft patch this week, but fundamentals are not to blame. An overwhelming goldilocks consensus may be the root cause; we made no changes in our pro-cyclical stance.

22.11.2017 | 10:41 Uhr

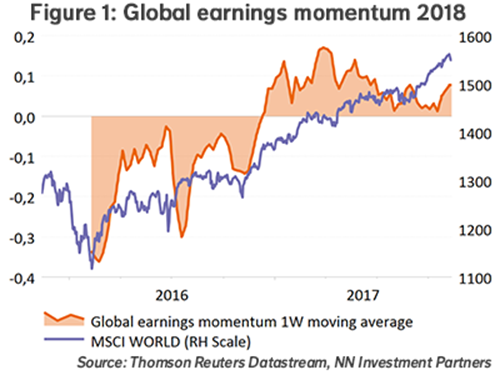

Equity markets are going through a soft patch this week. The weakness in European equities and cyclical sectors is especially noteworthy. Did something fundamentally change? We do not think so. The macro economic data are invariably strong, as was illustrated this week by the strong GDP data for Q3 in Germany. Business and consumer confidence also remain at high levels. At the same time, there is no sign of inflation, which gives central banks room to pursue a very gradual and predictable exit strategy. The earnings side remains strong, reflected in good Q3 earnings, especially in the US and Japan. The 2018 global earnings momentum has also improved further.

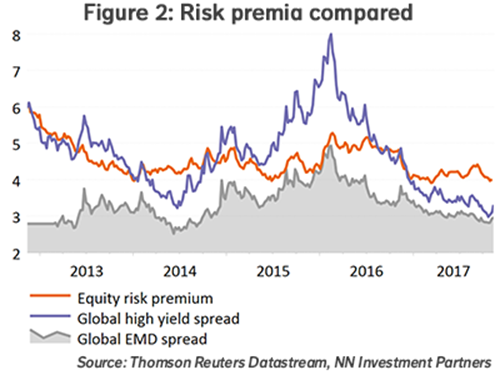

Finally, the equity risk premium is still attractive especially if we compare these with the risk premiums currently on offer in credit space.

So what changed last week? A first observation is that the credit market was also confronted with chilly headwinds. Of course, this asset class has become vulnerable to bad news, given the very tight valuations leaving little room for disappointment. Doubts with regard to the US tax reform coupled with anxiety about future Fed policy led to outflows. Limited liquidity in this asset class may have exaggerated the move in spreads. At the same time being overweight credit is one of the most crowded trades, which makes it extra vulnerable to profit-taking. In view of the large increase in the financial leverage of US companies, contagion might pop up first in this area of the market. This is illustrated by the underperformance of highly leveraged versus lowly leveraged companies.

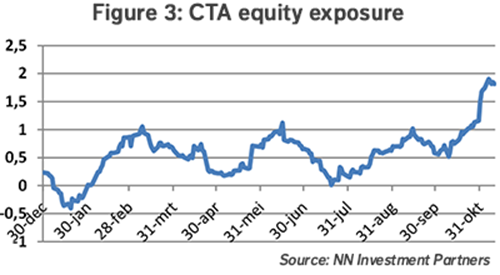

A second observation is the widespread consensus that is currently dominating investor thinking. According to the latest investor survey, “goldilocks” is the key theme for 2018. The positioning has been evolving accordingly. Cash levels have dropped to the lowest level since October 2013 and the equity exposure is the highest since April 2015. Strangely enough, the number of investors that think that the equity market is overvalued has also risen to the highest level on record, comparable with the end of the previous century. We could say that the fear of missing out is currently a strong force driving investors reluctantly into equities. These are not strong hands and risk selling by the slightest headwind. This was also visible in the rising trend in equity exposure of CTA-investors, who are highly active and often momentum-driven.

The consensus is equally strong when we look at sectors and regions. The three most overweight sectors are technology, financials and consumer discretionary, whereas the least favoured sectors are consumer staples, utilities and telecoms. From a regional point of view, the preference for non-US markets is widespread.

Over the past couple of days, we saw position squaring where the consensus overweights underperformed the consensus underweights. In this respect, it was strange that in a week of rising bond yields, bond proxies like utilities and also real estate outperformed financials. This behaviour is totally opposite to what we have seen before and to what is fundamentally justified.

As there is no fundamental justification for this sudden shift in investor preferences, we think this is a temporary phenomenon. For this reason we keep our current sector allocation which is tilted towards a gradual rise in bond yields and cyclical strength.

Diesen Beitrag teilen: