NN IP: Decent start of the earnings season

Equity markets display a shift away from the cyclical sectors towards more defensive parts of the market. We are still in an environment where both the growth/reflation theme and the search for yield theme are alternating.

23.10.2017 | 09:36 Uhr

In euro terms, global equities grinded higher over the past week. The political environment did not change a lot. In Austria, right-wing parties won the elections, which could lead to a more euro-sceptic attitude, and the Spain/Catalonia issue is still deadlocked with no easy way out. Markets and European politicians consider this rightfully as a local issue with no repercussions on the whole of the Eurozone.

In Germany, Merkel continues to work on the “Jamaican” coalition with the Greens and the FDP. No quick fix is expected, given the divergence in views amongst the partners.

We observed, however, a shift away from the cyclical sectors towards more defensive parts of the market. Especially bond proxies did well, with Utilities and Real Estate outperforming the broader market. Of course, the weak inflation numbers including the Michigan short- and long-term inflation expectations that came out on Friday in the US and that pushed bond yields down, helped these bond proxies.

It therefore looks that we are still in an environment where both the growth/reflation theme and the search for yield theme are alternating. Key variables in this respect are the macroeconomic data, which continue to surprise on the upside across all regions and the trend in bond yields, which looks to be dragged to the downside by the weak inflation numbers and a monetary policy expected to tighten only in a very gradual way without surprises. These latest inflation data did however not have any meaningful impact on the view that the Fed will hike interest rates in December. Overall, we expect an additional two hikes in 2018 and in the Eurozone a lower-for-longer QE program with the first rate hike only forecasted by Q2 2019.

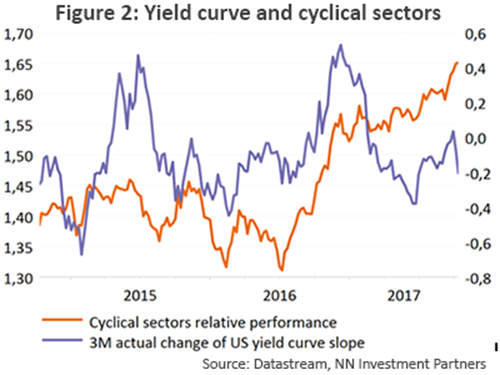

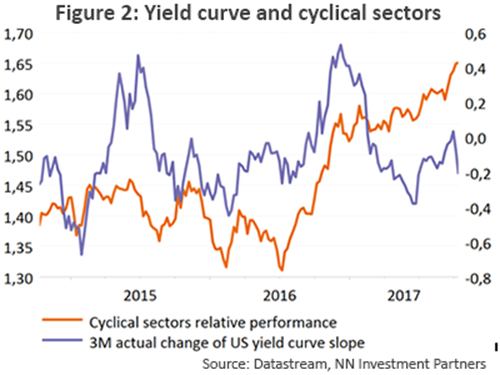

Figures 1 and 2 illustrate the dichotomy we are currently in. Macro data point towards an overweight in cyclical sectors, whereas the most recent shift in the US yield curve points towards a more defensive outcome.

On balance, we maintain our cyclical preference through IT, Energy and Industrials and are most cautious for Consumer Staples.

In the US, the Q3 earnings season has kicked off. It is still far too early to draw conclusions, but the start was decent. More than 82% of companies did better than expected and the average positive surprise was a bit above 5% on earnings and 1% on revenues.

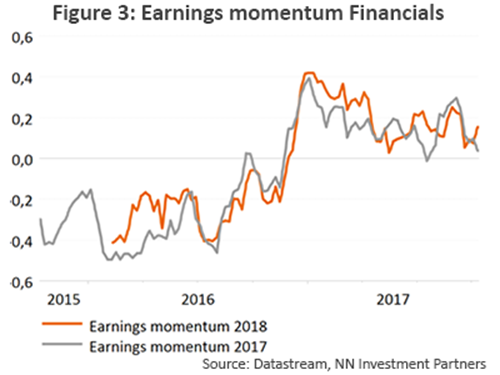

In these first days, the focus was primarily on the financial sector. The trend amongst the financials was similar. The net interest income and the cost containment were two factors that were positive whereas the fee income disappointed.

The earnings momentum for the sector may have weakened going into the season, but it remains positive and the 2018 momentum has even risen. Part of this weakening is linked to the insurance industry, which faces the impact of hurricane and earthquake-related damages. We maintain a medium overweight for the sector.

Diesen Beitrag teilen: