NN IP: Sensitivity to a repetitive risk

As long as investors price more Korea risk, EM equities will struggle to outperform. But a further escalation of the conflict still looks unlikely. Meanwhile, EM growth continues to benefit from declining EM interest rates.

21.08.2017 | 14:09 Uhr

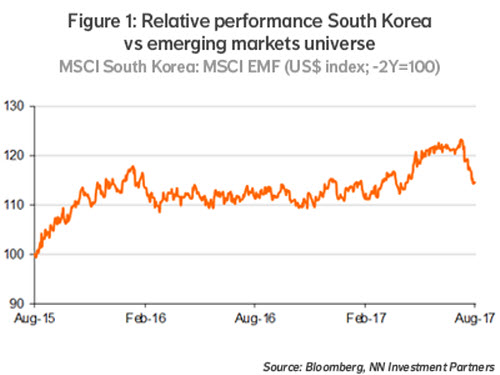

With South Korea alone accounting for 15% of the EM equity universe and Asia for no less than 72%, the sensitivity of EM to the evolving North Korea situation cannot be low. So if investors think that more Korea risk should be priced, the Asian markets will feel that relative to the rest of EM, and EM as a whole will have little chance to outperform DM. This we have seen in the past week: South Korea strongly underperformed (see Figure 1) and EM gave away all its outperformance over DM of the preceding weeks.

Always in the past decades, when the Korea conflict was the primary reason for investors to sell Asian equities, a good opportunity emerged for non-panicking EM investors to buy. This is because in the end, the belligerent behaviour of either the North Koreans or the Americans never escalated to outright military conflict. In the current situation, it should not be different. The risks involved, for one of the most densely populated parts of the world, with a large economic relevance, are simply too high. Of course, an accident could happen. And perhaps, with Trump in the White House, the risk of a miscalculation, due to a lack of experience with foreign affairs, is higher than it has been in decades. But still, both Washington and Pyongyang have much more to lose than to gain from a military clash. And more importantly perhaps, the Chinese leadership will do everything in its power to maintain the status quo. So again, like in the many other episodes of the Korean crisis, a de-escalation looks much more likely than a military confrontation.

None of this necessarily means that markets will stop pricing the risk of escalation. President Trump’s inexperience, his frustration about the repeated failures to get his domestic policy agenda implemented, the technological progress in the North Korean missile programme and the possibly growing recklessness of Kim Jong-un – these factors might justify a higher probability of a military event than currently priced by markets. They might, but it remains almost impossible to give probabilities to the different scenarios. And even if we did estimate the risk of a military conflict at 10%, how much of this probability has been priced by now?

At this point we do not see convincing reasons to approach the current episode of the Korean situation differently from earlier episodes. So we tend to think we should be adding to those assets that have suffered most from rising North Korea fears. If we consider EM equities specifically, we clearly see opportunities after the sharp underperformance of the past week, all the more so because the fundamental environment for EM equities remains good.

Strong EM growth momentum

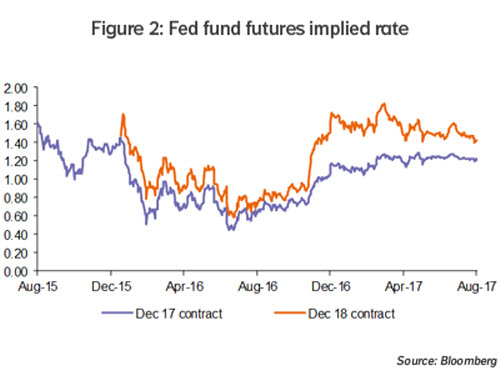

Expectations of DM monetary policy normalisation have remained calm in the past weeks. This has been reflected by the Fed funds futures, which continue to move in a tight range (see Figure 2). For EM assets, this remains a good environment. As a result, flows to EM continue to be strong. This is the main reason why EM bond yields remain on a steady downward trend. The easing of EM financial conditions, which has been with us since the beginning of the year, explains why EM credit growth has started to pick up and why EM domestic demand growth has been strengthening and broadening out in the past months.

After six years of slowing and outright weak EM domestic demand growth, we are now in the early stages of a recovery. This is typically a good environment for EM equities. Our proprietary EM financial conditions indicator as well as our EM growth momentum indicator remain clearly in positive territory. This suggests that the EM growth recovery theme will last. So we hold on to our medium-sized EM overweight. With a bias to add, if we feel that investors price too much Korea risk.

Diesen Beitrag teilen: