NNIP: The waiting game continues

By not hiking rates, the Fed has brought more uncertainty to the market outlook. EM equities received some oxygen though.

24.09.2015 | 16:00 Uhr

The Federal Reserve decided not to hike last week, but the underlying reasons did not make us, nor the equity market, cheerful. Both the statement and the press conference hinted at softer external developments, being heightened concerns about China and other emerging economies. At the same time, the recent tightening in financial conditions through a stronger US dollar, widening credit spreads and the equity market correction did part of the job for the Fed. However, the flipside to this observation is a central bank being overly responsive to financial markets and confusion about who is in the lead: the markets or the central bank? A third reason for not hiking relates to the inflation outlook, on which the Fed became a little bit more worried.

Equity markets did not react well the day after, as another major central bank is feeling less comfortable about the economic outlook. Earlier this month also the ECB made a downward assessment to its growth and inflation outlook. Lower nominal growth is of course not positive news for corporate profits. We expect continued weakness in DM earnings momentum and are looking with more than usual anxiety to the upcoming earnings season.

Regions that may see the selling pressure diminishing for the time being are emerging markets and developed Asia ex-Japan. Indeed, after the Fed's decision EM assets did outperform DM assets. Emerging Asia, but also developed Asia ex-Japan, outperformed global DM equities by more than 2% last Friday. It might be that the long period of underperformance of Asian ex-Japan assets may have come to a halt. This is also confirmed by the trend in fund flow data, which indicate a shift in the flows out of Japan and the Eurozone into the rest of Asia and the US.

Valuation of EM and Asia ex-Japan equities at very low levels

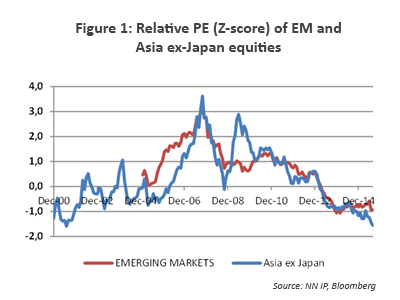

Of course valuation has also come a long way for these two regions. Figure 1 illustrates the relative trailing PE for both of them. The level is expressed as a Z-score over a 10-year period.

For Asia ex-Japan the relative trailing PE has fallen to the lowest level since the turn of the century. Exactly the same conclusion can be drawn based on the trend in the relative price-to-book ratio. The region also offers a more than decent dividend yield of 4.4%.

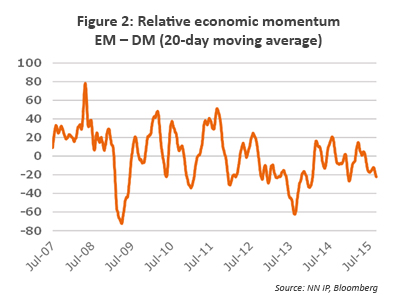

Of course, there are fundamental reasons for this underperformance. The link with the boom-bust cycle in commodity prices looks obvious. The economic surprise indicators for EM are well below those in DM and also earnings momentum has been consistently weaker. However, both indicators are showing some signs of stabilization – albeit at a low level. Maybe the pendulum will switch back somewhat more in favour of emerging markets, not because they are strengthening but due to the weakening earnings outlook in DM. Note the high sensitivity of European earnings to EM growth.

Less negative stance on Asia ex-Japan and EM equities

Based on these valuation arguments – combined with less pressure on emerging markets – we decided to close the underweight position in Asia ex-Japan.

For the broad emerging market universe we can also identify some behavioural dynamics to justify a less negative stance. Positioning is very low for the region. According to the BofA/ML investor survey, the weight in EM equities has fallen to the lowest level since at least 2005. Being underweight EM is considered as the second most crowded trade (the first one being long USD). At the same time, EM risks are well-identified given that a Chinese recession and/or an EM debt crisis are considered as the two biggest tail risks by investors.

Likewise, fund flows were very negative. Last week was the 15th consecutive week of EM fund redemptions. Year-to-date, EM funds have faced almost USD 50 billion in redemptions, the highest number since at least 2000. So it seems fair to say that a lot of negative news has been priced into EM and that it is bound for a relative bounce. This warrants an upgrade from a medium to only a small underweight. In the meantime however, the fundamental story remains difficult with the slowdown in China, the broad weakness in Brazil and the drop in commodity prices putting pressure on the commodity producers.

Diesen Beitrag teilen: