Schroders: Three reasons supporting Japan's long term story

Are Japanese equities a sound long-term investment? This is a question frequently asked by investors, especially by those overseas.

22.08.2014 | 09:28 Uhr

Sophisticated investors are understandably worried about long-lasting structural problems in Japan – namely an ageing society, a huge government deficit, and energy problems. We do not disagree, but we do not believe these concerns present an immediate risk to investing in Japanese equities, and furthermore, they are not unique to Japan. Other type of investors may look at more short-term news flow. They may see Japan as a tactical bet and wait for positive catalysts such as GPIF, Japan’s largest government pension fund, increasing its allocation to Japanese equities, or the Bank of Japan (BOJ) taking additional easing measures. These would be positive in the short-term; however, they may fail to have the desired effect and there is also the possibility of other negative news flow hitting the market in the short term.

For years, the Japanese equity market had been out of favour for investors simply due to poor performance, a weak economy suffering from deflation and a lack of political leadership. However, Prime Minister Abe has been successful so far in reversing such negative trends and eventually raising stock prices. Notably, the market surged more than 50% in 2013. This has been tempered somewhat during the course of 2014. Investors’ views, both long-term and short-term, seem to be mixed and the market direction this year is still uncertain. Therefore, we think it sensible to present our long term view, providing three key reasons why we believe the long-term story for Japanese equities is intact.

An orthodox investment theory supports the idea that corporate fundamentals and valuations determine investment opportunity. That means improving corporate fundamentals, along with earnings growth, and attractive valuations should provide long term returns to investors. As a bottom-up investment manager, this is the story we are focusing on as we closely watch Japanese companies and its economy on the ground.

Reason 1: Exit from deflationWe have long insisted that we invest in Japanese companies, not the Japanese economy, and we believe Japanese companies can grow much more strongly than the economy. Having said that, it is also true that the macro economy has a significant influence on corporate fundamentals. Indeed, Japanese companies had been suffering from deflation for many years due to low growth, yen strength, and a lack of effective policy response. We think Abe’s economic policy, dubbed Abenomics, has been on the right track and Japan is now on the course of exiting from deflation. The BOJ has been playing an important role in boosting Japanese people’s sentiment and the economic trend has finally turned around.

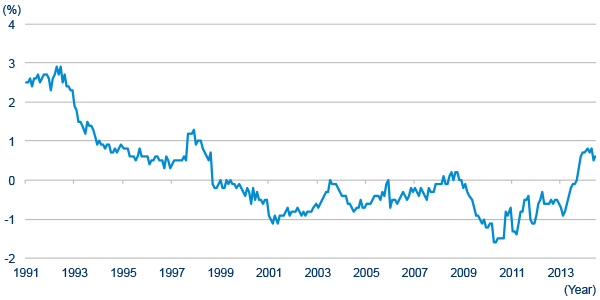

The Consumer Price Index (CPI), excluding foods and energy, has turned positive since September 2013 and has risen to 0.6% year-on-year, a level we have not seen since 1998. Despite the impact of the consumption tax increase in April this year, we think the positive trend toward an inflationary environment will continue on the back of the BOJ’s aggressive policy as well as a relatively high level of consumer confidence and management sentiment. A further increase of the consumption tax from 8% to 10%, planned in October 2015, can be a risk to the Japanese economy. However, we can expect policy support to mitigate potential short-term pain.

CPI (excluding food & energy, yoy, %)

This new inflationary phase for the Japanese economy should be positive for corporate earnings going forward. In particular, yen strength and price declines, which had depressed Japanese companies’ earnings growth and profitability, will no longer damage corporate fundamentals. Abenomics is exactly designed to tackle some of the long-term structural problems of the Japanese economy acknowledged above. It may be too early to judge its success or failure but, at least, an improving macroeconomic environment will remain supportive of corporate earnings.

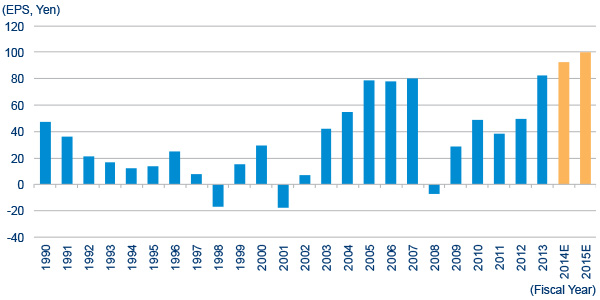

Reason 2: Solid growth of corporate earningsSince the global financial crisis in 2008, Japanese companies’ earnings had been depressed. The impact of the global financial crisis itself was severe and yen strength added significant damage. Japanese companies have faced further difficulties since then, including the great earthquake and Thailand floods in 2011, and a boycott of Japanese products in China in 2012. We saw the normalisation of corporate earnings in fiscal year 2013 when the TOPIX-based earnings per share (EPS) hit a historical high and we expect to see solid growth going forward. Additionally, a corporate tax cut, planned from 2015 as one key development of Abe’s growth strategy, will further raise EPS numbers.

Top down estimates of TOPIX EPS (yen)

At the company level, many Japanese companies have been making significant efforts to restructure their businesses and reduce costs to cope with an environment of deflation and yen strength. This has allowed them to become more flexible in managing various aspects of their business including currency risk. Cost structures and balance sheets are therefore well positioned to benefit from top line growth coming from either the domestic or global economy. As an investor, we need to be selective, but we are certainly finding many competitive companies who can grow and lead Japanese industries in the long term.

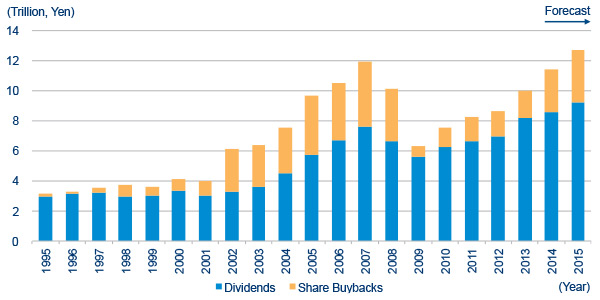

Reason 3: Improving corporate governanceCorporate governance in Japan is making steady progress and we expect this will lead to further improvement in profitability and eventually in shareholder returns. We have seen an increasing trend of share buybacks and dividends by Japanese companies.

Shareholder returns (aggregate amount of share buybacks and dividends)

Cross holdings (whereby pairs of companies hold stakes in each other) were one of the key features of the Japanese equity market in the past, but this has dramatically changed over the past 20 years. At present, shareholders, not stakeholders, are putting more pressure on management. Recent developments in Abe’s growth strategy include the introduction of a Stewardship Code (2014) and a Corporate Governance Code (expected in 2015). Such initiatives encourage management to enhance their governance structure. A prominent example would be adding external directors to their boards. The number of companies with external directors has increased from 55% in 2012 to 74% in 2014, out of listed companies on the 1st section of the Tokyo Stock Exchange (TSE), according to the TSE.

Some old-fashioned Japanese companies tend to retain unprofitable businesses and accumulate cash on their balance sheets at the sacrifice of profitability. This is one of the main causes of the low return on equity (ROE) of Japanese companies, around 9% for TOPIX as at the end of fiscal year 2013, which has been criticised by investors when comparing this key metric with other developed markets. We expect this will gradually change as a result of improving corporate governance as well as greater engagement by institutional investors, leading to an improvement in ROE. This should create further upside for investors.

ConclusionWhile we have not touched on valuation, we do see reasonably cheap valuations based on positive earnings growth for the next year. We can be even more positive if we look at further long term earnings growth supported by an improving macroeconomic environment. Additionally, the ongoing improvement in companies’ shareholder focus should add upside potential through higher profitability and higher shareholder returns. This is why we believe the Japan story will not end in the short-term; this is a long term story.

Diesen Beitrag teilen: