NN IP: Strong earnings, fading event risk

Fading headline risk is fuelling risk appetite, and a strong earnings season may further support equities. The technology sector, meanwhile, remains of crucial importance for the global equity market.

24.04.2018 | 12:07 Uhr

The past couple of weeks were dominated by headlines over trade, geopolitics, with the focus on the Middle East, and data protection in the IT sector, specifically Facebook. The trade news had an especially big influence on daily market moves, which is understandable given the negative impact of trade wars on the global economy. Companies have thrived on the globalisation wave of the past decades, and production chains for products ranging from cars to phones are integrated internationally.

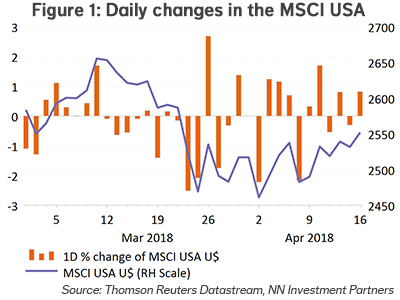

Figure 1 shows the daily moves of the US equity market since the beginning of March. The bigger moves are mostly linked to changes in sentiment related to potential trade wars. As one can see, these moves are erratic, depending on the news (or tweet) of the day. Recently the mood is becoming more favourable again, especially after the measured retaliation (no overbidding) by China and President Xi’s reconciliatory speech on Monday 9 April.

The geopolitical risk is also considered to have decreased after last weekend’s missile strikes in Syria, which have so far not been followed by any further escalation. This was reflected in lower oil prices and slightly higher treasury yields.

Focus on earnings season

The market also began focusing on corporate earnings this week. The first results are encouraging and point to another strong season. Consensus estimates predict 18% growth compared to the same quarter of last year. The biggest growth will be seen in commodity and technology earnings. We would not be surprised to see earnings coming in above 20% given the rise in the oil price, the global growth recovery, the lower USD and the US tax reform. Barring additional bad news on trade and geopolitics, this could offer support for the equity market.

However, this is no silver bullet, as the market reaction after the strong earnings reports of the financial sector illustrates. Financials are actually underperforming the broader market. We attribute this to muted comments regarding the impact of a flattening yield curve on the net interest income and weak loan growth. In addition, the sector still is a consensus overweight, which may have led to “sell-the-fact” behaviour among investors.

The technology sector is another point of discussion, especially after Facebook’s data protection issues, the subsequent hearings in Congress of its CEO Mark Zuckerberg and the fears of more regulation of parts of the IT sector. Judging by the market reaction, Zuckerberg did a good job defending Facebook’s business model. On the technology regulation front, no new measures have been announced. Of course, more regulation is not in the genes of Republican congressman and women, so it may take some time to get it into place. The market reacted with relief. However, in Europe the GDPR (General Data Protection Regulation) that will start 25 May could impact advertising revenue. The EU is also discussing the possibility of a 3% sales tax on the revenues of tech companies.

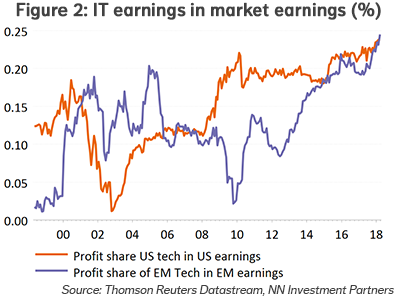

The IT sector is of crucial importance for the global equity market. This is especially true for the US and Emerging Markets, where the index weight of the sector is between 25% and 30%. For EM this is a historic high; for the US it is the highest since the technology bubble 18 years ago. The big difference between now and then is the profit contribution of the sector. Figure 2 shows that technology earnings currently represent 25% of regional earnings in the US and EM.

The sector as a whole is not overvalued if we combine the price-to-book ratio with the return on equity. The 10% (and growing) gap between tech and the rest of the market clearly justifies the valuation premium.

One of the bigger challenges remains the high positioning in the sector. Being overweight FANG stocks (30% of tech market cap) is the most crowded trade, and these companies have probably the most at stake in regulatory changes. We are neutral on the sector.

Diesen Beitrag teilen: