NN IP: Where we are in the earnings and valuation cycle

While US equities may be vulnerable in the medium term, the short-term outlook is supported by good macro and earnings data, and by the US’s safehaven status in the current geopolitical turmoil.

21.08.2018 | 09:19 Uhr

ES Figure 1 In this piece, we will try to identify where we are in the earnings- and valuation cycle. This week, we will focus on the US market, which appears to be at the most advanced stage of the cycle. Next time we will do the same for Europe.

First observation: Over the past 12 months, US net earnings growth was 20%, almost three times the long-term average. Of course this is an inflated number following the comprehensive tax reform. However, even the growth in gross operating profit is above average. Figure 1 illustrates the trend in EBITDA, where we note that the level of growth has been stable over the past year at around 9%.

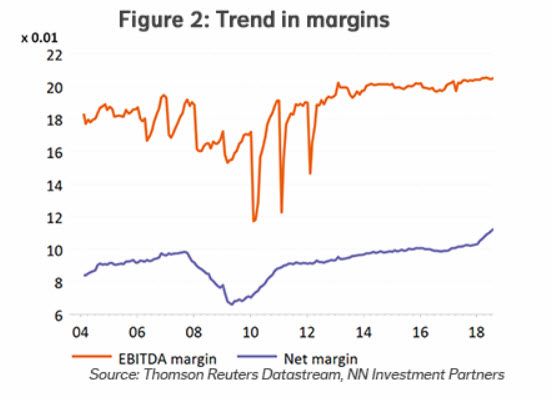

Second observation: Operating margins are also stable at historic highs, well above the pre-crisis levels. Here headwinds may start to build due to the appreciation of the USD, the risk of rising costs caused by higher commodity prices, production bottlenecks and increasing labour costs (although this is not really visible yet in the data). Higher financing costs due to Fed tightening and higher long-term bond yields could take another chunk of net profits, especially as the indebtedness of US non-financial companies has increased to the highest level in 15 years. Finally, an economic slowdown over the course of the coming quarters can clearly not be excluded.

ES Figure 2 One element to take into account is, of course, the growing importance of the highly profitable, little indebted IT sector (EBITDA margin of 31%, 10% above the market average). This may explain the rising trend in operating margins. An additional support for US equities is the record amount of equity buy-backs (around 2% of market cap) as companies use part of the repatriated cash to fund these.

Valuations provide a mixed picture

Third observation: Valuations provide a mixed picture. Thanks to the boost from tax reform, the PE based on 12-month forward earnings has dropped. This makes sense as investors are unwilling to reward a one-off tax boost to the same extent as an improvement in the real earnings power. On the contrary, on price to EBITDA, we can conclude that the US market is valued close to historic highs.

ES Figure 3 If we look at the cyclically adjusted PE, we notice that for this metric as well, the US has reached its most expensive valuation since the TMT bubble. Meanwhile, the US equity risk premium has fallen close to its lowest post-crisis levels (around 3%). A rise in bond yields could compress the equity risk premium further unless it is accompanied by an upward revision in the LT growth outlook.

Conclusion

Given the high point in the earnings cycle and taking into account that valuations are also elevated relative to historic norms, US equities look vulnerable over the medium term. On the other hand, the short-term outlook is supported by the good relative macro and earnings data and safe haven status of the US in the current geopolitical turmoil.

Diesen Beitrag teilen: