Robeco: ‘When Fed hikes, buy global equities and commodities’, history says

A question, that has lain dormant for a decade, is popping up again. Wat does a Fed hiking cycle mean for my investment portfolio?

24.05.2016 | 10:00 Uhr

It took a while, but investors slowly start to realize that the Fed is for real. It has been over a decade since we last experienced a proper Fed rate-hike cycle. And, as Yellen emphasized many, many times now, it won’t be fast, it won’t be massive, but there will be one. Hence, a question, that has lain dormant for a decade as well, is popping up again. Wat does a Fed hiking cycle mean for my investment portfolio?

A look at history

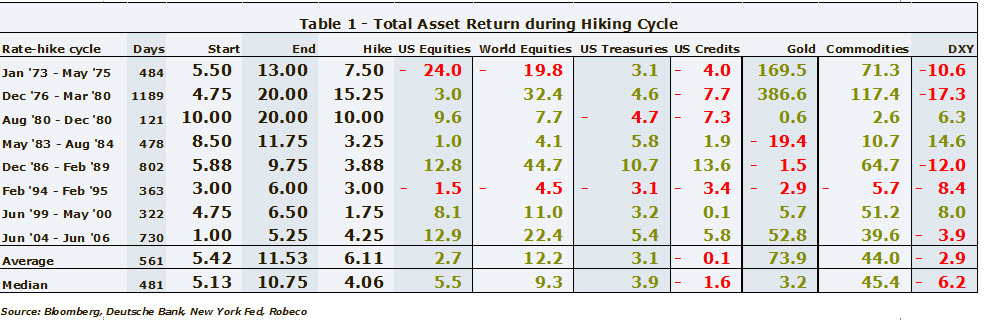

People in general, but investors in particular, too often believe that ‘this time is different.’ This tendency makes history an obvious place to start looking for an answer. The table below shows the returns of a series of major asset classes during the last eight Fed hiking cycles, starting in 1973. Admittedly, the table holds a lot of data, but when scrutinized they reveal some interesting insights.

First, commodities and gold generated massive returns during periods of monetary tightening. Commodities gained an average of 44% during the last eight hiking cycles, while gold went up a staggering 74%. Now, before you rush off to put all of your money in gold ETFs, please take another look at the table. It shows that the average gold return is dominated by two hiking cycles, which also happen to be the ‘oldest’ ones. In fact, in three out of the six most recent hiking cycles the price of gold went down. On one occasion (the ultra-short hiking cycle of 1980) the return was basically flat. This is reflected in the median gold return (the ‘middle’ value of the return series), which is ‘just’ 3.2%. Hence, gold has been a far less attractive bet than the average return suggests. With a median return of 45%, this is definitely not the case for commodities as a group. Historically, commodities have been the place to be when the Fed raises rates.

Second, go global! Global equities have done much better than their U.S. counterparts. On average, global stocks beat American stocks by almost 10%. That’s huge!

Third, contrary to what many investors think, the U.S. dollar tends to depreciate when rates go up. It may sound plausible that higher rates attract foreign investors and savers, but history proves otherwise.

Fourth, Treasuries beat credits. Even as the Fed lifts short-term rates, Treasuries manage to yield a positive return. And not just during the ‘older’ hiking cycles when interest rates were at much higher levels. A flattening of the yield curve can help explain these positive returns. As the Fed hikes, future growth estimates are reduced, pushing down longer-term interest rates as well. Perhaps lower growth forecasts also cause spreads to widen, explaining the underperformance of credits. But even if this is the case the negative average and median return look a bit puzzling. The Fed tends to raise rates when economic conditions improve, reducing the probability of defaults. It would require quite some spread widening to warrant for the difference with Treasuries.

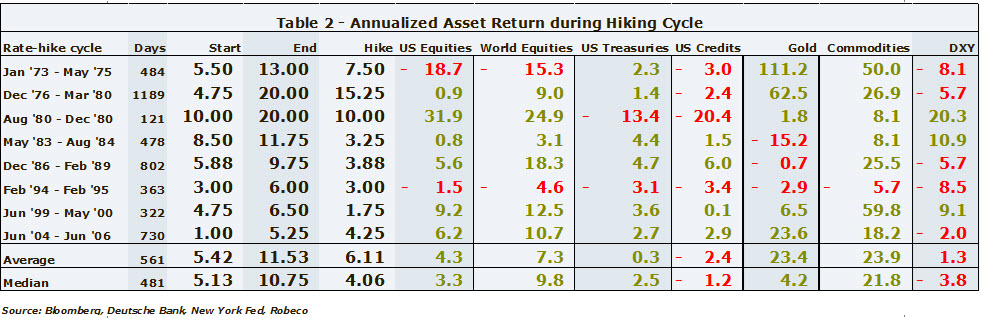

Annualized Returns

There is one issue with the table above, though. The returns are not really comparable since the rate-hike cycles vary greatly in length, from just a couple of months, to over three years. To adjust for duration, the table below shows the average annualized returns. This yields very similar results, however. Governments bonds are the exception to that statement. They still beat credits, but from an absolute return perspective they’re hardly worth looking at.

Is this time different?

If history has anything to say about it, you should add commodities and global equities to your portfolio during a hiking cycle. But is this time really not different? Well, for commodities China could spoil things. As China’s economy matures and its growth rate slows, demand from the world’s biggest commodity consumer declines. This started off one of the biggest bear markets in commodity prices in the first place. One thing is changing, however. Mining companies have massively scaled down future investment in capacity. OPEC ‘freezed’ output and low oil prices caused output from U.S. shale companies to fall. Supply and demand will likely rebalance somewhere during the coming hiking cycle, positively impacting prices. But, do not expect a straight line up from here.

For global equities things look a bit more straightforward. Contrary to U.S. equities, overseas stock markets are not expensive, although they’re not really cheap either. Companies outside the U.S. are still reaping the benefits of a massive devaluation of their currencies against the U.S. dollar. In addition, central banks outside of the U.S. are easing instead of tightening. So, while it will take some time before we know, betting on history appears to give you decent odds, yet again!

Jeroen Blokland

Diesen Beitrag teilen: