NN IP: A quiet summer after all for emerging market debt

Emerging market debt has performed quite well in the past few months. The strong belief of investors in a very gradual tightening of monetary policy in developed markets and the improving EM growth backdrop are the key reasons for the EM resilience.

25.08.2017 | 16:31 Uhr

A quiet summer after all

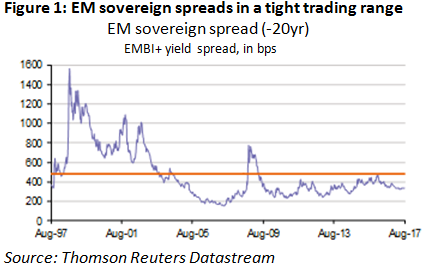

Even during the hottest days of the most recent episode of the North Korean conflict, EM spreads did not widen much (see Figure 1). The tight trading range of 320-340 bps in which EM hard-currency sovereign spreads have traded most of this year is still intact. Also the ongoing infighting in the White House and the overall ineffective Trump government has not had any negative impact on EM spreads. Even the weaker-than-expected Chinese activity data for July failed to do some damage.

Two factors explain most of the resilience of EM assets lately: the strong confidence among investors that DM central banks will continue to be very cautious in normalising monetary policy and the improving EM growth backdrop.

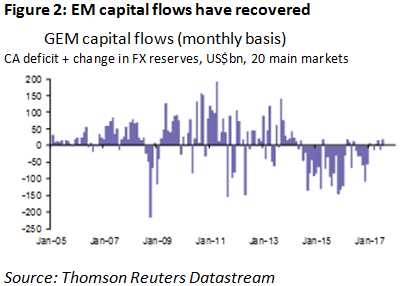

Markets have gradually priced out most of the earlier anticipated policy tightening by the Fed. This is clearly visible in the Fed fund futures. Only one rate hike is priced now for the coming one and a half year. Hence the EM carry trade remains highly popular. Broad capital flows to the emerging world have been recovering since the beginning of the year and were particularly strong in July with an aggregate inflow of USD 18 billion (see Figure 2). The strength in flows to the highest-yielding markets, such as Brazil, Russia and Indonesia, suggests that risk appetite has increased again recently.

With risk appetite for EM yield strong and rising and with hardly any US monetary policy tightening priced in, it is probably wise to approach the upcoming Jackson Hole get-together with some caution. Simply because it feels like there is more room for hawkish than dovish surprises coming from the different speeches.

Nevertheless, in the last few days, looking at the riskier EM segments, we do not really see increased caution. We also tend to believe that the Jackson Hole speeches will not change much in the benign liquidity environment for EM, but if all risk of a hawkish surprise is being priced out, we automatically should be more alert. This is the main reason why on balance we are keeping only a modest overweight in EM debt: a small underweight in sovereign hard-currency debt combined with a medium-sized overweight in local-currency bonds.

Reviewing the more endogenous factors that drive EM debt, such as inflation, fiscal and external imbalances and growth momentum, we continue to see a solid macro backdrop. The recent pick-up in EM credit growth is particularly exciting. This should help the domestic demand growth recovery to strengthen in the coming quarters. EM equities should benefit more from this than EM debt. But also for the debt categories it is a positive as accelerating domestic demand growth alleviates fiscal problems and can help interest rates to move lower. With domestic demand growth still rather subdued and only recovering for a few months, it is too early to fear economic overheating and rising inflation in EM.

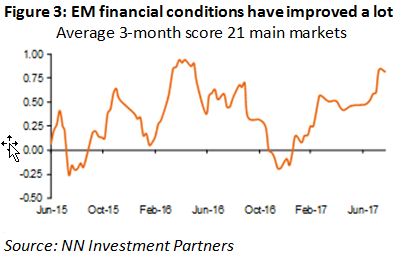

The declining macro risks and low inflation in combination with good capital inflows is all nicely reflected in the continuous easing of financial conditions. Our own EM financial conditions indicator has been rising a lot in recent weeks (see Figure 3), which gives us comfort that the domestic demand growth recovery will continue. Also, in the improvement of this indicator we see the confirmation that the environment for EM assets remains good.

Diesen Beitrag teilen: