NN IP: Calm has returned on spread markets

Spread market sentiment soured in the first half of November, but in the past few weeks the mood of the market has improved on the back of solid macro data. In terms of positioning we currently prefer Investment Grade over High Yield credit.

13.12.2017 | 09:29 Uhr

The spread widening of the first half of November turned out to be another wobble. As such, it resembles earlier periods of tension in spread markets seen in 2017, like we had in the run-up to the French presidential election in March-April or due to the rise in geopolitical tension around North Korea in August. This time around, a multitude of factors appeared at the origin of the spread widening. It started in September when Fed exit expectations started being repriced, leading to profit taking in particularly local-currency EM debt. In November other factors became dominant, like idiosyncratic events (US telco), high corporate supply ahead of an expected slowdown in December, disappointment about the size and timing of the US tax reform proposal, and US curve flattening. Nevertheless, calm returned again against a background of continued solid macro and earnings data and a renewed search for yield.

As the valuation of credits is high across the board, investors are nervous about any reversal of fortunes for the asset class. As witnessed this year, triggers for such reversals need not to be spread market-specific but may be vaguely related. It highlights a high degree of vulnerability of spread markets currently.

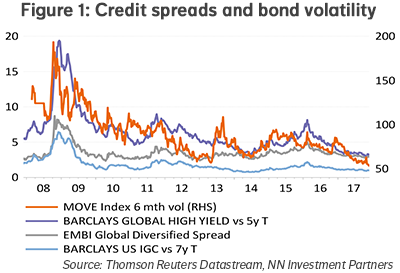

Spread levels are indeed tight in historical perspective. Nevertheless, the correlation of spread levels with levels of market volatility remains high. Hence, the low level of market volatility is matched by equally low spread levels. This is illustrated in Figure 1, in which the MOVE Index is the measure of government bond volatility.

This low level of market volatility may reflect some complacency of market participants, but it may equally be justified. We tend to lean towards the latter currently. Global economic growth is solid, synchronized and broad-based. Corporate earnings and balance sheets are healthy. Moreover, inflation is subdued, allowing central banks to remain accommodative at this stage which feeds expectations of the all-important gradual nature of monetary policy normalization. Spread markets have been very much supported by central banks in the aftermath of the global financial crisis, orchestrating a major search for yield trend. As yet, this trend seems unbroken but into next year things may change depending mainly on inflation dynamics and subsequent central bank exit perceptions and actions. A leading indicator for spread products in this respect are bank credit standards, as these historically lead defaults and hence spread levels. For now, they still point to credit standards being eased for firms in both US and Eurozone which, combined with solid macro data, foresees a continuation of low default rates.

Investment Grade preferred over HY on a risk-adjusted basis

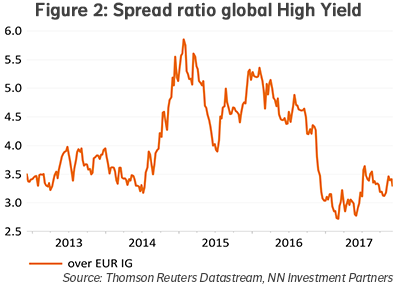

In terms of positioning we prefer Investment Grade (IG) over High Yield (HY) credit on a risk-adjusted basis. EUR IG and USD IG are overweight while Global HY is neutral. One of the factors supporting this positioning is relative valuation. The HY spread ratio over IG spread is still around the lows seen over the past years.

The steepness of the Bund curve (2y to 10y around historical average) remains supportive for EUR IG. With the ECB having confirmed that rate hikes would only come well beyond the end of the asset purchases program (which lasts at least until September 2018) short-term rates appear firmly anchored in negative territory, leaving carry support for EUR credit. Moreover, the share of credits is expected to rise from January onwards in the EUR 30 billion monthly purchases.

We raised the overweight in USD IG credit to medium. Better market technicals due to lower expected supply, and reduced leverage, the extent of which depending on the size and timing of US corporate tax reform, are supportive. Foreign inflows to the category should remain a tailwind, while also short-term momentum of USD IG (and relative to EUR IG) has improved recently.

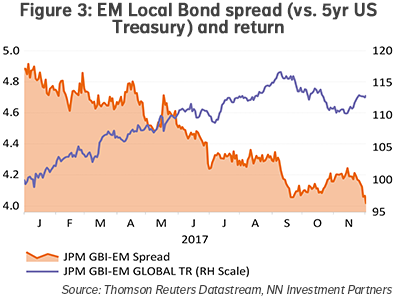

Within the EMD block we closed the underweight in EMD LC rates. Short-term (EM FX) momentum and EM inflation surprises have improved for EMD, as well as the short-term TED spread in terms of liquidity. Sentiment has also improved, while EMD LC attracted inflows again in the past few weeks after prior outflows..

Diesen Beitrag teilen: