Schroders: Monthly markets review - May 2017

An overview of markets in May 2017 when economic news remained encouraging and political risks faded.

07.06.2017 | 08:58 Uhr

US

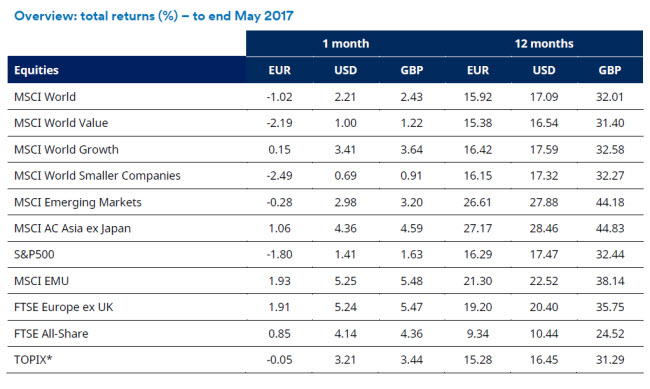

The S&P 500 recorded a positive return of 1.4% over the month. US equities advanced against the backdrop of improving macroeconomic data following a run of weakness. The Bureau of Economic Analysis upgraded its estimate of first-quarter GDP growth from 0.7% to 1.2% and revealed that household expenditure had risen 0.4% in April.

Despite the improvement in the data – which prompted forecasts US GDP would bounce back in the second quarter – many forward-looking activity indicators continued to disappoint, building on the recent trend. Notably, the Institute for Supply Management reported a further decline in its manufacturing purchasing managers’ index (PMI), which fell for the second consecutive month to 54.8 in April.Large-cap equities outperformed over the period with the more domestically-orientated Russell 2500 and Russell 2000 recording respective losses of 1.1% and 2.0%. This was against a backdrop of increased political uncertainty following President Trump’s dismissal of the FBI director; the bureau is currently investigating links between the Trump campaign and the Russian government.

Europe

Eurozone equities notched up gains in May, with the MSCI EMU index returning 1.9%. Domestically-focused sectors such as utilities and telecommunications services led the way. Utilities were further boosted by speculation of merger & acquisition activity. Meanwhile, cyclical (economically-sensitive) sectors including materials and consumer discretionary were the laggards. The first quarter earnings season concluded during the month and this was a further source of support for the market, with good earnings growth from a large number of sectors.

Eurozone GDP expanded by 0.5% quarter-on-quarter in Q1, the same pace as in Q4 and in line with market expectations. Forward-looking survey data continued to be robust with the flash eurozone composite PMI holding steady at a six-year high of 56.8. Data released at the end of the month showed the unemployment rate dipped to 9.3% in April from 9.4% in March, with inflation estimated to fall back to 1.4% in May from 1.9% in April.

Political events continued to be an important focus, with centrist Emmanuel Macron winning the second round of the French presidential election. This had been widely expected after the first round in April when he and anti-EU candidate Marine Le Pen reached the run-off.

UK

The FTSE All-Share rose by 4.4% over the month. Many of the market’s internationally diversified large-cap sectors performed well following sterling weakness. Sterling weakened amid concerns over what a narrowing in the polls ahead of the UK general election might mean for the Brexit negotiations.Large-cap equities were also supported by a reversal in the so-called “reflation trade”1 with a rotation back towards some of the more defensive areas of the market and away from cyclical sectors. The FTSE 100 outperformed the wider market, recording a gain of 4.9% compared to the FTSE 250, which returned 2.2%.

The reflation trade unwound somewhat amid increased uncertainty around the global growth outlook. Despite this trend, many cyclical sectors still generated positive absolute returns over the period against the backdrop of some robust corporate results, including strong first-quarter numbers from the oil & gas and financial sectors.

On the negative side, the basic materials sector fell over the month amid some disappointing Chinese macroeconomic data and following an ongoing reversal in iron ore prices. Meanwhile, many domestic cyclical sectors underperformed against the backdrop of the increased political uncertainty in the UK.

Japan

The Japanese stockmarket rose sharply in the first few days of May then moved broadly sideways to produce a total return of 2.4% for the month. Broadly defensive areas such as foods and telecommunication stocks performed well while economically-sensitive sectors such as marine transport and steel stocks underperformed, together with financials. Real estate stocks were able to register a modest outperformance. For the second month running the strongest sector was “other products”, led by Nintendo which continued to react positively to last month’s results announcement and ongoing newsflow around game releases.

The underperformance of cyclical stocks was somewhat surprising as economic data was generally positive. Preliminary data showed real GDP grew at an annualised rate of 2.2% in the first quarter. Labour market data continued the very strong trend seen for some time and industrial production was strong although slightly lower than some estimates. Forecast data continued to suggest that the Japanese economy is moving into a more robust phase of recovery, which is driving expectations for a pick-up in inflation in the second half of 2017.

The corporate results season for the fiscal year to March 2017 was completed in May, with a majority of companies reporting profit figures above expectations. Companies’ own forecasts for the new fiscal year are slightly lower than expected but look excessively conservative in the light of recent economic data. Despite this relatively positive economic and corporate backdrop, any improvement in equity market sentiment was constrained by the ongoing maelstrom of US politics together with the escalating risk from North Korea.

Asia (ex Japan)

Asia ex Japan equities continued on their stellar run as May delivered a fifth consecutive month of positive returns. Sentiment for global stocks remained upbeat amid a risk-on approach from investors. In China, stocks saw solid gains on renewed buying interest in smaller companies and technology names. These gains came despite a softening in key data points as well as a credit rating downgrade for the country from Moody’s. However, the Chinese yuan did end the month up +1.1% against the US dollar as the greenback depreciated against most global currencies.

In Hong Kong, stocks advanced on solid earnings results for some of the city’s blue chip heavyweights. Over the strait in Taiwan, technology stocks led the market higher as its key benchmark index – the TAIEX – closed above the 10,000 point mark for the first time in 17 years. Korean stocks were the region’s big winner as its market saw strong gains on share price rises for key exporters and an election victory for new President Moon Jae-In.

In ASEAN, the Philippines, Thailand and Indonesia all saw their markets gain. Indian stocks also advanced on hopes that the government’s reform programme will strengthen growth and corporate earnings.

Emerging markets

A supportive global backdrop was beneficial for emerging markets. The MSCI Emerging Markets index posted a positive return and outperformed the MSCI World.

The improving outlook for European growth served to improve sentiment towards emerging European equities. The confirmation of Emmanuel Macron as French president, following the second round election, was also positive. These tailwinds benefited the markets of Hungary and the Czech Republic in particular.

Elsewhere, Korea outperformed, supported by the pick-up in global growth which is expected to continue to boost earnings. Furthermore, Moon Jae-In was elected president in May, replacing Park Guen-Hye who was formally impeached in March. There is now the prospect of a fiscal stimulus package. Despite moves to deleverage the economy, China also posted a robust return and outperformed, in part given central bank action to increase liquidity.

By contrast, Brazil underperformed as political risk increased following corruption allegations against the president. Russia was the weakest index market as energy prices weakened.

Global bonds

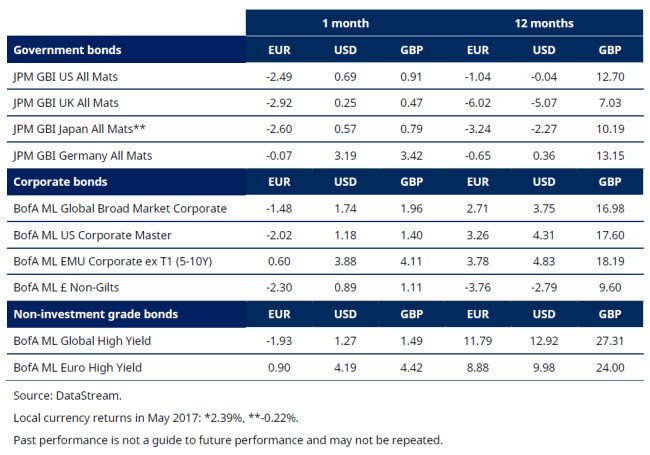

Global bond markets were stronger across the risk spectrum in May as financial and economic data remained broadly positive and investors weathered geopolitical concerns. Riskier assets continued to perform well, though most indices were firmer.

In the US, President Trump faced one of his most tumultuous periods yet. Following his controversial sudden dismissal of James Comey as head of the FBI, reports emerged suggesting the president may have committed or attempted an obstruction of justice. The president caused a further stir with the announcement of the US’ withdrawal from the Paris climate change agreement.

Emmanuel Macron was confirmed as the new French president. However, while this helped sentiment and European yields, focus shifted to Italy amid rising expectations of an early election. With polls still show strong support for the populist Five Star Movement party, Italian yields retreated into month-end.

Despite the somewhat uneven global backdrop, government yields generally narrowed and were aided by benign inflation data. The 10-year Treasury yield fell from 2.28% to 2.20%. The 10-year gilt and Bund yields fell two basis points apiece to 1.07% and 0.30% respectively. Italian and French spreads narrowed modestly.

The investment grade2 BofA Merrill Lynch Global Corporate Bond index rose 0.94% (in local currency) and outperformed government bonds by 0.41%. The equivalent high yield index rose 0.73% (in local currency) and outperformed government bonds by 0.40%. The outperformance of high yield credit in Europe bucked the trend elsewhere.

Turning to convertibles, global stockmarkets continued on their upward slope in May with strong gains on key global stockmarkets. The overall MSCI World index was up 2.2%. Convertible bonds as measured by the Thomson Reuters Global Focus convertible index, gained 1.1% in US dollar terms in April. Implied volatility, as a typical measure of the price for the conversion right, remains just over 30% while historic volatility figures are extremely low. As a truly global convertible bond specialist we are able to find pockets of cheap convexity3 within our convertible bond universe.

Commodities

The Bloomberg Commodities index recorded a negative return, as all three components finished in negative territory. In the energy segment, coal (-12.1%), natural gas (-6.3%) and Brent crude (-2.8%) were all down, amid oversupply concerns. OPEC members, and some non-member nations, agreed to extend production cut targets for nine months. However, latest production figures indicated the first monthly rise in OPEC output this year. In industrial metals, iron ore declined 13.6% as Chinese supplies, which were already elevated, hit record highs. Copper (-0.6%) and zinc (-0.9%) were also weaker. Within the agriculture component, sugar (-7.8%) was the weakest commodity. Precious metals were relatively stable with gold and silver up 0.3% and 1.3% respectively.

Den vollständigen Artikeln finden Sie auch hier.

Diesen Beitrag teilen: