Schroders: UK election result – What a hung Parliament means

The UK general election unexpectedly resulted in a hung parliament, where no party had an overall majority. Our investment experts Azad Zangana, Alix Stewart and David Docherty discuss the economic and market implications of this surprise result.

12.06.2017 | 08:58 Uhr

What is the economic view of the results?

Azad Zangana, Senior European Economist & Strategist:

“The result is clearly a surprise, given polls in the run-up. A minority Conservative government would be reliant on the support of opposition parties. Passing a Budget, for example, in such an environment could prove very difficult. It may be that a minority government would not last for very long.

“On the economic side, we may well see corporates and households reduce their spending due to the uncertainty. The UK economy has already been slowing and this slowdown would likely continue.

“On the other hand, one can read this election result as a pushback against austerity. The Conservative manifesto implied austerity for a further five years and this is unlikely to be the case now.”

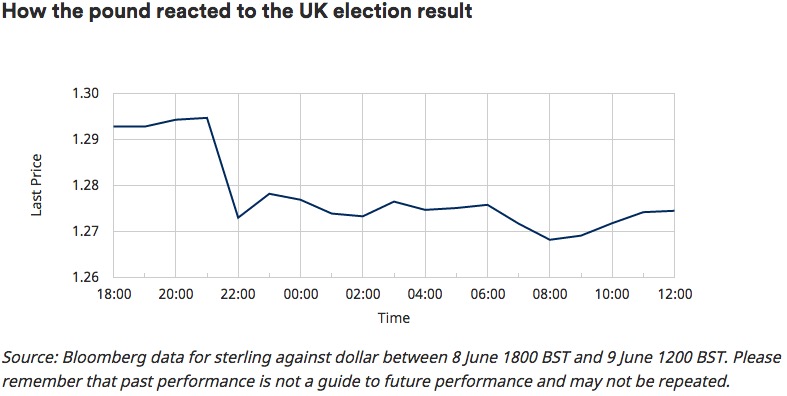

How has sterling reacted?

Azad Zangana:

“On the currency front, the pound has fallen but not by as much as some in the market might have expected. A falling pound will lead to higher inflation. Wage increases have already been failing to keep pace with inflation so higher inflation implies a greater squeeze on household finances.

“For corporates, a weaker pound is beneficial for exporters as their products are cheaper for overseas buyers. However, importers will face additional costs, and the question is whether these will be passed on to consumers.”

What is the impact on bond markets?

Alix Stewart, Fund Manager, Fixed Income:

“There are a number of implications. Firstly, the falling pound is inflationary and bond markets do not like inflation. Secondly, an end to austerity would imply more borrowing and increased gilt issuance, which would be another negative for bond markets.

“Longer-term, another factor may be the potential for a softer Brexit. This would likely be perceived as positive for the economy, but this could in turn open the way for the Bank of England to raise interest rates. This would be a third negative for bond markets.

“Another important factor to consider is that non-UK investors buy a sizeable proportion of UK bonds. The uncertainty over Brexit, and the potential for an unstable UK government, could potentially deter overseas investors. This would also see borrowing costs rise for the UK.”

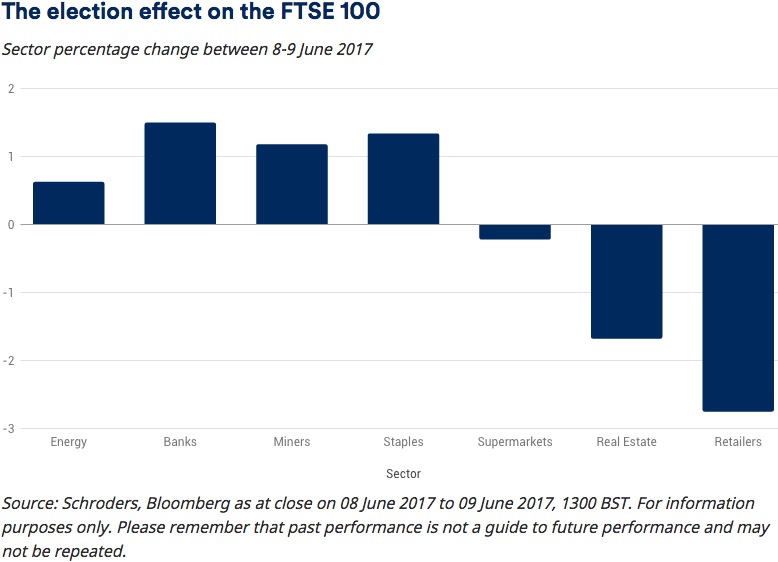

How are equity markets reacting?

David Docherty, Fund Manager, UK Equities:

“In terms of the initial reaction, UK stockmarkets have already witnessed a flight to safety today. Internationally-exposed firms, particularly those with dollar earnings, are doing well. Meanwhile, the domestically-focused consumer stocks have come under pressure. This is a snap reaction that we have seen before, particularly around the Brexit vote, and it may not last for very long.

“Another consideration is the potential for a ‘reflation trade’ in the UK, if the government’s focus were to switch away from austerity and towards higher public spending.

“In the medium-term, investors must recognise that the possibility of a Labour government in the near future has increased. They should start to consider the potential impact of Labour’s policies, such as renationalisation, higher corporation taxes and a higher minimum wage.

“Above all though, investors need to place today’s result in context. This means not just looking at the politics but also at the global economic backdrop.

“Most importantly, UK equity investors need to look at the bottom-up stock-specific opportunities that may emerge in stocks that suffer an unjustified sell-off.”

What is the impact on Brexit and sterling?

Azad Zangana:

“Exiting the European Union continues to be the dominant factor in the UK’s longer-term economic outlook. Brexit talks are slated to start on 19 June but it’s not clear now who will lead the talks from the UK side.

“Brexit is the overriding factor in terms of the outlook for sterling. Indications of a softer, and indeed successful, Brexit will likely be positive for the pound. On the other hand, a hard Brexit would be negative for sterling.

“Theresa May called the election on the basis of strengthening her mandate in negotiating Brexit. The fact that she has lost her majority is therefore a concern.

“The Brexit timeline is fixed and can only be extended if all EU member states agree. There is no reason why they would agree to do that. The chances of the UK being offered a ‘take it or leave it’ deal have increased substantially in our view.”

Where are the opportunities in UK equities?

David Docherty:

“As I mentioned, there could be some parallels with the Brexit vote, which initially saw international-earners perform well while domestic stocks sold-off. This trend then reversed fairly quickly. If such a scenario were to occur again then domestic consumer stocks such as retailers could be perceived as attractively valued opportunities.

“There are some such companies in the UK that also offer a ‘self-help’ or management change element that could make them interesting opportunities.

“We would highlight that, since Brexit, there has been an enormous divergence in the performance of the best and worst stocks in each sector. This demonstrates the importance of focusing on the stock level, not just on sectors."

How will the Bank of England react?

Alix Stewart:

“There’s been a huge amount of focus on political events in recent years but in fact central bank actions have been much more important for fixed income markets than politics.

“The Bank of England (BoE) took prompt action in the wake of the Brexit vote last year. This is perhaps the main reason why markets have remained relatively sanguine despite the surprise outcome.”

Azad Zangana:

“The BoE is likely to provide reassurance to markets, saying that it stands ready to act if needed. However, there is a limit to what they can do if the economic picture were to worsen substantially. Restarting quantitative easing, for example, would weaken sterling and potentially make matters worse.

“The answer may lie on the fiscal side. In the event of a UK recession - which is not our base case scenario - the government could use fiscal policy to boost the economy. That said, it could prove extremely difficult for a minority government to pass such a policy in parliament.”

Diesen Beitrag teilen: