Pictet: "Japan ist derzeit ein besonders attraktiver Markt"

Teruhiko Nishimura, Head of Total Return Japanese Equities, und Tomohiro Yamaguchi, Senior Investment Manager bei Pictet Asset Management, erklären, warum sich der japanische Aktienmarkt ideal für eine marktneutrale Anlagestrategie eignet.

19.10.2018 | 09:39 Uhr

For Japan, August 2, 2018 was a momentous occasion.

That was the day when the country’s stock market overtook China’s to become the world’s second biggest, regaining the title it lost four years earlier.

Valued at just over USD6 trillion, Japan’s stock market is undoubtedly one of the most liquid in the world. However, ironically, it is also among the most inefficient: share prices can deviate markedly from fair value.

Why these discrepancies? It’s partly to do with information scarcity. Compared with its peers, the Japanese stock market is under-researched - about 42 per cent of companies listed in the TOPIX index have no sell-side analyst coverage whatsoever.

This

compares with about 1 per cent for the equivalent index in the US, the

S&P 1500.1 But even those companies which do have broker coverage

experience a wide dispersion in analyst estimates - there is often a

significant gap between company guidance and what counts for consensus

market forecasts.

Take the case of Sony, the diversified electronics and entertainment giant. Among 24 analysts who cover the conglomerate, there’s a 33 per cent gap between the highest and lowest estimates for the operating profit for fiscal year ending March 2019 (see chart).

The company's own guidance is lower than the most conservative estimate, and stands 15 per cent below the consensus estimate. And Sony is not an isolated example – the experience is the same for many other Japanese companies, which can lead to wild swings in share prices during earnings results seasons.

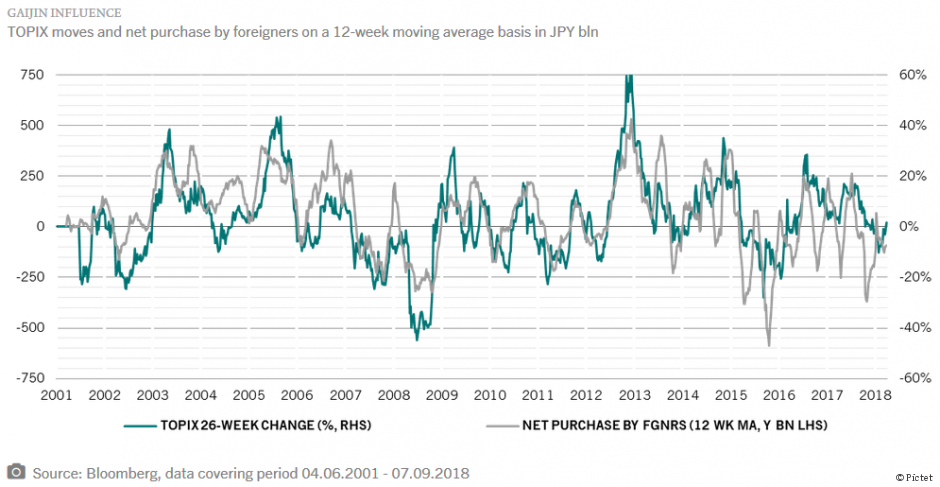

Another distinguishing feature of Japan’s stock market is its investor base. Its deep liquidity and low transaction costs have made it popular with foreign investors, who make up on average at least half of daily trading volume.2

That has an significant bearing on market dynamics. During episodes of stress, such as an emerging market crisis or a China-driven sell-off, this group of investors tends to liquidate their Japanese assets, regardless of corporate fundamentals, and use the money to cover losses elsewhere.

Conversely, during rallies foreign investors tend to chase the market higher, often reacting to specific corporate events or domestic developments (see chart). As such, their presence tends to expose the market to swings in global investor sentiment, which can lead to higher volatility.

At the same time, the market is host to another distinctive block of investors whose trading activities do not always pay regard to corporate fundamentals.

These include the Bank of Japan and the Government Pension Investment Fund, which together own more than 10 per cent of Japanese large-cap stocks and represent the biggest shareholder of one in three of them.

It is because of these idiosyncrasies that the Japanese stock market lends itself especially well to alternative investment approaches.

Market neutral for Japan

We believe investors looking to better harness Japan’s investment potential should consider a market neutral approach.

This distinctive investment style combines long and short equity positions and seeks to produce returns almost exclusively from “alpha” – or the security-specific return generated by a skilled investor manager.

At the same time, it aims to limit “beta” exposure, or risks stemming from overall market movements.

This shouldn’t be confused with a long/short directional strategy, under which a manager relies on both beta and alpha to generate returns.

Our market neutral portfolio, or PTR-Akari, is made up of individual “strategies” within the various sub-sectors. Each strategy contains a combination of long and short positions based on an idiosyncratic stock- or industry-specific theme.

These strategies are designed to extract company-specific sources of returns independent of market moves – we hold single or multiple long or short positions and hedge them against a single stock, a customised basket or a corresponding sub-sector index. Japan’s wide market breadth, as well as its low stock borrowing cost – the cheapest in Asia – mean that we can find optimal hedges within each industry sub-sector.

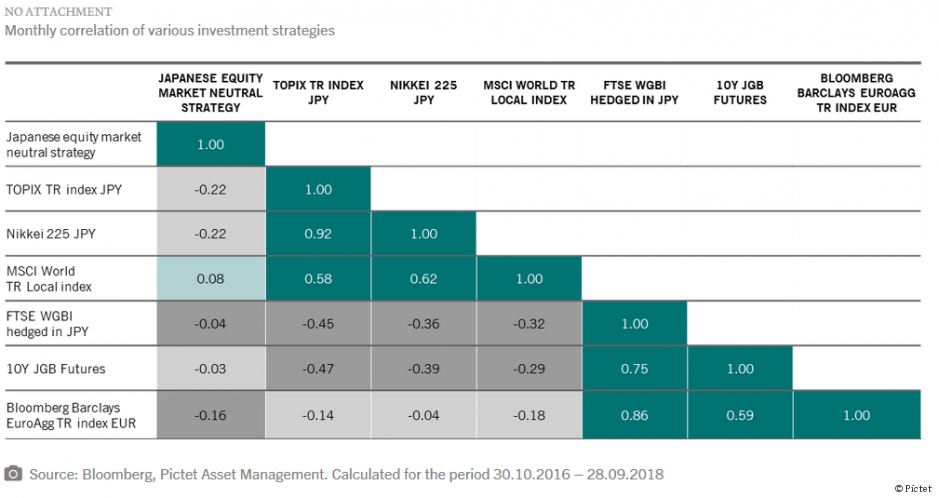

While targeting overall beta to be neutral, we also take steps to diversify our industry exposure. At the same time, we seek to identify and hedge other common systematic risks such as those linked to moves in foreign exchange and interest rates. This fine-tuning helps ensure our portfolio's returns are not correlated with those of the market.

Global value chain analysis

To identify investment opportunities, we typically analyse Japanese companies from the perspective of their global value chains – the full range of activities involved in the production of a good or service. For example, a smart phone may be designed in one country but assembled in another, using labour and materials from several suppliers from around the world. All of these sub-sectors make up a smart phone value chain.

This approach allows us to analyse companies beyond the traditional industry framework used by mainstream equity benchmarks and gives us a broader perspective, which helps to determine how competitive or profitable a particular Japanese firm is in the context of the global economy.

This also helps us to identify sources of alpha that cannot be replicated easily by exchange-traded funds.

We form our strategies by analysing relevant stocks within a certain value chain and anticipating domestic or global events which could trigger changes in their earnings outlook or financial positions.

For example, when we look at the electric appliances sector, we consider it through the value chains of technology, machinery and chemical goods. It is an industry that is undergoing a structural transformation, thanks to advances in technology and automation. We see demand picking up for electric components after years of stagnation because more and more industries, including automobile, are using electric parts to enable automation and data analysis. We have identified some companies which should be able to raise prices and boost earnings (our long positions), at the expense of others which we think are less competitive (our short positions).

Dynamic investment process for a diversified portfolio

Our investment process starts with screening around 2,200 Japanese companies for liquidity.

Only the 500 or so stocks which either have market capitalisation of over USD1 billion or average daily trading volume of over USD10 million make the cut and form our investable universe.

In the next stage we analyse corporate fundamentals from the perspective of global value chains, meeting company management in the process. We also gauge the extent of the gap between various sell-side estimates and our own bottom-up views.

This screening takes the potential investment candidates down to about 200-300. We then use our extensive industry experience in buy-side, sell-side and running proprietary trading books to choose optimal entry and exit points and maximise opportunities which the market presents, taking into account Japan-specific technical factors.

We fine-tune the portfolio, taking into account factors such as size, liquidity and technical signals. At the same time, we seek to eliminate residual market risks. Our final portfolio has 100 to 140 positions across up to individual investment 50 strategies.

Our distinctive investment process produces a portfolio whose returns are uncorrelated with those of other asset classes and has proven to be resilient during times of market stress (see chart).

We believe this strategy should appeal to investors who wish to diversify their existing global equity portfolios and achieve better volatilty-adjusted returns.

Diesen Beitrag teilen: