UBS: Off to the races

The US presidential primaries are receiving blanket coverage worldwide. This is due in large part to the unexpected success of unconventional candidates in both the Republican and Democratic parties. While it’s still too early to draw definitive conclusions on potential policy changes, we can offer some perspective on the market impact that divided government has had.

18.03.2016 | 08:24 Uhr

Passions Trump party leadership

This week’s presidential primaries were the latest in a long string of political contests to determine the nominees for the US presidency. The results suggest that former Secretary of State Hillary Clinton is on a course to win an outright majority of delegates at the July Democratic convention. On the Republican side, businessman Donald Trump leads the delegate count but is less certain to claim the needed majority as a handful of other candidates remain in the race.

When the nominees of the two major parties are determined, it should become easier to discern clear policy differences and gauge the likely outcome of the election. In addition to the presidency, control of both houses of Congress is up for grabs, and the ultimate balance of power will dictate next year’s legislative activity.

Will markets feel the Bern?

Are investors right to worry about how the election’s outcome could affect the US economy and financial markets, given the popularity of unconventional candidates like Trump and Senator Bernie Sanders? We think any alarm is premature at this early stage of the election process.

While there will certainly be clear differences between the two parties’ candidates on important issues like tax reform, trade policy and regulation, control of the US government is likely to remain divided in some way between Republicans and Democrats. A shared power arrangement leads either to compromise or gridlock on contentious issues, and the latter can indeed roil the economy and/or markets.

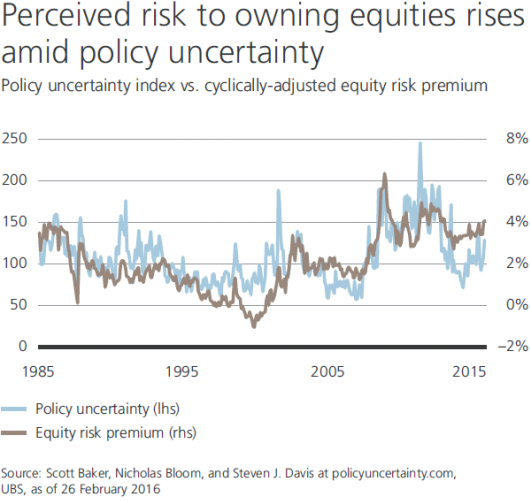

The statistics suggest an election year alone does not derail US stock performance – S&P 500 annual total returns during voting years (11.2%) differ little from the long-run 12% yearly average since 1926. High policy uncertainty is a different risk, and has historically affected asset market performance. Equities performed poorly when US credit was downgraded by Standard & Poor’s in 2011 and in the lead-up to the fiscal cliff negotiations in late 2012.

The figure to the left shows a quantitative measure of policy uncertainty developed by social scientists at Stanford University and the University of Chicago. Current policy uncertainty is muted, and the perceived risk of owning stocks versus bonds (equity risk premium) is high. US equities look attractively valued compared to bonds, though not as starkly as they did during recent spikes in policy uncertainty.

Author: Brian Nick, Head of Tactical Asset Allocation U.S.

Der komplette Marktkommentar als PDF-Dokument.

Diesen Beitrag teilen: