Eurozone equities poised for re-rating

The case for eurozone equities is growing stronger as sovereign QE now seems more likely and earnings improvements are on the horizon.

10.12.2014 | 10:32 Uhr

The chances of the European Central Bank (ECB) engaging in sovereign bond purchases have risen in recent weeks. There are several existing ECB stimulus programmes that are yet to run their course – notably the targeted long-term refinancing operations and asset backed securities purchases. Nonetheless, recent rhetoric from central bank policymakers suggests we need to allow for the possibility of an announcement on sovereign quantitative easing (QE) in 2015, probably in either the first or second quarter.

The ECB may shy away from setting an explicit target for QE purchases but we would expect the central bank's balance sheet to be expanded towards €3 billion from around €2 billion currently. In our view, the boost that would be provided has already been priced in to the fixed income market but not yet to equity markets. The programme would kick-start a reinvestment cycle in Europe, with bondholders such as insurers selling those bonds to the central bank and using the proceeds to buy equities.

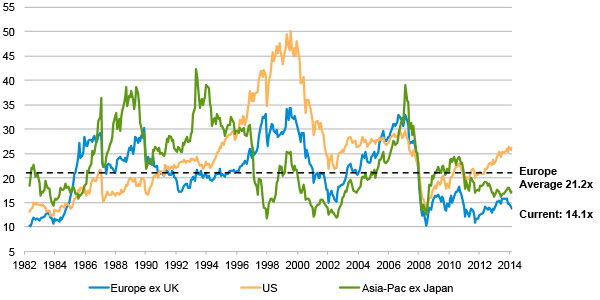

QE to drive eurozone re-rating

If we take the view that QE is on its way, what would we expect the impact to be on the eurozone equity market? All three QE programmes in the US had a substantial positive impact on US equities and we would expect a similar scenario in Europe. On a cyclically-adjusted price-to-earnings (CAPE) basis, the eurozone is currently trading at a depressed valuation. We believe that with QE the market can begin to close the valuation gap; currently Europe ex UK equities are valued 50% below the long term average, offering investors very significant upside.

Cyclically-adjusted P/E of global regions

Source: Thomson Datastream, as at 30 November 2014

Again, following the pattern that we have seen in the US, some of this re-rating is likely to play out ahead of any QE announcement. This will warrant a more constructive stance on eurozone equities looking into 2015.

This is backed up by some more encouraging data from the eurozone. For example, the weakness in Germany since the summer has largely abated with the Ifo business climate survey turning higher in November and factory orders rising more than forecast in October.

Earnings to improve even without QE

Moreover, even if sovereign QE is not forthcoming, we still see a bright outlook for eurozone equities. We think the weakness of the euro against the dollar could add around 5% to earnings per share (EPS). Bond yields have also ground ever-lower and the corresponding refinancing opportunity could add another 5% to EPS. Share buybacks could contribute another 1-2% and the recovery of the banking sector – now that the Asset Quality Review is over – some 2-3%. Taken together, these factors demonstrate the significant possibility of an upturn in eurozone corporate profits next year, regardless of what the ECB decides to do.

Added to the factors above, there is the anticipated boost to consumer spending coming from the fall in the oil price. We estimate that the drop should have a positive impact of around 0.7% on 2016 GDP and more than 1% on personal incomes. This is a still low growth environment, but importantly it is not a ‘no growth’ environment.

New set of market leaders likely in 2015

Looking ahead, we view this as a cyclical opportunity in eurozone equity markets. It may be appropriate to moderate weightings in some defensive sectors such as healthcare and consumer staples – both of which performed well in 2014. With oil prices weak, the energy and utilities sectors will likely suffer. By contrast, the boost to personal incomes should see consumer discretionary plays – for example, autos and consumer cyclicals - fare well.

Other potential winners in 2015 include secure growth stocks and higher quality firms that have pricing power in their markets. Germany could be the equity market to spring a positive surprise, particularly as the macro backdrop appears to have troughed. However, there are some value opportunities left in southern Europe - particularly those companies that can still benefit from reduced refinancing costs.

As ever, we need to be mindful of potential risks. Emerging markets are an area to watch, as are widening spreads in high yield bond markets such as US oil & gas. Overall though, we see plenty of reasons for optimism and think a constructive stance is warranted to take advantage of the possible uplift to come from both sovereign QE and earnings improvements.

Diesen Beitrag teilen: