Henderson: A reflationary world: asset allocation considerations

Nick Watson, portfolio manager within Henderson’s Multi-Asset Team, discusses how the team has been implementing some of its key thematic calls. He explains how positioning is aligned to their outlook for steady recovery, inflation normalisation and the end of super-easy monetary policy.

14.02.2017 | 13:55 Uhr

An active-passive riddle

We think the debate on whether active or passive investing is inherently ‘better’ is wrongly tied to the notion that it has to be a binary choice. The two can perform very differently across the economic cycle, and during varying market regimes, so there is an argument for allocating to both, selectively. We are fortunate that our Multi-Asset remit gives us wide access to both active and passive worlds – and via internal or external means. It has allowed us to remain flexible and dynamic during times of heightened market uncertainty, and capture good risk-adjusted returns, while mitigating downside risks and keeping a lid on costs.

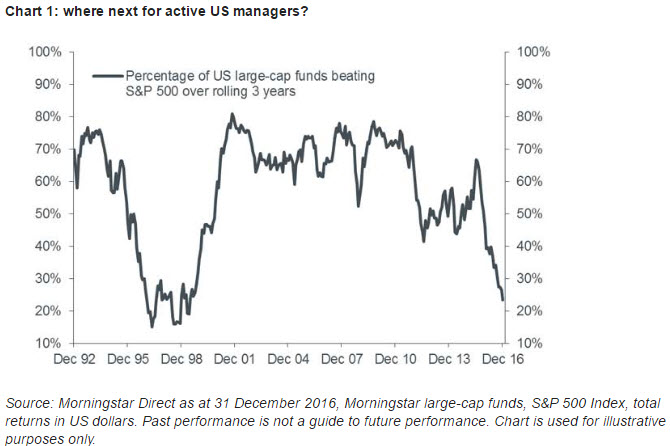

Lower cost passive investing strategies and vehicles have undeniably reaped rewards during the post-financial crisis years. Super-easy monetary policy has propelled markets ever higher and this has meant a difficult environment for active stock-picking strategies when correlations increase and almost every asset rises (chart 1). It is our belief, however, that the great moentary easing is over and growth is returning as a key market driver. With that, we expect fundamentals-based investing to make a come-back. In this scenario asset performance increasingly diverges across regions, sectors, styles and among individual companies, as investors reassess their inherent value. And in this lies an argument for adjusting our active-passive tilt towards more active underlying strategies.

Our regional allocation choices

Global growth is steadying and broadening, with 2017 shaping up to be the sixth consecutive year in which gross domestic product (GDP) growth is in the 3%-5% range. Beneath the surface, however, there is great variation even among the major economies, in terms of where they lie within the economic cycle, and idiosyncratic risks – not least political ones.

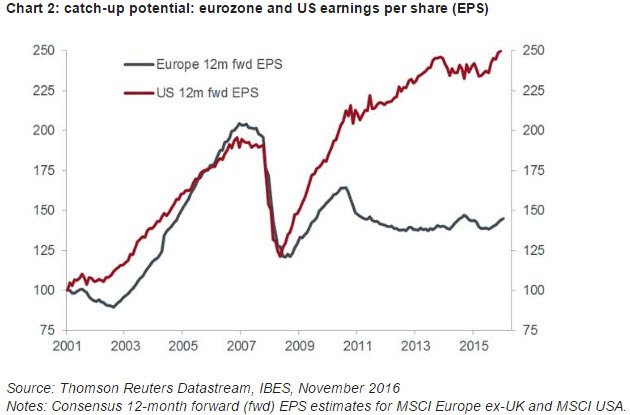

Notably, the US economy is late cycle, with labour market tightening in evidence, whereas data indicates there is still significant spare capacity in Europe. The reflationary theme, although a broad one globally, is more robust in the US, with early indications that President Trump is pursuing fiscal expansion adding weight to the argument that US growth and inflation will continue to gather momentum. Our pick, on a comparative basis, is European equities, because these are still relatively ‘unloved’ by investors from a global perspective. The market currently trades on what we believe is an attractive valuation versus the US. Not only does the value story look compelling, we also see considerable scope for earnings growth to accelerate after lagging the US for five to six years (chart 2).

While we are positive on European equities at an overall regional level, we also have clear views on which areas of the market we want to be in – and which we would prefer to avoid. We see a case for mixing both growth and value styles in Europe: growth stocks typically perform well when price-to-earnings (P/E) ratios are rising and interest rates and bond yields are low or falling: Europe may still see P/E expansion. Equally, there are areas of value where earnings have the potential to grow, and as reflationary forces build. Within our Europe-ex UK allocation, we currently hold internally and externally managed funds, and futures in order to implement our views.

Actively managing EM exposure

Over the past few months, we have grown more cautious about emerging markets (EM), and have been actively managing our exposure. We had been positive on EM for roughly 18 months, given a stabilisation in macroeconomic activity, and the fact that the asset class was relatively underowned. While there is much still to be optimistic about – Russia and Brazil emerging from recession, India’s consistent growth, China’s resilience – we have been taking profits. Our tactical retreat stems from a current lack of clarity over how protectionist the Trump administration might become on trade. We not only have the ability to use specialist EM funds to adjust our exposure, but we can also do so via global equity portfolios that have underlying holdings in EM.

A risk-adjusted approach to high yield

We have also been adjusting our allocation to high yield fixed income. The character of credit markets has changed remarkably during the post-crisis years, being one of the assets that was supercharged by quantitative easing. Buy-and-hold strategies worked incredibly well. But, as the US Federal Reserve progresses with normalising monetary policy, we expect that investors will have to become increasingly more dynamic to achieve returns in credit.

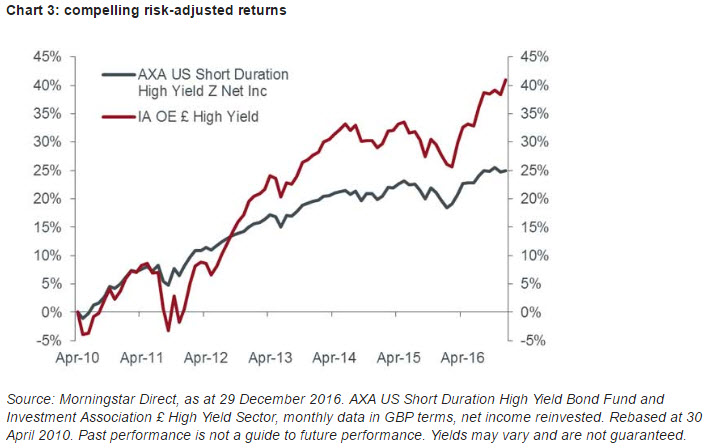

For example, high yield bonds had a very strong run in 2016 and it is hard to see a repeat of that return profile. We are therefore scaling back some risk, moving from high beta active managers (those who have typically produced strong returns, but carry greater downside risk) to those with a more cautious approach. By way of example, in selected portfolios we favour the AXA US Short Duration High Yield Bond Fund. It yields around 4%, compared to the market’s yield of roughly 6%, but we think it prudent to forgo some yield in order to avoid some of the arguably more dangerous parts of the market: for example, we see risk in oil producers. Although past performance is not a guide to future performance, the fund has produced about 70% of the market return with about 40% of the volatility (chart 3): we believe this is a sensible risk-adjusted way of investing in high yield.

We continue to strive as a team to accurately assess the macroeconomic and political backdrop, implement the right asset allocation calls, and utilise the most efficient and effective vehicles to capture investment opportunities globally.

Die Wertentwicklung in der Vergangenheit ist kein zuverlässiger Indikator für die künftige Wertentwicklung. Alle Performance-Angaben beinhalten Erträge und Kapitalgewinne bzw. -verluste, aber keine wiederkehrenden Gebühren oder sonstigen Ausgaben des Fond.

Die Informationen in diesem Artikel stellen keine Anlageberatung dar.

Diesen Beitrag teilen: