Henderson: Q&A: unlocking value in Japanese smaller companies

In this Q&A, Yunyoung Lee, Manager of the Henderson Japanese Smaller Companies Strategy, covers: Overview of the strategy, expectations for Japanese smaller companies’ performance, key drivers of the Japanese equities market and current investment themes.

10.02.2017 | 09:54 Uhr

Q: How would you summarise the strategy?

A: The strategy seeks to deliver long-term capital appreciation by investing in Japanese smaller companies, defined as the bottom 25% of the market capitalisation range. It is a bottom-up, analysis-driven high conviction portfolio of around 50-60 stocks. When I look for new investment ideas, the key two factors considered are valuation (undervalued companies in terms of their balance sheet and also earnings) and investment catalysts to drive earnings and returns.

Q: What are the key differentiators of the strategy?

A: Two factors underpin the success of our approach:

Focus on valuation and catalysts for stock appreciation

As smaller companies are typically under-researched compared to larger ones, we look to discover mispricing opportunities through in-depth proprietary fundamental research focused on a company’s incremental changes. We do not only seek deep value opportunities but also a key driver or catalyst to a company’s earnings over the next three years. Examples of catalysts include new products, new management, restructuring, new regulation or industry-wide changes.

Portfolio monitoring − regular quarterly updates with senior management

In smaller companies, there is a more direct relationship between the views and actions of a few key individuals on a company’s performance compared to larger companies. For this reason, it is important to conduct regular meetings with senior management. A quarterly company meeting is in place for each holding. We try to meet the same key people to validate the investment thesis (eg is the company making progress? What are its future plans?). We then adjust the position size based on our level of conviction, the stock valuation and fundamental research.

Q: What factors will drive Japanese equities’ performance this year?

A: I think there are three main drivers in the medium term: Reacceleration of corporate earnings growth Overall, Japanese equities’ performance was disappointing in 2016 as earnings momentum slowed following strong growth over the last three years. The main reason for this was the strong yen. Now that the currency has relatively stabilised, we think Japanese companies’ earnings growth is set to reaccelerate and therefore Japanese stocks look to be in a strong position to outperform other developed equity markets this year. Strong support for Japanese equities In 2016 the largest buyers of Japanese stocks were state entities like the Bank of Japan and GPIF (Government Pension Investment Fund), as well as Japanese corporations mainly via share buybacks. This is likely to continue into 2017 providing strong support to the market. The GPIF doubled its equity allocation since 2014 and now owns more than 5% of the Japanese equity market according to Bloomberg. Foreign investors were net sellers of Japanese stocks last year but should earnings growth return this position is likely to reverse.

Improving corporate governanc

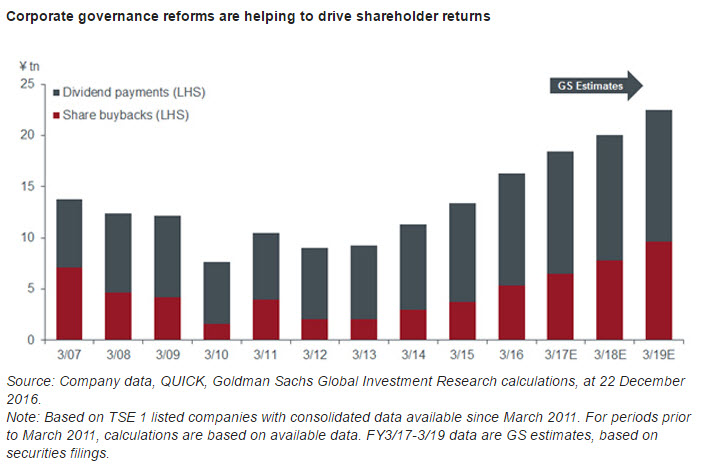

There is a noticeable improvement in corporate governance among Japanese corporations following the changes introduced by President Abe (eg a corporate governance code in 2015). There is more focus on rewarding shareholders with many Japanese companies adopting ROE (return-on equity) targets, while dividend hikes and share buy backs are increasingly the norm rather than an anomaly. This is a trend that looks set to gain momentum – from April to December 2016 a record ¥5.5tn share buybacks were announced by Japanese corporations (see chart).

Q: How do you expect Japanese smaller companies to perform this year?

A: I am constructive on Japanese equities. The market returned almost 80% (Topix total return in yen terms) during the ‘Abenomics* rally’ between 2013 and 2016. During the same period Japanese companies’ earnings grew around 90% (Source: Bloomberg; average diluted earnings per share of Topix-listed companies). At the start of 2016, the markets had relatively high expectations for Japanese stocks to outperform. However, current market expectations do not seem as high, based on the current allocation of major global equity funds to Japan, as well as recent trading patterns of foreign investors. Therefore, we think it is possible for Japanese companies to deliver both double-digit returns and earnings growth in 2017. While the weaker yen initially benefited larger companies last year, smaller companies soon caught up and outperformed the former by 5% (Russell/Nomura Smaller Companies versus Larger Companies Index). I expect a similar level of relative returns from smaller companies this year, as in addition to the three supportive factors for Japanese equities, smaller companies are more domestically-focused and generally have less exposure to external macroeconomic and political headwinds compared to larger, more global-focused companies.

*refers to Prime Minister Shinzo Abe’s aggressive reflationary fiscal and monetary policies

Q: What are your current key investment themes and favoured sectors?

A: Our long-term investment case focuses on the increasing demand from the emerging Asian middle class for the next ten years. While the Japanese consumer remains weak we think the global reflation trend will eventually reach Japan. I think we may see a consumption recovery in the second half of 2017. We hold FANCL, a well-known preservative-free beauty products and health food manufacturer in Asia, which stands to gain from inbound tourism particularly from China. The stock currently trades on an attractive valuation of 5x EV/EBITDA (enterprise value/earnings before interest, taxes, depreciation and amortisation), while structural reform from new management looks promising. The Tokyo Summer Olympics in 2020 has been driving a construction and infrastructure boom since the host city announcement in 2013. This is an investment catalyst for our overweight to the materials sector. A key holding for us here is Tokyo Steel Manufacturing Co. Our conviction in the stock has risen following recent meetings with senior management, which is feeling more confident about medium-term earnings. A key competitive advantage for Tokyo Steel is its relatively low cost base. While some of its competitors will be subject to rising coking coal prices over the next few years, Tokyo Steel uses electricity (electric arc-furnace steel manufacturer), which benefits from more stable pricing.

Q: In your view, what are the key risks facing Japanese equities?

A: I think the main headwinds are more likely to be external rather than market-specific. The largest risk to a Japanese bull market is negative macroeconomic and political developments in the US, Europe or China. Amid ongoing concerns over a slowdown in the global economy, yen fluctuation, volatile oil prices, and the Bank of Japan’s policy decisions, we believe the strategy’s fundamental stock-picking approach and current positioning remains appropriate. In our efforts to capture attractive returns for investors, we continue to seek deep value opportunities and potential investment catalysts for Japanese smaller companies.

Note: references made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Die Wertentwicklung in der Vergangenheit ist kein zuverlässiger Indikator für die künftige Wertentwicklung. Alle Performance-Angaben beinhalten Erträge und Kapitalgewinne bzw. -verluste, aber keine wiederkehrenden Gebühren oder sonstigen Ausgaben des Fond.

Die Informationen in diesem Artikel stellen keine Anlageberatung dar.

Diesen Beitrag teilen: