NN IP: Eurozone euphoria

The investment case for Eurozone equities versus US equities has continued to strengthen in the past few weeks. The political situation seems to be turning in favour of the Eurozone, while macro and corporate fundamentals are also looking better on this side of the Atlantic.

05.05.2017 | 11:16 Uhr

Politics and fundamentals are in favour of the Eurozone

The investment case to overweight Eurozone equities relative to US equities has continued to strengthen. The first round of the French elections had a positive outcome with Macron coming in first before Le Pen. The polls indicate that he will also win the second round on 7 May by a wide 60/40 margin, which is well above the margin of polling error. US politics on their side remain words, smoke and mirrors. The latest catalyst was the failure of President Trump to repeal Obamacare, this despite a republican majority in both the House and the Senate. It is an illustration of the gap between words, election promises, ideas and actual policy making. This has cast more doubts on the effectiveness of the current US administration with regard to Trump's other plans. Last week a "tax plan" was drawn, but it looks more like a set of intentions than anything else. If the tax plan comes through, it will be a positive tail event as the market has hardly taken on board the positive impact on earnings from a reduced tax rate.

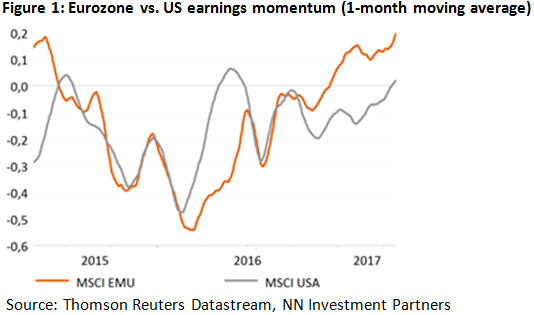

Apart from politics, also macro-economic and corporate fundamentals are better in the Eurozone than in the US. So far, the positive earnings surprise in Euroland is bigger than in the US (10% positive surprise versus 6%), even as also in the US the earnings season is developing very well.

Eurozone profit margins have room to improve

Also in the medium term we think that Eurozone earnings can outgrow US earnings. This is linked to their different point in the earnings cycle. For this we look at recent margin developments. Corrected for the financial sector and the extremely volatile energy sector, we observe that the current gap in profitability is the highest in 20 years. Moreover, the US is back at its historic highs, whereas Eurozone margins are still 300 basis points below pre-crisis levels, primarily due to the recession in 2012 caused by the euro crisis. We see no reason why margins in the Eurozone could not move back to pre-crisis levels, unless Eurozone growth will never reach previous levels again and companies cannot improve their productivity any further. Given the high operational leverage in the Eurozone, margins could start to expand rapidly.

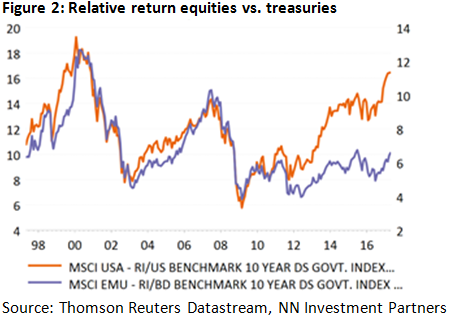

Another way to assess the point in the investment cycle is to compare the reflation waves in the US and the Eurozone over the past decades. We observe that the US and Eurozone investment cycles have decoupled, with the US much more advanced in its preference for risky assets.

Favourable valuations and market dynamics in the Eurozone

To put it differently, the equity risk premium is more attractive in Euroland at levels around 5%, which is well above the long-term average. We feel that this risk premium has room to decline further once the French elections are behind us. The improvement in the macro prospects and corporate developments do also justify a lower risk premium. In the US, on the other hand, the equity risk premium is well below its 10-year average and does not take into account a lot of the political uncertainty. It is not that far from the Goldilocks-levels of 2003-2007. Also on the more traditional valuation metrics, the US trades at a hefty premium relative to the Eurozone (20% on price to forward earnings and 80% (!) on price to book).

Market dynamics also turn in favour of the Eurozone. Flows from non-Eurozone investors are positive but are well below the levels we witnessed in 2015 when the ECB announced its asset purchase program. With political uncertainty in decline, more flows can be expected. Rising flows historically coincide with higher valuation multiples. Eurozone sectors that can benefit most are domestic cyclicals, financials and peripheral markets.

Hence, we upgrade Eurozone equities from a medium to a large overweight. In addition, we maintain our positive stance on Japan and emerging markets. The main short-term driver for Japan is the exchange rate. This driver dominates the favourable cyclical and structural developments underway. The latter are the reason for our overweight.

Diesen Beitrag teilen: