Pictet: EUR Short Term High Yield Debt - Five years on

From a builder of Swiss trams to a British cinema chain, the European short-term high yield market now offers a variety of attractive corporate bonds.

07.02.2017 | 11:41 Uhr

Q. Pictet-EUR Short Term High Yield has just marked the fifth year anniversary. How has this market evolved in the past five years and how has the fund performed?

The market has progressively matured since we began investing in it in 2012 – it is larger, more diverse and more liquid. The investable universe – non-investment grade bonds with maturities of up to four years – has grown to around EUR150 billion from EUR80 billion while the number of companies issuing such debt has risen to 180 from 70, representing just over half of the firms in the broader high yield market.

This is a structural trend: companies have been increasingly using the high yield market to fund themselves because banks have scaled back lending since the 2008 financial crisis. The market is now home to many household names. Indeed, I come across companies we help finance on a daily basis – from the builder of the tram I use in Geneva, to the French telephone operator I use in Paris and the British cinema chain where I recently watched a film. We expect this structural growth in the market to continue in the coming years.

Q. Looking back on the past five years, how has the fund stood the test of time?

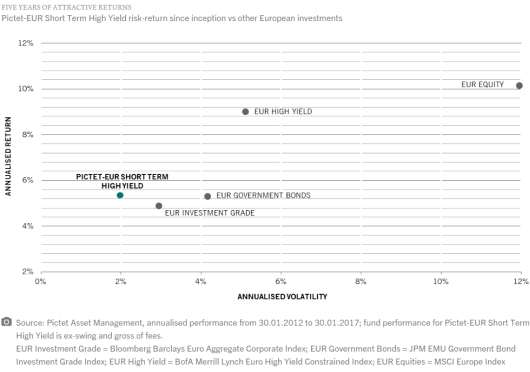

We’ve had a fair share of tumultuous events in the past five years: the European sovereign debt crisis, the taper tantrum (the surge in US Treasury yields in 2013), a commodity crisis, and, of course, Brexit. But the strategy has proved resilient – even in 2014, when a number of companies defaulted on their bonds, the portfolio managed to deliver a moderately positive return. This gives me confidence in our approach where we aim to deliver steady return while keeping volatility in check.

Q. How do you control volatility?

We have been successfully controlling the volatility of returns by limiting the maturity of the debt we buy. For example, we have at least 90 per cent of our portfolio in paper whose final legal maturity is four years. Limiting the maturity of our investments helps protect the portfolio in the event of a steepening bond yield curve, which occurs when yields on longer maturity bonds rise by a greater magnitude than those on shorter-maturity securities. We also limit our holdings of financial bonds (senior debt only) and triple-C rated bonds; each of these bond categories is restricted to 10 per cent. This helps cap the volatility and reduce the potential for capital loss.

In 2016, we were able to minimise the scale of peak-to-trough falls in the value of the portfolio in times of broad market stress. At the beginning of the year, the fund lost 1.5 per cent in mark to market, less than half of what the broader all maturity European High Yield market. In the days following the UK referendum to exit the European Union, the fund also outperformed the all maturity index. For the whole of 2016, the fund gained 4.8 per cent, surpassing our pre-year expectations of 3-3.5 per cent.

True, investors may give up a little bit of return on the final legal maturity approach as the yield on a callable bond is higher than that of a straight bond. However, this makes the portfolio more defensive, allowing investors to generate stable income while limiting the risk of capital loss. It also reduces sleepless nights.

Q. What is the lesson you have learned in running this fund?

Over the course of five years we have had a number of ups and downs but the strategy has withstood these risks. We’ve had three defaults since 2012 but avoided large drawdowns. We think credit events are part of the game as long as we invest in the high yield market. However, our portfolio construction process is based on solid credit selection and risk management. This allows us to identify credit problems early and avoid or limit accidents and their impact.

- "We have had a number of ups and downs but the strategy has withstood these risks."

Q. What’s your outlook for the short-term European high yield debt market in the coming years and which risks are you monitoring in particular?

High yield debt investors have benefited from falling sovereign bond yields and a narrowing of their yield spreads in the past few years. We think spreads might widen slightly in the medium term but they are likely to be supported by commitment from the European Central Bank to keep borrowing costs low to aid economic recovery. Improving economic fundamentals are supportive of the high yield market and default rate projections remain around that 1.5-2 per cent mark, below the long-term average of 3.8 per cent.

Once the ECB begins to scale back its bond purchases, any accompanying market stress is likely to impact BB-rated debt and other sectors in which investor positioning is excessively bullish, such as utilities. We think the short-end of the bond curve will see yields increase at a moderate pace, allowing us to reinvest the money in the 3-4 year maturity area and capture higher yields there. Also, if higher rates are a reflection of more robust economic fundamentals, this would tend to benefit European high yield debt; issuers tend to be mid-sized firms whose profits are mostly generated domestically. Even when yields do rise in Europe, the final maturity feature of our fund should allow investors to protect the portfolio from potential losses.

One of the long-term positive trends in the short-term European high yield debt market is the improving credit quality of bond issuers. The share of BB-rated debt has risen to approximately 72 per cent of the market, compared with 67 per cent a year ago. This partly reflects the rising number of “fallen angels” – bonds which have just lost their investment-grade status – but also a steady improvement in fundamentals of companies and their ability to repay debt.

That is not to say we can be complacent. We are monitoring political risks in Europe, with elections taking place in the Netherlands, France and Germany, as well as keeping a close eye on Britain’s negotiations to exit from the European Union.

Diesen Beitrag teilen: