Robeco: Das Schmelzen der Minen

"Aktien für Metalle und Minen sind in den letzten Monaten, als Resultat des massiven Abfalls der Rohstoffpreise, zusammengebrochen. Der Oktober und auch die Monate danach könnten sich nochmal als schwierig herausstellen", sagt Jeroen Blokland in seinem Blog-Beitrag.

30.09.2015 | 16:17 Uhr

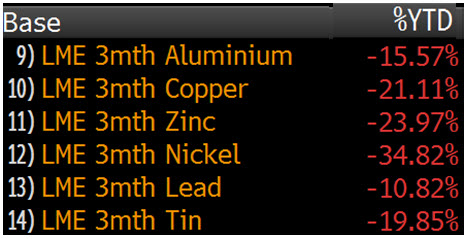

Metals and mining stocks have completely collapsed in recent months as a result of the massive, and ongoing, drop in commodity prices. Copper, often seen as a bellwether of the economy, is down 20% this year alone. But that price movement actually ‘outperforms’ that of other metals like zinc and nickel, which have lost 24% and 35% of their value since the start of this year. It should come as no surprise, then, that the commodity carnage has taken its toll on the stock prices of metals and mining companies.

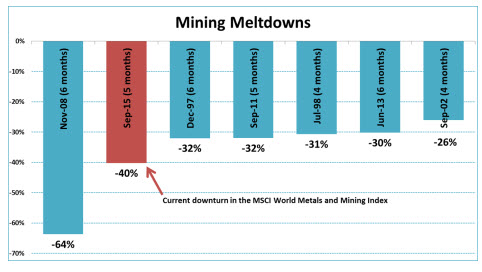

To show just how severe the ‘mining meltdown’ is, I have calculated the biggest drawdowns of the MSCI World Metals and Mining Index based on calendar month returns, since its inception in 1995. To cut to the chase right away, the graph below reveals that the current meltdown is the second biggest on record. The MSCI World Metals and Mining Index has now fallen for five consecutive months losing more than 40% of its value on the way. Only during the (six months) run up and outbreak of the global financial crisis, in 2008, did stock prices of global metals and mining companies fall more. That said; the current meltdown hasn’t come to an end, yet. October, and perhaps even the months after that, can still turn out to be ugly as well. So, while the cyclical character of mining and metals stocks leads to impressive stock price movements from time to time, the current commodity collapse has already propelled this meltdown to the second biggest on record.

Diesen Beitrag teilen: