Schroders: European equities - Economic recovery favours domestically-focused firms

Eurozone equities have had a volatile summer but the region’s economy continues to recover and improvements in corporate earnings should drive further share price advances.

20.08.2015 | 13:04 Uhr

Europe’s economic recovery remains on track

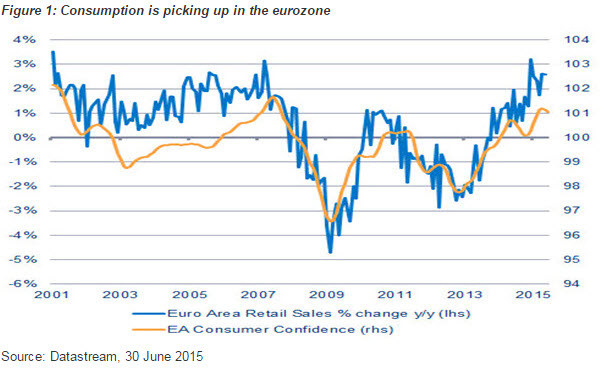

Eurozone equities experienced a stellar start to 2015 amid the European Central Bank’s announcement of quantitative easing (QE). The market’s performance in recent months has been uneven but we continue to see numerous potential drivers of further share price gains. First and foremost, we would point to the ongoing economic recovery in Europe. Reforms and fiscal consolidation undertaken by several countries, notably in the periphery, are starting to show results while ultra-loose monetary policy, including QE, has led to improvements in business confidence. Consumer demand has also been resilient and the fall in oil prices over the past 12 months is helpful for this, especially as the full impact is still to be felt.

Corporate profits poised for further improvement

The gradual recovery in the European economy provides an encouraging backdrop for corporate earnings to improve. After several years of caution due to the economic situation, pent-up demand from consumers and businesses is now being released. The lower oil price is an important factor in boosting profits as companies reap the benefits of reduced input costs. It is the eurozone, rather than pan-Europe, that is driving improved profit growth. Eurozone corporates have grown their earnings by 18% year on year in the second quarter of 2015, accelerating from 11% in the first quarter (source: Barclays Capital, as at 17 August). In terms of sectors, banks and media stocks – both largely domestically-focused areas of the market – have performed particularly strongly in the second quarter with earnings growth of around 40%. We see this earnings momentum as being well underpinned and anticipate further profit improvements in the coming quarters as the cyclical recovery in the eurozone gains traction. We would also highlight the scope for eurozone profit margins to recover towards their pre-crisis levels, as US profit margins have already done.

Greek worries have faded

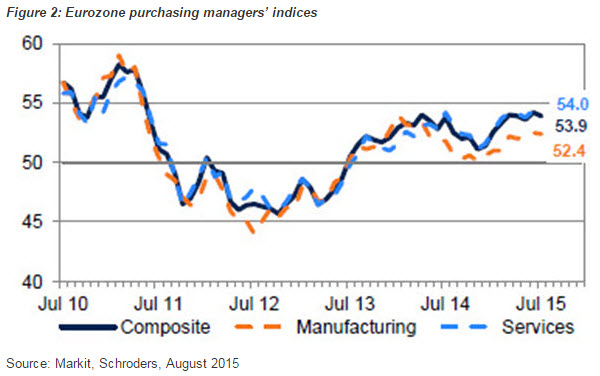

The Greek debt crisis has largely been responsible for the recent stockmarket volatility amid fears that the country could leave the eurozone. These fears have faded for the time being as Athens has accepted a rescue package, although doubts remain about the government’s appetite to implement austerity. As we have said before, Greece represents less than 2% of eurozone GDP, it is not in the main equity benchmark and its debt is predominately held by institutions. We therefore continue to feel that any resurgence of ‘Grexit’ concerns should have a limited impact on the broader eurozone economy. Indeed, recent purchasing managers’ index data have remained comfortably in expansion territory despite the worries over Greece.

A bigger worry than Greece, in our view, is the slower growth being experienced by emerging markets. China has dominated the headlines but Latin America is another region of concern. An interest rate increase by the US Federal Reserve – which may come in the autumn – would be likely to exacerbate the problems facing some emerging markets with the US dollar expected to strengthen further. China’s recent currency devaluation has prompted some concerns but the euro has weakened against the renminbi over the past two years so eurozone exporters are still benefiting from currency tailwinds at current levels.

Favouring companies with domestic exposure

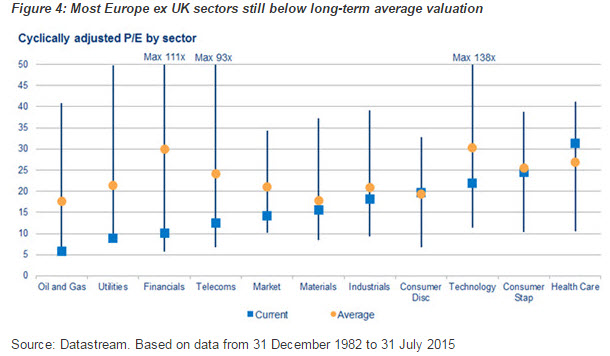

Given the economic recovery in Europe, we particularly favour companies whose operations are focused on the domestic economy. Domestically-focused stocks are seeing stronger positive earnings per share revisions than exporters but on average trade at a substantial discount. That said, it remains the case that the weaker euro has been beneficial for exporters and the euro’s weakness versus the US dollar continues to act as a tailwind. There are certain areas of international exposure that we see as particularly attractive, such as the US construction market. However, we would be wary of firms with significant exposure to those emerging markets where growth is slowing. We would also currently avoid commodities; the energy sector has seen sharp share price falls but it is not yet clear when the inflection point will come that could herald a recovery.

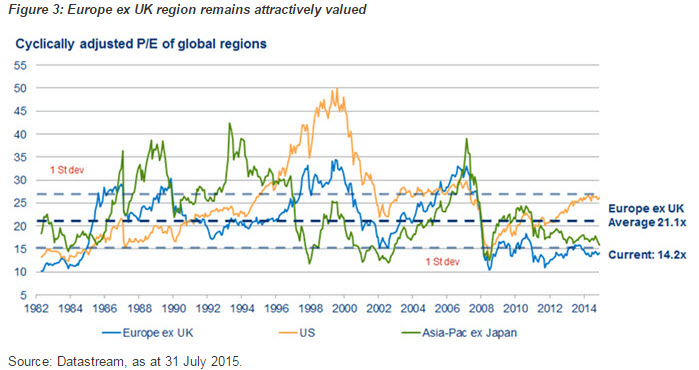

We continue to feel that the banking sector offers the most attractive mispriced opportunity in the eurozone. Domestic lending activity is on the rise and there is substantial scope to grow profits and dividends. Meanwhile, valuation levels should continue to provide support with the eurozone equity market as a whole looking attractively valued compared to its own history and to other regions. A final point to note is that we are starting to see rising merger & acquisition activity across Europe, which may help to close some of this valuation discount.

Diesen Beitrag teilen: