Schroders: Where next for the Chinese stockmarket?

Following the extreme recent stockmarket volatility, our Global Emerging Markets Equities team examines what’s been happening in the Chinese stockmarket and assesses the road ahead.

13.07.2015 | 08:42 Uhr

In summary:

• Year-to-date there has been a spectacular amount of volatility in the Chinese stockmarket. The impact has been most pronounced for the local A-shares but H-shares, which are constituents of the MSCI China index and where we invest, have also been drawn in.

• Despite such market volatility, after sharp moves up followed by equally sharp moves back down, we find ourselves not far from where we started at the beginning of the year. The MSCI China index has now fallen by 2.5% year-to-date but was up 29% at its peak. The Shanghai A-share market has returned around 16%, but was up 60% at its highest point.

• The rally and subsequent fall has not been fundamentally driven; rather it has been liquidity and momentum-led and dominated by retail investors. Consequently, our overall stance on the Chinese economy and the equity market remains little changed. We do not follow a trading approach and remain overweight China in our core Global Emerging Markets strategy.

Reasons for the market rise:

In reaction to the slowing economy, the Chinese government has implemented a number of interest rate and reserve requirement reductions in recent months to avoid major disruptions to the labour market. In addition to the stimulus, they have allowed local governments to swap their banks’ loans into longer-dated bonds in order to begin the process of addressing the rapid increase in debt since 2010. Chinese debt is currently around 200% of GDP, but most of this is in the corporate sector, 126% - mainly state-owned enterprises (SOEs) - and some in local government, 35%. Household debt is modest at 24%. Recently the government has also removed the 75% cap on the loan to deposit ratio for banks.

The result of these measures has been that liquidity in the banks has increased at a time when opportunities for attractive lending are becoming harder to find; local governments are issuing bonds rather than borrowing from banks, which is pressuring margins. Wealth management products are attracting increasing scrutiny and the amount they can lend to certain industries is being restricted. The consequence of these developments is tbat banks have increased lending related to the stockmarket.

The government has also been a public cheerleader for a strong market; corporate debt is high and a lot of this is within the SOEs. One way to clean up the balance sheets of the corporate sector is to swap debt for equity. Unsurprisingly new issuance and IPOs have increased sharply.

The exceptional performance of the A-share market has been primarily due to strong retail buying; retail investor activity accounts for about 80% of the volume of the local A-share market. We think the catalyst for retail buying was a combination of several reinforcing factors;

- The expectation that government stimulus will continue to provide a boost to the economy which would be positive for the market.

- Speculation on where investor flows will go given ongoing loosening of the regulations around the HK-Shanghai Connect scheme.

- The prospect of Chinese A-shares being included in the MSCI Emerging Market (EM) index would result in a heavy buying by international investors.

- The lack of attractive alternatives in which households can invest their savings; with a closed capital account, domestic savings have traditionally gone into bank deposits or wealth management products but interest rate liberalisation and greater scrutiny has made this less attractive.The property market no longer looks so attractive after several years of strength given increased supply. At the margin, other outlets for savings have also become harder to use; for example, gambling junkets to Macau have been restricted.

Reasons for the market fall:

The availability of easy money to invest in the A-share market has led to an explosion in the number of margin accounts being opened and in the overall size of margin lending. Recent data suggests that margin financing has reached RMB2.2 trillion or around 12% of the free float of marginable stocks and 3.5% of GDP. Both are arguably the highest in the history of global equity markets.

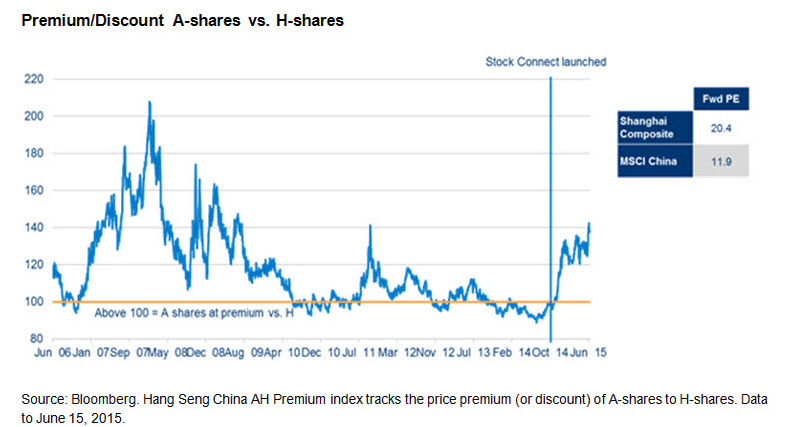

This has helped push valuations up significantly and the premium of the A- versus H-shares has also increased markedly. The average price-to-earnings ratio (P/E) for the A-share market is now around 20 times although the median P/E is over 40times while H-shares are trading at closer to an average P/E of 12 times. The economy is yet to react to the stimulus and there has been no real change in the outlook for earnings so this has been a pure speculative re-rating of the A-share market.

With valuations having increased rapidly and the government stepping-up their scrutiny of margin financing, a correction should not come as a complete surprise. Moreover, the strength of the market has resulted in an acceleration of IPOs and equity offerings, which has been a contributory factor. Finally, MSCI decided not to include China A shares in the MSCI EM index for now, although they have said it will be under ongoing review.

Outlook and positioning

In the immediate term, the outlook for the Chinese market remains highly uncertain. As mentioned above, the A-share market is subject to speculative retail activity and government policy decisions. Our base case is the authorities are keen to support the market, but at the same time does not want things to run out of control and a speculative bubble to develop. On the other hand, they do want a stable market.

So on balance we would expect the market activity to broaden out and stocks with strong fundamentals to perform well. Despite the recent easing, real interest rates in China are still high and the economy sluggish. Further stimulus is therefore likely which should be positive for the market. Moreover, cleaning up SOE balance sheets via a debt for equity swap is still likely a key policy aim.

Recent government action and rhetoric is therefore aimed at stabilising the market. However, whether this will be successful remains to be seen and recent, seemingly reactive attempts, to shore up investor confidence in response to market falls have appeared uncoordinated.

Over the long term, we expect China to avoid a hard landing and successfully transition the economy. China is moving into an era of slower growth and reform progress to achieve a more sustainable level of growth should be seen as a positive by the market.

The H-share market has not seen the same degree of speculative activity as the A-share market, although there has been some spillover. Valuations in the H-shares generally remain attractive and in line with broader global emerging markets, and we continue to find a number of fundamentally strong companies in which to invest. Despite elevated market volatility, we have remained overweight China. At the stock level we have also made few changes and remain invested in our highest conviction buy ideas.

Diesen Beitrag teilen: