UBS: A slowdown, not a recession

Recent economic data has been generally disappointing, both in the US and other countries. Since nearterm improvement appears unlikely, UBS Investment Research has reduced this year’s economic growth forecast for the US to 1.5% from 2.8%.

05.02.2016 | 08:58 Uhr

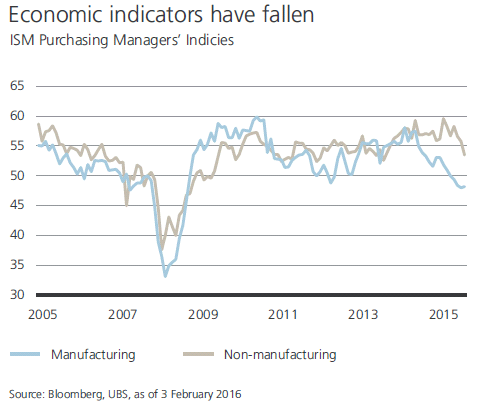

That would be the lowest rate since 2009, and projects the US to grow slower than the Eurozone – where the 2016 outlook was scaled back to 1.6% from 1.8%. Financial market turbulence has prompted stories in the media that the US is at risk of falling into recession. In our view, such fears are overblown; we expect growth to revive after the current bumps fade. In recent months, a wide gap has developed between the manufacturing sector and the rest of the economy (see chart). Globally, manufacturing is plagued by excess capacity and weak demand, partially due to slowing growth in China.

For US manufacturers, the strong dollar exacerbates the situation. Manufacturing output is likely to remain weak until excess inventories decline, which could take several months if demand does not grow. While lower energy prices would normally be encouraging, the collapse in energy-related investment spending has hurt manufacturers that previously benefited from the investment boom. The auto industry has been a bright spot in manufacturing, but given record sales last year, the upside appears limited.

Most non-manufacturing industries, in contrast, remain reasonably healthy. Almost 90% of the US economy is non-manufacturing, and we do not expect the downturn in manufacturing to drag the rest of the economy into recession. The improving labor market and low inflation support real household income and consumer spending. The Affordable Care Act has given millions of people access to health insurance, boosting demand for medical services.

Construction activity, hard hit by the financial crisis, has rebounded strongly over the past four years. While growth is starting to slow in some areas, home prices and rents are still rising at a solid pace, encouraging builders to continue increasing housing starts. We are therefore optimistic that the economy can go on growing modestly until the manufacturing sector gets past the bumps.

Author: Brian Rose

Der komplette Marktkommentar als PDF-Dokument.

Diesen Beitrag teilen: