UBS: European Building Materials - Mixed Dynamics in Q1

While Q1 is seasonally less important for cement makers in general, especially in the US/Europe, Cemex's EM exposure (ex Mexico) in general suffered.

28.04.2017 | 10:39 Uhr

Somewhat subdued Q1 performance

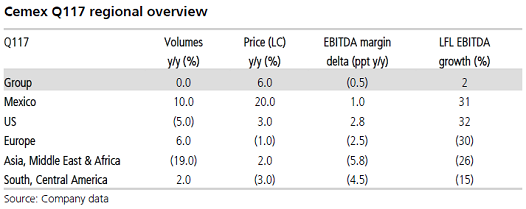

Cemex reported LFL sales of +6% (0% volume; +6% price) and LFL EBITDA growth of +2% (c4% below consensus), leading to slight y/y margin compression of 50bps. For historical price and volume trends, see pages 2-3 of this note.

Regional highlights in Q1

Mexico continued on its strong path, with volumes +10% y/y and prices +20% in local-currency terms. Prices also rose +9% vs Q4. The US, in a small quarter, saw volumes -5% and prices +3% (+1% sequentially) and EBITDA +32% LFL. Germany saw volumes +12% and price -2%. The UK saw volumes decline -10% (impacted by one-off contracts in the prior year) and prices +4%. Poland saw volumes +8% and prices turn positive for the first time in at least 2 years to +2%. Spain volumes grew +19% in Q1. Colombia saw volumes -2% and price down -18%, leading to LatAm (ex Mexico) EBITDA falling 15% LFL, with margins -4.5ppt y/y. Egypt was soft, with volumes -32% y/y and prices +16% y/y (but down -46% in US$ terms). Philippines was weak (similar to peers) with volumes -9% and prices -7% y/y.

Outlook mostly unchanged

Overall group volume growth outlook for 1-3% is unchanged, though Spain is raised to +5% (was +2%) while Philippines was cut to +3% (was +7%) and Egypt to -5% (from 0%).

Read-through to European cement players mixed

While CRH has already reported, we see the read-through as mixed. Growth in Mexico is a positive for both Buzzi and LafargeHolcim (LH). However, the negative trends in Colombia, Egypt and the Philippines partly offset this for LH and HeidelbergCement (mainly Egypt). US trends are mixed as expected in Q1 against a tough comparison basis and are unlikely to serve as a representative picture for 2017 as a whole. There appear to be some early signs of European pricing improving, although we believe it is somewhat early to call for a major trend change.

Der komplette Report als PDF-Dokument.

Diesen Beitrag teilen: