UBS: Final countdown

We are now less than a week from concluding one of the most divisive and dispiriting elections in US history. For the first time since pollsters began seriously collecting voter preferences, the nation must choose between two candidates whose unfavorable ratings exceed their favorable ratings.

04.11.2016 | 11:30 Uhr

So no matter who wins next Tuesday, more people will likely be displeased by the outcome than pleased. Small wonder that this entire campaign has cast a pall over the electorate. But this sense of despondency resonates well beyond the voting booth. In a special pre-election edition of the Investor Watch survey, our colleagues in the US Client Strategy Office found that the anxiety surrounding this election has also affected investor sentiment. Of those investors surveyed, 55% responded that they have taken action to limit their risk exposure in advance of the election, with 30% increasing their cash holdings and 25% shifting to a more conservative allocation. What’s more, the level of angst does not appear to be “partisan,” with Republicans, Democrats and Independents all expressing similar levels of anxiety.

What should investors focus on in the moments before the election, given uncertainty about the outcome and anxiety over the impact?

1. The separation of powers ensures that no individual or institution could unilaterally dominate the nation’s governing process. Thus the president – regardless of who that might be – will be forced to work with Congress to implement any substantial legislative initiatives. Given the low probability of either party sweeping both the executive and legislative branches (20% probability for the Republican sweep, 5% for the Democratic sweep) the more market-friendly “status quo” divided government will likely endure following the election.

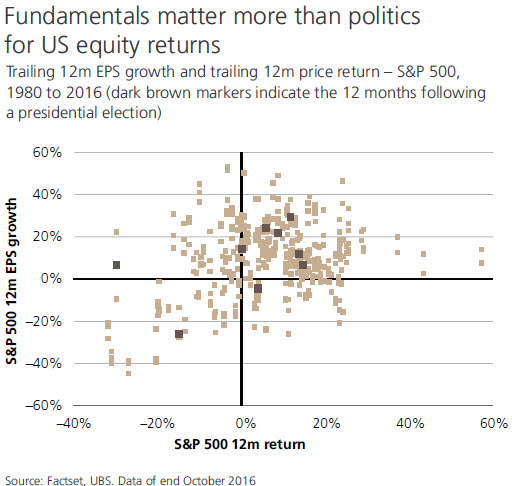

2. The choice of president generally does not alter investment outcomes. Instead, market returns tend to be determined more by fundamental factors such as relative valuations and earnings growth (see figure). So with risk premiums still high by historical standards and earnings growth poised to reaccelerate, equity markets are unlikely to suffer a material and sustained drawdown following the election.

3. Our work indicates that making investment decisions based solely upon political preferences or emotional reactions can lead to sub-optimal outcomes. We estimate that common behavioral biases can cost investors 100–400 basis points in annual performance. Given the current low return environment, making an investment plan in advance that helps prevent just some of these behavioral pitfalls could contribute markedly to overall portfolio performance.

Authors: Mark Haefele, Global Chief Investment Officer, Wealth Management

Mike Ryan, Chief Investment Strategist, WM Americas

Der komplette Marktkommentar als pdf-Dokument.

Diesen Beitrag teilen: