UBS: Half-fed

Finally satisfied that the improvement in the labor market is "confirmed", the Fed has hiked rates. But that's only half their mandate –the question of inflation still remains.

22.12.2015 | 09:45 Uhr

Back in 2012 the Federal Reserve told us that it was all about the labor market. The Fed assured markets that rates were not going up until the unemployment rate fell below at least 6.5%. The US economy sailed through that barrier twenty months ago, but still the Fed did not raise rates. Now, the Fed tells us, the improvement in the labor market is "confirmed" (with unemployment at 5%) and it has finally hiked rates. So that is one half of their dual mandate sorted out, what about the second half?

Inflation has continually disappointed the Fed. Its forecasts for headline inflation have been too high, but that is largely because they, like almost everyone else, got their oil forecast wrong. But even their forecast for core inflation (excluding food and energy) has been too high by about 0.2–0.4 percentage points. Nonetheless, the Fed is still forecasting both headline and core inflation to rise back up steadily towards target over the next two years.

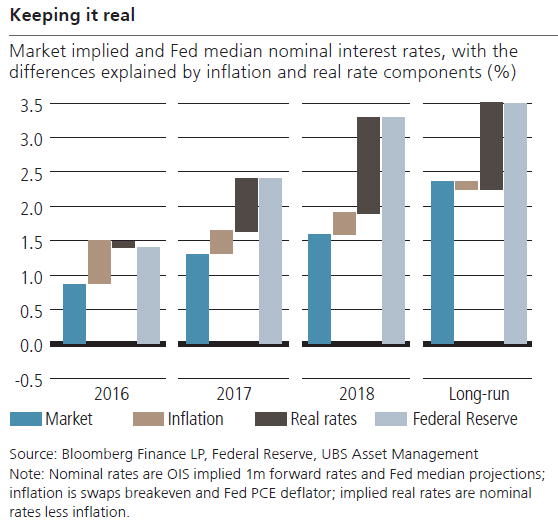

The market is less hopeful. Break-even inflation rates (implied by the difference between nominal and inflation-linked US Treasuries) suggest that headline inflation will remain below the Fed's forecast. But this inflation differential only explains part of the difference in nominal interest rate projections. The really big difference in views comes from the market's views on real rates.

The comparison is somewhat complicated by the Fed's focus on the personal consumption expenditure (PCE) deflator, while inflation-linked bonds are tied to the traditional CPI inflation measure. Theoretically, the PCE deflator is much better because month-by-month it adjusts for how much people are spending.

For example, if oil prices fall people may drive more, so the downward effect is larger because more of their 'volume' of purchases is going to oil. The CPI only makes that adjustment once per year. Unfortunately, because there are so many moving parts it tends to get revised a lot. For example, PCE core deflator has been revised up by an average 0.4% in 2013. So it is something of a moving target. The more traditional CPI measure does not get revised much, but one could just argue that if the CPI measure is wrong it simply stays wrong.

Der komplette Marktkommentar als PDF-Dokument.

Diesen Beitrag teilen: