UBS: Update on the Federal Reserve's December meeting

In line with market expectations, the Federal Open Market Committee (FOMC) raised the target range for the federal funds rate by 25 basis points to 0.50–0.75%. Given that the market widely expected the increase, the focus was on the language and the FOMC members' projections for future rate increases. Both of these were marginally more hawkish than expected.

16.12.2016 | 11:04 Uhr

Overview

The statement following the meeting noted that economic activity "has been expanding at a moderate pace," and inflation measures have moved up "considerably but still are low."

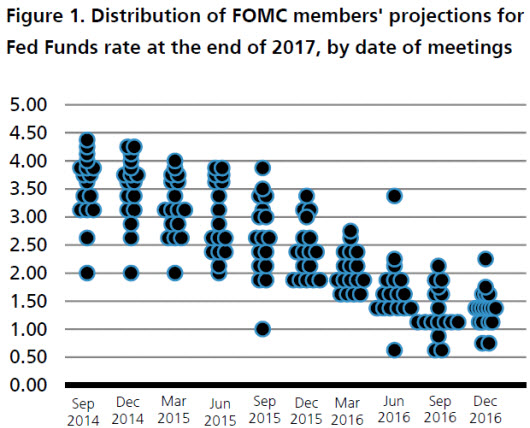

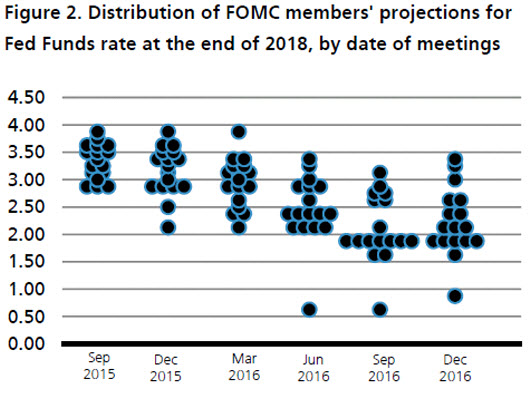

The dot plots charts which follow, suggest Fed members have become slightly more hawkish. This is not necessarily surprising given the recent improvement in economic data, continued advances in employment, and prospects for more expansive fiscal policy going forward.

Based on median estimates (Figure 1), Fed members now anticipate three 0.25% rate increases in 2017 - up from the two increases previously projected for next year. They continue to project three rate increases in 2018 as well (Figure 2). The dot plot, which is published after the FOMC meeting, reflects members' opinions on where the fed funds rate should be at the end of the stated period.

Implications for Fixed Income Portfolios

Market reaction to yesterday's meeting was somewhat contained. US interest rates drifted higher while credit spreads remained unchanged to slightly wider. It may take some time for market participants to digest what we view as a slightly more hawkish turn by the Fed.

More broadly, the recent move higher in US interest rates in November and into December has restored term premium, and we anticipate this trend will continue at a tempered pace. The immediate impact to our fixed income portfolios is limited given the interest rate hike was largely expected.

Against the backdrop of globally diverging monetary policies, heightened political event risks and de-synchronized growth, we currently have moderate active risk in our fixed income portfolios. Many strategies remain near neutral in terms of overall interest rate exposure, thus the impact from active duration positioning has been relatively muted. We continue to favor interest rate exposure in Europe, Australia and New Zealand over US and Japan.

Implications for All-Equity Portfolios

In US equity markets, stocks initially rose following Wednesday's announcement, but retreated shortly after Chairman Janet Yellen's news conference. Major indices ended the day in negative territory. Nevertheless, we do not think the Fed's recent action will have a meaningful impact on our all-equity portfolios going forward.

Implications for Multi-Asset Portfolios

In our multi-asset portfolios, we have retained a long US 10-year Treasury breakeven trade which reflects the likelihood that inflation will overshoot. However, relative to German bunds and peripheral European debt, we see US nominal bonds as offering attractive carry after the recent spike in yields.

Prior to the US election, one of our highest conviction views globally was that US inflation risks were underpriced. Therefore, the majority of our multi-asset portfolios were long inflationlinked US Treasuries against nominal US Treasuries - often referred to as the 'breakeven inflation rate.' Given the significant rise in inflation expectations since the US election, we believe the investment case for this position is clearly more balanced.

While Donald Trump's victory severely jolted the highly consensual "lower for longer" narrative and put fiscal policy firmly on the agenda, we do not expect the Fed to be pre-emptive in addressing rising inflation risks. Indeed, a more sustainable recovery in prices is precisely what the Federal Reserve wants.

The FOMC statement that "near-term risks to the economic outlook appear roughly balanced" is consistent with last month's message, as well as the accompanying statement that came with the December 2015 rate hike. This suggests strongly to us that the Fed will lag the data and want to see clearer signs of sustainable inflation before hiking again. As the FOMC pointed out, market measures of inflation compensation may have shifted, but remain low. Therefore, we expect some overshooting of US inflation, and while at least some of this is now in the price of US Treasuries, we have retained the breakeven trade.

In terms of equities, most of our multi-asset portfolios remain overweight US Value Equities. Our analysis shows that collectively, US equities are overvalued, but on a sector and factor level there is very significant valuation divergence. While the valuations of bond proxies and secular growth stories (e.g. technology) became stretched amid the highly consensual 'lower for longer' narrative, more cyclical 'Value' sectors including Energy and Financials have underperformed and now look very attractive relative to the wider market.

Historically, Value as a factor has outperformed when the US yield curve is steepening. Mr. Trump's victory prompted a very sharp rotation within US equities back towards Value plays as longer-dated Treasury yields spiked higher. But given the scale of the outperformance of Growth versus Value in recent years and the likelihood that inflation overshoots, we believe the reversal has further room to run.

We expect the US dollar to continue to be well supported given our belief that the Fed is likely to let inflation rise. We see the chances of three hikes in 2017 as slightly higher than what is reflected in futures markets.

In Emerging Markets, we retain a positive bias toward equities and selected currencies. There was some marked weakness across emerging market equities immediately following Mr. Trump's victory. However, we believe fears about the impact of a stronger US dollar and wider trade protectionism risks are overdone and are more than reflected in emerging market equity valuations.

We do not see a stronger US dollar as derailing the improvement in overall demand momentum in emerging markets or the earnings upgrade story. Furthermore, we see the potential boost to US growth from an increase in infrastructure spending and lower tax rates as positives for demand growth in emerging markets.

Within emerging market currencies, we have recently taken profits in the Russian rouble after more buoyant oil prices supported strong performance. We retain a long exposure to the Colombian peso, which is another currency likely to be supported by more stable energy prices, and to the Mexican peso, which we view as structurally cheap on a long-term basis.

Der Marktkommentar als pdf-Dokument.

Diesen Beitrag teilen: