UBS: wdywyctb?

I was particularly struck by a shift in mindset that MIT Professor Michael Schrage sees in today’s great organizations. According to Schrage, innovators no longer ask questions like, “what should our product do?”, but rather “who do you want your customers to become?”(wdywyctb?)

24.03.2016 | 11:46 Uhr

How companies are reacting to the Fourth Industrial Revolution was the subject of a recent event held at the Massachusetts Institute of Technology (MIT) for our Industry Leaders Network. Clients from all over the world who run private businesses make up the network. It is a great platform to help these entrepreneurs become better global leaders and the CIO office to become more knowledgeable about the latest business trends. I was particularly struck by a shift in mindset that MIT Professor Michael Schrage sees in today’s great organizations. According to Schrage, innovators no longer ask questions like, “what should our product do?”, but rather “who do you want your customers to become?” (wdywyctb?)

It is an interesting idea to consider. With regard to investing, we help our clients to become globally diversified in order to protect and grow their wealth over generations.

Global hopes, local fears

In recent months, many regions have seen a rise in political uncertainty that has deterred clients from investing. These concerns range from Brexit in the UK to political uncertainty in Germany, from the corruption saga in Brazil and instability in the Middle East, to the populist turn in US politics. Meanwhile, individual central bank policies – such as the introduction of negative interest rates in Japan, and the unexpectedly dovish tilt of the US Federal Reserve – are becoming more unpredictable.

wdywyctb?

With global growth low, debt-to-GDP ratios high, and central banks trying a diverse set of new policy tools, many regions run the risk of local policy errors having a large negative impact on local economies. Only by becoming more diversified can investors hope to maximize opportunities, while limiting their risk exposure to specific events. Of course, diversification does not always help – as we saw earlier in the year, major macro-economic forces can send all risk assets down together. But the outlook has brightened for well-diversified investors, and the same factors that spooked markets at the start of the year have turned more supportive in the past month. Concerns about negative interest rates, falling commodity prices, and declining Chinese reserves have eased.

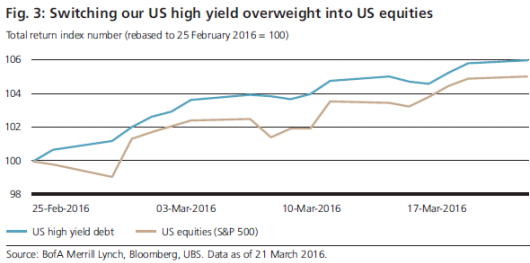

Credit spreads are now narrowing, Chinese capital outflows have slowed, and manufacturing data in the US is stabilizing. In my last letter, I highlighted that US high yield credit was effectively pricing in a recession. We believed that such fears were exaggerated and so we overweighted US high yield in February. Since then the asset class has moved more than 6% higher, outperforming US equities. The gains have been so rapid that we now believe that high yield credit is offering less value, and we are moving to a neutral stance in our tactical asset allocation. Alongside our overweight position in European high yield, we now prefer to take our risk in US equities, which typically offer greater value at a later stage in the business cycle, after the US high yield market has rallied.

While our US change takes us to an equity overweight in our global tactical asset allocation, it represents only a modest increase in risk, since it is matched by a reduction in exposure to US high yield debt. In spite of improved economic data and further central bank accommodation over the past month, profit growth is muted, and individual risks still have the potential to undermine markets. We still prefer to wait for clearer evidence of accelerating growth and earnings before adding significantly to risk.

Global hopes

Since the lows of February, a number of the negative macro drivers I highlighted in prior letters have improved.

Europe – lower credit costs, decent growth

European financials were under considerable scrutiny, but this pressure has eased. The European Central Bank’s (ECB) targeted long-term refinancing operations have addressed concerns about bank creditworthiness and monetary policy transmission, providing a clear means by which negative interest rates can translate into lower borrowing costs for banks, consumers, and businesses.

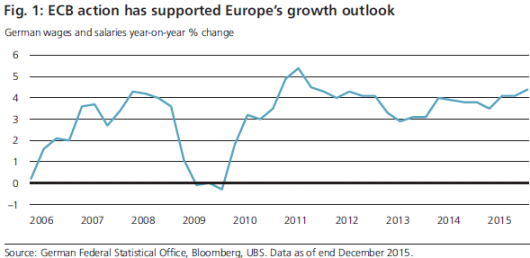

Confidence in Europe’s growth has held up too. Industrial production surpassed expectations this month. Retail sales growth remains robust. And Germany in particular still looks strong – consumption is expanding, backed by wage growth of more than 4% per annum.

Muted profit growth keeps us from being more bullish on the region, but we still maintain an overweight position in Eurozone equities against emerging market equities, along with an overweight position in European high yield credit relative to high grade bonds.

US – investment fears easing

The downturn in US manufacturing and subsequent weakness in services sentiment generated concern last month that the US could be heading for recession. Yet better data has improved the outlook. The ISM manufacturing index has shown signs of stabilizing. Jobs growth is strong. US high yield bond prices are up by 5% since the beginning of March, with some weeks recording the strongest inflows into the asset class on record.

It will be important to monitor the rise in US core inflation. The Fed leaned to the dovish side at its last meeting due to its own concerns about a variety of global risks.

The market remains geared towards a relatively accommodative Fed, only pricing one and a half 25 basis point rate hikes by the end of this year. The Fed could hike at a faster pace if domestic inflation continues to rise.

China – stabilization in capital account

Last month, I highlighted China’s falling foreign exchange reserves as a key risk for markets. The country’s capital account has since stabilized, with USD 28.5bn flowing out in February, about one-third of the declines registered in December and January. The currency has strengthened by around 1% versus the US dollar since the start of March and, unlike last year, there are clearer signs that China’s policymakers are getting their way with the economy. The uptick in fiscal spending, the surge in new lending, rising property starts, and a stabilizing yuan all indicate that policy measures are, for now, having their desired effect.

We can question whether some of the effects of this intervention (for example, property prices in Shenzhen rising 50% in a year) are in China’s long-term interest. But for global markets the latest data provides a welcome respite.

Local fears

Most of these global developments offer cause for hope. Yet sentiment among clients I have spoken with remains cautious, often because they are fearful about local events.

If addressed incorrectly, these fears could significantly hamper portfolio performance. Below, I look at three local cases in more detail. The investment principles used to manage these examples apply across the board: hedge what you cannot know, limit exposure to specific risks, and don’t overreact to potential tail risks.

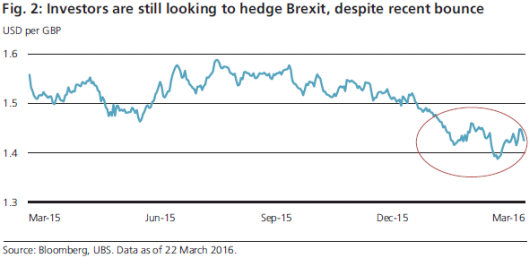

UK – hedge what you cannot know: Most opinion polls suggest a lead for the “remain” camp in the upcoming referendum on European Union membership. But the outcome will be close, given the greater propensity of older “leave” supporters to vote. The pound has already declined against the US dollar since the beginning of the year to reflect heightened uncertainty (see Fig.2). And investors are still looking to insure themselves against the pound falling further, as indicated by option market pricing. It will remain important for UK-based investors to identify mismatches between assets and liabilities, and to hedge their near-term currency risks.

For global investors, given the uncertainty, we are keeping a neutral stance on the pound and UK equities. There are, however, opportunities for those looking to express a view in derivatives markets: options markets are pricing in adverse outcomes, in particular in currencies, dividend futures, and equities.

Brazil – limit exposure to specific risks: The stock market and currency have reacted positively to signs that the government’s time may be limited. Impeachment proceedings have been initiated against President Dilma Rousseff. The announcement that former President Luiz Inácio Lula da Silva will become chief of staff (de-facto top decision maker) is being legally challenged, and has further alienated those discontented with the establishment. Volatility in equity and currency markets will likely stay high.

Local investors are taking defensive positions until the political outlook clears up, choosing to invest mostly in short-term government bond instruments earning high nominal rates. For any rally to be sustained, Brazil will need to find a credible leader able to bring together the dissenting voices and put forward a reform agenda. The key metric will be the fiscal deficit. Brazil is on track to run a 2016 deficit of about 10% of GDP and a primary deficit of 1.8%. To be convinced that public finances are stabilizing, we would like to see a primary surplus of 1.5% of GDP. Equities might rally further if the governing Workers’ Party administration falls. But we wouldn’t expect it to last unless we get a serious replacement.

US – don’t overreact to potential tail risks: In the US, the anti-establishment candidacy of Donald Trump, who leads in the race to capture the Republican nomination, has raised concerns about the impact of the US election on markets. Still, it would be rash to shift investment positioning based on political fears at this point. Historical data shows that US stocks have not tended to suffer much from election uncertainty. Since 1926, the average nominal return in election years for the S&P 500 equity index has been 11% – in line with the overall average of 12%.

Perhaps more importantly, the US political system of checks and balances has tended to mitigate radical change. Over the past 40 years, the same party has only controlled the White House, Senate, and House of Representatives simultaneously about 30% of the time. It seems far-fetched at this point to assume some of the extreme campaign rhetoric from either side will become legislation.

Investment positioning

Diversifying your portfolio away from the potential risks of any one political economy is growing increasingly important. In a low-growth, high-debt world, regional economies and investment performance could face downside risks from local policy mistakes. What is the best strategy to benefit from global opportunities, and avoid overexposure to event risk at home? In our view, the answer is portfolio diversification, across asset classes and geographies.

We believe a disciplined and international approach is best executed by focusing on a long-term strategic asset allocation that employs time-tested principles: limiting home bias, taking advantage of diversification, and hedging currency risks.

Author: Mark Haefele, UBS Global Chief Investment Officer, Wealth Management

Der komplette Marktkommentar als PDF-Dokument.

Diesen Beitrag teilen: