Morgan Stanley IM: Alternative Lending Through the Cycle

As fintech alternative lending grew into a new asset class, investors wondered how these loans might perform in an economic downturn. We've now seen their fundamental resilience.

17.10.2022 | 08:05 Uhr

Here you can find the complete article

Each recession is different, but we now have instructive data. The asset class was not immune to the havoc wreaked during the acute initial phase of the pandemic, but unsecured consumer alternative loans originated before the onset of COVID-induced shutdowns broadly exhibited fundamental resilience. Furthermore, impaired loans rebounded rapidly as economic conditions stabilized. For consumer loans originated after COVID’s onset, the marketplace model that alternative lenders use for matching consumer borrowers with loan investors drove rapid recalibration in underwriting standards, reflecting changed economic realities. Tighter credit conditions and higher interest rates on new loans compensated investors for both heightened risk and heightened risk aversion.

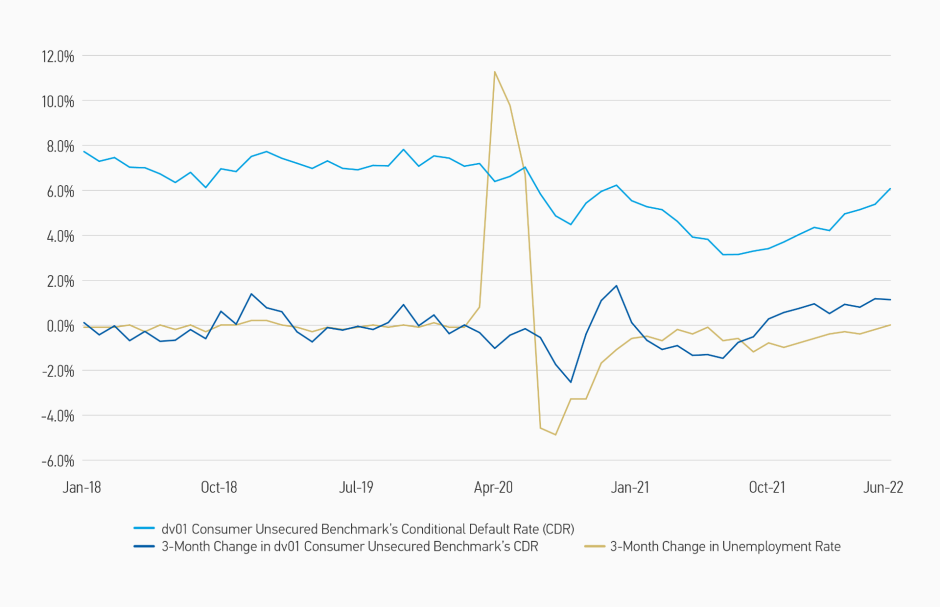

We believe three metrics are of critical importance as investors evaluate fintech alternative lending’s performance through the pandemic: how much the loan impairment rate increased relative to the sharp change in the U.S. unemployment rate, how long the loan impairment rate remained elevated, and what percentage of impaired loans ultimately resulted in charge-offs—defaulted loans removed from the books or marked down to low expected recovery values. On these metrics, alternative lending availed itself admirably. Display 1 illustrates the resilient performance of consumer unsecured loans in the face of a spike in unemployment.

DISPLAY 1 Consumer Unsecured Loan Default Rate vs. Unemployment (2018-2022)

Source: Consumer Unsecured Benchmark CDR: dv01, as of June 30, 2022

Quarterly Unemployment Rate: https://fred.stlouisfed.org/series/UNRATE#0, as of June 30, 2022

Conditional Default Rate (CDR) represents the amount charged-off in a given month divided by the start-of-month balance and then annualized.

How Do Changes in the Unemployment Rate Affect Changes in the Consumer Loan Charge-Off Rate?

When evaluating the expected performance of consumer alternative loans through a downturn, we use an intellectual framework that models the expected change in the consumer alternative loan charge-off rate as a lagged function of the unemployment rate change. This framework is informed by historical credit card data that tracks consumer charge-off trends over extended periods of time, including multiple prior recessions. Of course, behavior of the American consumer through prior recessions was no guarantee of how consumers would behave post-COVID— particularly given that the pandemic lacked recent historical precedent. Furthermore, while credit card lending is also a form of unsecured consumer lending, we recognize that it provides an imperfect proxy for consumer alternative lending. Credit card loans might sit higher in borrowers’ payment priority hierarchies than do loans facilitated by alternative lenders. Conversely, alternative loans generally repay via automated pulls directly from borrowers’ bank accounts, and they typically amortize rather than revolve like credit card loans.

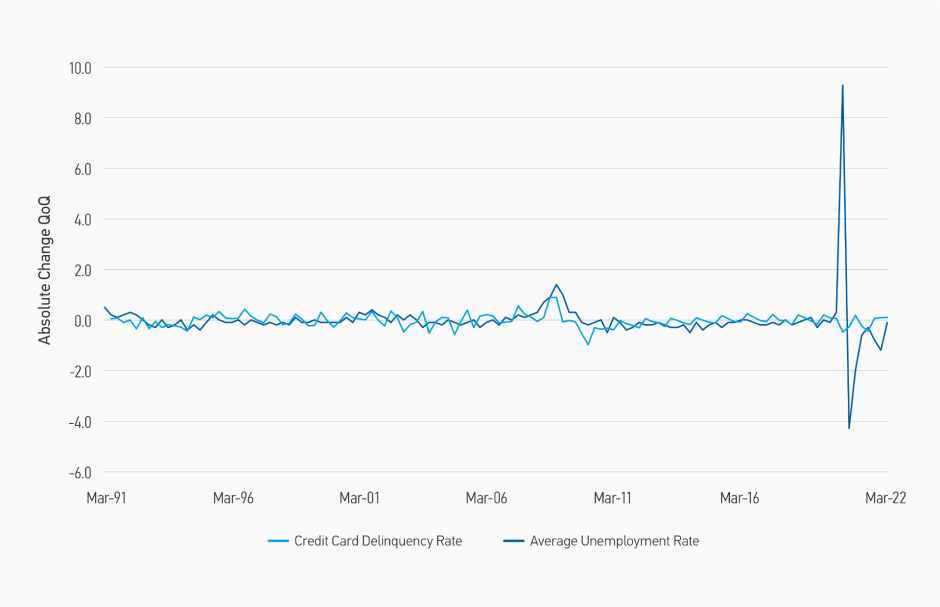

Display 2 shows that, pre-COVID, changes in consumer credit card delinquencies broadly tracked changes in the unemployment rate—both up and down. For example, both spiked during the Global Financial Crisis (GFC) but normalized soon thereafter. However, the trend was much less clear through the COVID period, with changes in delinquencies remaining much more stable than would have been expected given rapid changes in the unemployment rate.

Similarly, while the explanatory power is limited, regression of pre-COVID historical credit card data demonstrated roughly a 1:1 relationship between unemployment rate change and credit card charge-off rate change on a three-month lag. The regression suggested that any expected increase in charge-off rate following a rise in the unemployment rate typically would only apply to the period immediately following the unemployment rate increase. Afterwards, the charge-off rate would be expected to stabilize. Likewise, the charge-off rate would be expected to fall following an unemployment rate decline, which is typical after a recession. With this framework, it is important to remember that changes in the charge-off rate are annualized, so the duration of unemployment rate increase is critical when thinking about the prospects for alternative loans underwritten in advance of a downturn.

For reasons we will discuss in the following section, changes in delinquencies and charge-offs proved less correlated with changes in unemployment through the COVID period. As illustrated by Displays 1 and 2, consumers showed strong resilience despite the dramatic swings in unemployment as the pandemic unfolded.

DISPLAY 2

Changes in Credit Card Delinquency Rate Have Historically Mirrored

Changes in Unemployment Rate (1991-2022)

Source: Based on quarter-over-quarter absolute change in credit card delinquency rate from 03/31/1991 - 03/31/2022 per Federal Reserve data (https://fred.stlouisfed.org/series/DRCCLACBS), as well as quarter-over-quarter absolute change in average quarterly unemployment rate derived from each end of month datapoint calculated using a simple average for the three months included in each calendar quarter from 03/31/1991 - 03/01/2022 per Federal Reserve data (https://fred.stlouisfed.org/series/ UNRATE). Derived from analysis by Upstart Network, Inc.

ADDITIONAL RISKS

Alternative investments are speculative, involve a high degree of risk, are highly illiquid, typically have higher fees than other investments, and may engage in the use of leverage, short sales, and derivatives, which may increase the risk of investment loss. These investments are designed for investors who understand and are willing to accept these risks. Performance may be volatile, and an investor could lose all or a substantial portion of its investment.

Global Pandemics. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments. It is difficult to predict when events may occur, the effects they may have (e.g. adversely affect the liquidity of the portfolio), and the duration of those effects.

REITs. A security that is usually traded like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. The risks of investing in Real Estate Investment Trusts (REITs) are similar to those associated with direct investments in real estate: lack of liquidity, limited diversification, ad sensitivity to economic factors such as interest rate changes and market recessions. Loans May Carry Risk and be Speculative. Loans are risky and speculative investments. If a borrower fails to make any payments, the amount of interest payments received by the alternative lending platform will be reduced. Many of the loans in which the alternative lending platform will invest will be unsecured personal loans. However, the alternative lending platform may invest in business and specialty finance, including secured loans. If borrowers do not make timely payments of the interest due on their loans, the yield on the alternative lending platform’s investments will decrease. Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets, historically have created a difficult environment for companies in the lending industry. Many factors may have a detrimental impact on the Platforms’ operating performance and the ability of borrowers to pay principal and interest on loans. These factors include general economic conditions, unemployment levels, energy costs and interest rates, as well as events such as natural disasters, acts of war, terrorism and catastrophes. Prepayment Risk. Borrowers may have the option to prepay all or a portion of the remaining principal amount due under a borrower loan at any time without penalty. In the event of a prepayment of all (or a portion of) the remaining unpaid principal amount of a borrower loan in which alternative lending platform invests, the alternative lending platform will receive such prepayment but further interest will not accrue on such loan (or the prepaid portion, as applicable) after the date of the prepayment. When interest rates fall, the rate of prepayments tends to increase (as does price fluctuation). Default Risk. Loans have substantial vulnerability to default in payment of interest and/or repayment of principal. In addition, at times the repayment of principal or interest may be delayed. Certain of the loans in which the alternative lending platform may invest have large uncertainties or major risk exposures to adverse conditions, and should be considered to be predominantly speculative. Loan default rates may be significantly affected by economic downturns or general economic conditions beyond the alternative lending platform’s control. Any future downturns in the economy may result in high or increased loan default rates, including with respect to consumer credit card debt. The default history for loans may differ from that of the alternative lending platform’s investments. However, the default history for loans sourced via Platforms is limited, actual defaults may be greater than indicated by historical data and the timing of defaults may vary significantly from historical observations. The Platforms make payments ratably on an investor’s investment only if they receive the borrower’s payments on the corresponding loan. Further, investors may have to pay a Platform an additional servicing fee for any amount recovered on a delinquent loan and/ or by the Platform’s third-party collection agencies assigned to collect on the loan. Credit Risk. Credit risk is the risk that a borrower or an issuer of a debt security or preferred stock, or the counterparty to a derivatives contract, will be unable to make interest, principal, dividend or other payments when due. In general, lower rated securities carry a greater degree of credit risk. If rating agencies lower their ratings of securities in the alternative lending platform’s portfolio or if the credit standing of borrowers of loans in the alternative lending platform’s portfolio decline, the value of those obligations could decline. In addition, the underlying revenue source for a debt security, a preferred stock or a derivatives contract may be insufficient to pay interest, principal, dividends or other required payments in a timely manner. Even if the borrower or issuer does not actually default, adverse changes in the borrower’s or issuer’s financial condition may negatively affect the borrower’s or issuer’s credit ratings or presumed creditworthiness. Limited Secondary Market and Liquidity of Alternative Lending Securities. Alternative lending securities generally have a maturity between one to seven years. Investors acquiring alternative lending securities directly through Platforms and hoping to recoup their entire principal must generally hold their loans through maturity. There is also currently no active secondary trading market for loans, and there can be no assurance that such a market will develop in the future. High-Yield Instruments and Unrated Debt Securities Risk. The loans purchased by the alternative lending platform are not rated by an NRSRO. In evaluating the creditworthiness of borrowers, the Adviser relies on the ratings ascribed to such borrowers by the relevant Platform or otherwise determined by the Adviser. The analysis of the creditworthiness of borrowers of loans may be a lot less reliable than for loans originated through more conventional means. The market for high-yield instruments may be smaller and less active than those that are higher rated, which may adversely affect the prices at which the alternative lending platform’s investments can be sold. Leverage Risk: The Fund is permitted to use any form or combination of financial leverage instruments, and such use of leverage may expose the Fund to greater risk and increased costs; there is no assurance that the Fund’s leveraging strategy will be successful.

Diesen Beitrag teilen: