Morgan Stanley IM: An Introduction to Alternative Lending

As investors seek to diversify their portfolio exposures beyond traditional assets, alternative lending may offer attractive absolute and risk-adjusted return characteristics.

15.07.2022 | 09:02 Uhr

Here you can find the complete article.

An allocation to alternative lending may provide investors with exposure to a secular shift in the way consumers and small businesses access capital. In this paper, we provide insights on this asset class and discuss why we view it as a through-the-cycle allocation for well-balanced portfolios.

What Is Alternative Lending?

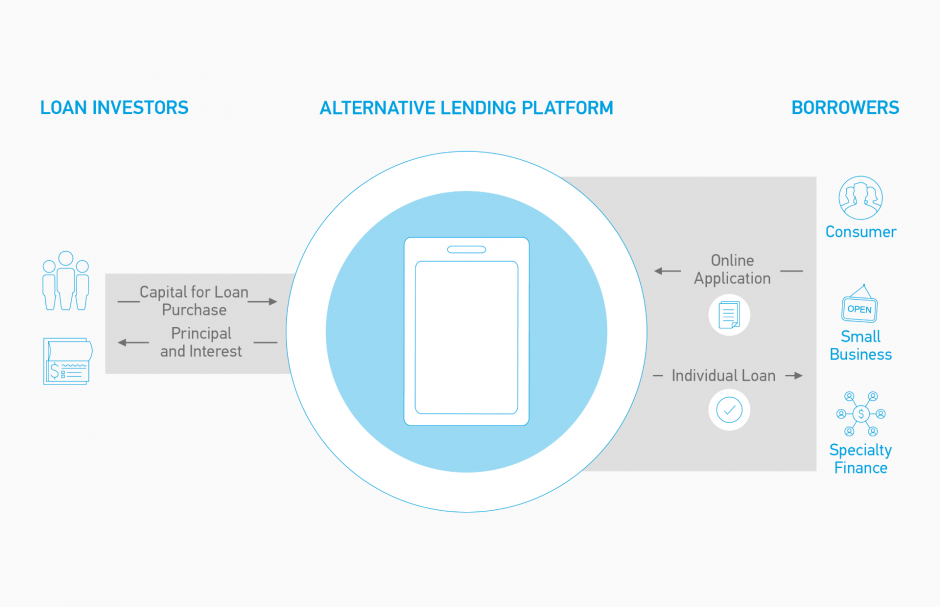

Alternately referred to as marketplace lending, peer-to-peer lending and P2P lending, alternative lending takes place through online platforms that use technology to bring together borrowers underserved by traditional lending institutions, with loan investors seeking attractive yield-generating investments. The lending model grew out of small-balance, peer-to-peer unsecured consumer loans financed by individual investors.

As the asset class matured, alternative lending evolved so that most loans are funded today by institutional investors, a group that counterintuitively includes even banks.1 Recognizing their technological and geographic constraints, community banks may focus on their core competency of deposit gathering while outsourcing credit underwriting and servicing to alternative lending platforms.

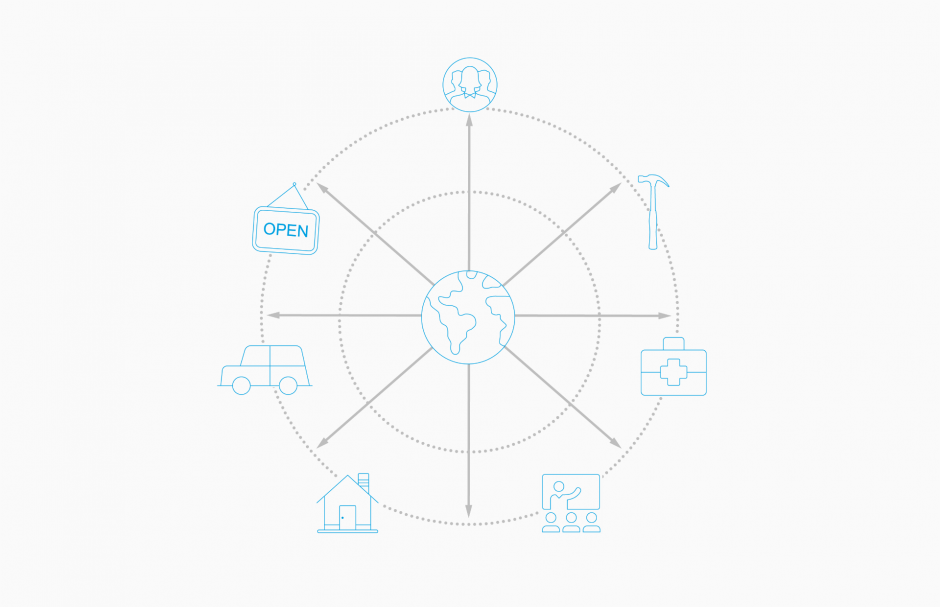

Credit risks underwritten by alternative lenders have expanded over time, beyond the unsecured consumer, to include small businesses, autos, commercial and residential real estate, receivables, student loans and other forms of specialty finance.

How Does it Work?

Consumer borrowers may seek alternative loans for a variety of reasons, including for debt consolidation or to pay down revolving credit card balances. By moving from a revolving structure to an amortizing installment structure, consumer borrowers may benefit from a lower interest rate than would be charged on a comparable revolving balance, such as from a credit card. Alternative lending platforms seek to streamline the traditional lending process by bringing borrowers and loan investors together, and by using technology-enabled models to rapidly underwrite borrower credit risk when determining appropriate loan pricing, terms and amounts offered to borrowers.

When borrowers accept loan offers, investors may purchase the loans post-issuance, for example, by actively selecting loans that they wish to purchase or by taking passive pro rata2 allocations of loans that meet prespecified criteria, considering loan type, size, term, duration, credit risk, geographic concentration, etc. Investors largely obtain the potential economic benefits and risks stemming from the loans, but the platforms typically maintain the customer relationship with end-borrowers and act as servicers for the loans, sending cash flows from the borrowers to the investors, net of servicing fees. The platforms also may charge loan origination fees, typically to the borrowers.

Platforms may use partner banks to formally originate the loans they underwrite. The partner banks typically conduct oversight on the platforms’ underwriting models and ensure that underwritten loans and servicing procedures comply with applicable laws. In some cases, the partner banks or platforms may maintain an economic interest in loans sold to investors.

The loans themselves generally have relatively low initial balances, and terms of three to five years are typical. Today the most common consumer unsecured alternative loan is fully amortizing, with a weighted average term3 of roughly 3.5 years and an average balance of roughly $10,043.4

The Evolution of Alternative Lending

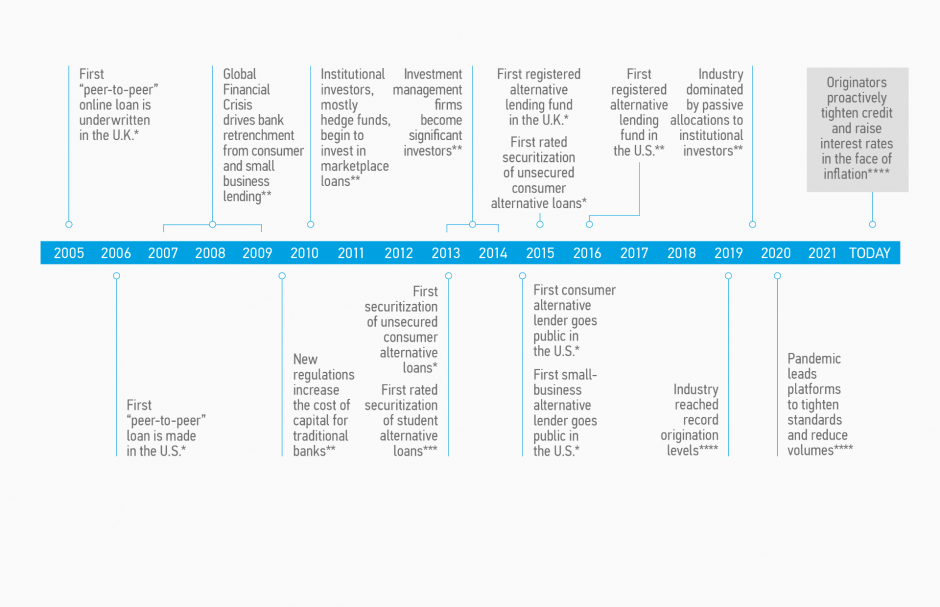

Alternative lending grew rapidly in the decade following the first peer-to-peer online loans underwritten in the U.K. in 2005 and in the U.S. in 2006, gathering pace in the wake of the Global Financial Crisis.5 These small-volume credit experiments leveraged marketplace models alongside technology-enabled customer acquisition, underwriting and loan servicing geared to borrowers who had grown comfortable with online services. Alternative lending volumes scaled as the aftermath of the 2008 financial crisis drove bank retrenchment from consumer and small-business lending, and as new regulations increased the cost of capital for traditional banks, stressing the traditional banking model.

To facilitate burgeoning loan volumes, alternative lending platforms evolved their funding models from the original peer-to-peer format to institutional buyers serving as the predominant loan investors, purchasing portfolios of loans in bulk. Hedge funds were early buyers, actively selecting individual loans that they expected would outperform the platforms’ average underwriting. As the platform underwriting models matured and the opportunities for hedge fund alpha6 generation declined, institutional buyers largely migrated to passive pro rata purchases of loans within each buyer’s defined credit box.

Passive pro rata allocations moved the due diligence focus for loan purchasers from individual, small-balance loans to all the loans underwritten by a platform within a purchaser’s defined credit box, as well as to the platforms themselves. Passive allocations also facilitated deeper integration with the capital markets. The first securitization backed by unsecured consumer alternative loans occurred in 2013, and the first rated securitization of those loans followed in 2015. U.S. consumer and small-business alternative lending platforms first listed their shares publicly in 2014. The first registered alternative lending fund launched in the U.S. in 2016. In 2021, Morgan Stanley Research estimated nearly $15.3 billion of asset-backed security issuance by the marketplace lending sector. Issuance increased materially as compared to FY 2020 volume of approximately $10 billion.7 YTD 2022 through April, asset-backed security issuance by the marketplace lending sector totaled approximately $3.7 billion, outpacing 2021 YTD issuance for the same time period.8

* “The Hourglass Effect: A Decade of Displacement,” QED Investors, Frank Rotman, April 13, 2015; AIP Alternative Lending Group research.

** AIP Alternative Lending Group. The statements above reflect the opinions and views of AIP Alternative Lending Group as of the date hereof and not as of any future date and will not be updated or supplemented.

*** https://www.sofi.com/press/sofi-completes-251mm-sp-rated-securitization-refinanced-student-loans/

**** Source: dv01 Insights - Covid-19 Loan Origination Report Volume 13. June 1, 2022.

Why Is the Opportunity Compelling Today?

In our view, there are four main reasons why alternative lending may be a compelling strategy for investors:

- Alternative lending may provide a potential combination of attractive yield and low duration that stands in sharp contrast to the traditional fixed income universe. Alternative lending’s relatively low duration may reduce sensitivity to changes in benchmark interest rates. One contributor to low duration is the amortizing structure typical of alternative loans, which may facilitate vintage diversification9 that may be challenging to achieve with traditional fixed income that only repays principal at maturity. Furthermore, alternative lending may offer outsized credit spreads,10 gross of any defaults and recoveries. While alternative loans often are unsecured, meaning, defaults typically will be higher and recoveries lower than with traditional fixed income, we believe that alternative lending’s outsized credit spreads may provide a cushion against realized principal loss when investors encounter adverse economic environments, such as those caused by the COVID-19 pandemic or experienced during the Global Financial Crisis.

- Unsecured consumer alternative lending may be diversifying versus other major asset classes, including traditional corporate credit. Alternative lending’s underlying credit exposure often stems from the consumer, rather than from corporate or government credit exposure that generally dominates traditional fixed income allocations.

- Unsecured consumer alternative lending exhibited fundamental resilience through the COVID crisis. In response to COVID-induced economic shutdowns, alternative lending platforms tightened credit standards, decreasing underwriting volumes and increasing borrower selectivity, and they increased borrower interest rates. They also offered short-term loan modification programs to impacted borrowers, which likely reduced borrower defaults as the economic backdrop stabilized.

- Alternative lending reflects a diversified opportunity set. Indeed, the volume and variety of strategies have flourished in recent years, providing multiple axes for diversification (e.g., by loan segment, credit quality, geography, security interest, balance size and/or loan duration).

For illustrative purposes only. The statements above reflect the opinions and views of AIP Alternative Lending Group as of the date hereof and not as of any future date, and will not be updated or supplemented.

Conclusion

While ramping inflation is negatively impacting U.S. consumer confidence, we believe that alternative lending’s modest duration may limit direct interest rate sensitivity should the Fed continue to hike interest rates as significantly as market participants expect. As a primarily consumer-focused private credit opportunity, we believe that alternative lending can diversify investor’s traditional and private corporate credit allocations. Alternative lending’s yield, duration, and amortization characteristics continue to stand in stark contrast to most corporate debt. For these and other reasons, we believe that alternative lending can play an important role in investors’ portfolios through the cycle.

1 Source: AIP Alternative Lending Group. Data as of March 31, 2022

2 Please see Glossary for definition.

3 Please see Glossary for definition.

5 “The Hourglass Effect: A Decade of Displacement,” QED Investors, Frank Rotman, April 13, 2015

6 Please see Glossary for definitions.

7 Morgan Stanley Consumer ABS Strategy - North America. Consumer ABS Dashboard - December 2021.

8 Morgan Stanley Consumer ABS Strategy - North America. Consumer ABS Dashboard - May 2022

9 https://www.morganstanley.com/im/en-us/financial-advisor/insights/investment-insights/alternative-lending-why-today-and-through-the-credit-cycle.html

10 Please see Glossary for definition.

GLOSSARY: Alpha: The excess return of an investment relative to a benchmark; also considered to be a measure of a manager’s investment skill. Credit Spread: The difference in yield between a U.S. Treasury security and a non-Treasury security. Duration: An approximate measure of a bond’s price sensitivity to changes in interest rates. Pro rata: A Latin term meaning in proportion. Sharpe Ratio: The average returned in excess of the risk-free rate per unit of risk or volatility. Volatility: Measure of dispersion of returns for a given type of security or asset class. Weighted Average Term: The weighted average amount of time for a group of loans to mature.

INDEX DESCRIPTIONS

S&P 500 Total Return Index is widely regarded as the standard for measuring large-cap U.S. stock market performance. This popular index includes a representative sample of 500 leading companies in leading industries. Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based fixed income benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. MSCI U.S. REIT Index is a free float-adjusted market capitalization index that is comprised of equity Real Estate Investment Trusts (REIT). With 150 constituents, it represents about 99% of the U.S. REIT universe as well as securities that are classified in the REIT sector according to the Global Industry Classification Standard. Bloomberg Barclays U.S. Corporate High Yield Total Return Index Value Unhedged measures the USD-denominated high yield fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bloomberg Barclays U.S. Corporate Total Return Index Value Unhedged measures the investment grade, fixed-rate, taxable corporate bond market. It includes U.S. dollar-denominated securities publically issued by U.S. and non-U.S. industrial, utility and financial issuers. Bloomberg Barclays U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

DISCLAIMERS

The views and opinions are those of the author as of the date of publication and are subject to change at any time due to market or economic conditions, and may not necessarily come to pass. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) or the views of the firm as a whole, and may not be reflected in all the strategies and products that the firm offers.

This piece is a general communication, which is not impartial, and has been prepared solely for informational purposes and is not a recommendation, offer, or a solicitation of an offer, to buy or sell any security or instrument or to participate in or adopt any trading or other investment strategy. This communication is not a product of Morgan Stanley’s Research Department and should not be regarded as a research recommendation. The information contained herein has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Certain information contained herein constitutes forward-looking statements, which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. No representation or warranty is made as to future performance or such forward-looking statements.

Any charts and graphs provided are for illustrative purposes only. Any performance quoted represents past performance. Past performance does not guarantee future results. All investments involve risks, including the possible loss of principal. Persons considering an alternative investment should refer to the specific fund’s offering documentation, which will fully describe the specific risks and considerations associated with a specific alternative investment.

Morgan Stanley AIP GP LP, its affiliates and its and their respective directors, officers, employees, members, general and limited partners, sponsors, trustees, managers, agents, advisors, representatives, executors, heirs and successors shall have no liability whatsoever in connection with any person’s or entity’s receipt, use of or reliance upon any information in this piece or in connection with any such information’s actual or purported accuracy, completeness, fairness, reliability or suitability.

ADDITIONAL RISKS

Alternative investments are speculative, involve a high degree of risk, are highly illiquid, typically have higher fees than other investments, and may engage in the use of leverage, short sales, and derivatives, which may increase the risk of investment loss. These investments are designed for investors who understand and are willing to accept these risks. Performance may be volatile, and an investor could lose all or a substantial portion of its investment.

Global Pandemics. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments. It is difficult to predict when events may occur, the effects they may have (e.g. adversely affect the liquidity of the portfolio), and the duration of those effects.

REITs. A security that is usually traded like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. The risks of investing in Real Estate Investment Trusts (REITs) are similar to those associated with direct investments in real estate: lack of liquidity, limited diversification, ad sensitivity to economic factors such as interest rate changes and market recessions. Loans May Carry Risk and be Speculative. Loans are risky and speculative investments. If a borrower fails to make any payments, the amount of interest payments received by the alternative lending platform will be reduced. Many of the loans in which the alternative lending platform will invest will be unsecured personal loans. However, the alternative lending platform may invest in business and specialty finance, including secured loans. If borrowers do not make timely payments of the interest due on their loans, the yield on the alternative lending platform’s investments will decrease. Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets, historically have created a difficult environment for companies in the lending industry. Many factors may have a detrimental impact on the Platforms’ operating performance and the ability of borrowers to pay principal and interest on loans. These factors include general economic conditions, unemployment levels, energy costs and interest rates, as well as events such as natural disasters, acts of war, terrorism and catastrophes. Prepayment Risk. Borrowers may have the option to prepay all or a portion of the remaining principal amount due under a borrower loan at any time without penalty. In the event of a prepayment of all (or a portion of) the remaining unpaid principal amount of a borrower loan in which alternative lending platform invests, the alternative lending platform will receive such prepayment but further interest will not accrue on such loan (or the prepaid portion, as applicable) after the date of the prepayment. When interest rates fall, the rate of prepayments tends to increase (as does price fluctuation). Default Risk. Loans have substantial vulnerability to default in payment of interest and/or repayment of principal. In addition, at times the repayment of principal or interest may be delayed. Certain of the loans in which the alternative lending platform may invest have large uncertainties or major risk exposures to adverse conditions, and should be considered to be predominantly speculative. Loan default rates may be significantly affected by economic downturns or general economic conditions beyond the alternative lending platform’s control. Any future downturns in the economy may result in high or increased loan default rates, including with respect to consumer credit card debt. The default history for loans may differ from that of the alternative lending platform’s investments. However, the default history for loans sourced via Platforms is limited, actual defaults may be greater than indicated by historical data and the timing of defaults may vary significantly from historical observations. The Platforms make payments ratably on an investor’s investment only if they receive the borrower’s payments on the corresponding loan. Further, investors may have to pay a Platform an additional servicing fee for any amount recovered on a delinquent loan and/or by the Platform’s third-party collection agencies assigned to collect on the loan. Credit Risk. Credit risk is the risk that a borrower or an issuer of a debt security or preferred stock, or the counterparty to a derivatives contract, will be unable to make interest, principal, dividend or other payments when due. In general, lower rated securities carry a greater degree of credit risk. If rating agencies lower their ratings of securities in the alternative lending platform’s portfolio or if the credit standing of borrowers of loans in the alternative lending platform’s portfolio decline, the value of those obligations could decline. In addition, the underlying revenue source for a debt security, a preferred stock or a derivatives contract may be insufficient to pay interest, principal, dividends or other required payments in a timely manner. Even if the borrower or issuer does not actually default, adverse changes in the borrower’s or issuer’s financial condition may negatively affect the borrower’s or issuer’s credit ratings or presumed creditworthiness. Limited Secondary Market and Liquidity of Alternative Lending Securities. Alternative lending securities generally have a maturity between one to seven years. Investors acquiring alternative lending securities directly through Platforms and hoping to recoup their entire principal must generally hold their loans through maturity. There is also currently no active secondary trading market for loans, and there can be no assurance that such a market will develop in the future. High-Yield Instruments and Unrated Debt Securities Risk. The loans purchased by the alternative lending platform are not rated by an NRSRO. In evaluating the creditworthiness of borrowers, the Adviser relies on the ratings ascribed to such borrowers by the relevant Platform or otherwise determined by the Adviser. The analysis of the creditworthiness of borrowers of loans may be a lot less reliable than for loans originated through more conventional means. The market for high-yield instruments may be smaller and less active than those that are higher rated, which may adversely affect the prices at which the alternative lending platform’s investments can be sold. Leverage Risk: The Fund is permitted to use any form or combination of financial leverage instruments, and such use of leverage may expose the Fund to greater risk and increased costs; there is no assurance that the Fund’s leveraging strategy will be successful.

Diesen Beitrag teilen: