Morgan Stanley IM: Bear Market Rally?

Evidence suggest that the recent strength in developed markets may just be a bear market rally with further downside potentially on the way. Here is how the GBaR team think about investment allocation to reflect the outlook.

12.08.2022 | 08:10 Uhr

Here you can find the complete article

July saw a rally in major developed markets, which had their best month this year, despite the U.S. going into a technical recession. The S&P 500 (TR) (USD) was up 9.2%, the MSCI Europe (TR) (EUR) followed at 7.6% and the MSCI Japan (TR) (JPY) was up by 4.0%1. Emerging markets did not receive the same boost, with the MSCI Emerging Markets Index (USD) marginally down -0.2%1. The last week of July saw a broad-based decline in yields globally. The U.S. 10-Year Treasury yield moved down from 3%2 at the end of June to 2.64%3 by month end. The VIX index also moved down to 213.

Despite the U.S. Consumer Price Index (CPI) surprising to the upside at 9.1%4, a lot of pessimism over inflation prospects appears already to be priced in. There is evidence that demand may come down, and has already done so for gasoline5, as consumers feel the impact of high inflation and a slowing economy. A technical recession, with U.S. Gross Domestic Product (GDP) coming in negative for the second consecutive quarter at -0.9% (Q2 2022)6, did not deter markets, which rallied. With the Federal Reserve hiking 75bps7, as expected, in the same week, markets may be sensing peak hawkishness. Remaining in the U.S., Q2 earnings have beaten expectations and guidance for the next quarter appears not as bad as markets feared. However, though we have seen a substantial derating in valuations, we do not think equities have priced downward revisions in earnings. Depending on the depth of the slowdown to come, our estimates suggest earnings for the S&P 500 should be 12% – 19% lower than current levels8. This supports our belief that recent strength in developed markets is a bear market rally, so we could still see further downside.

Investment Implications

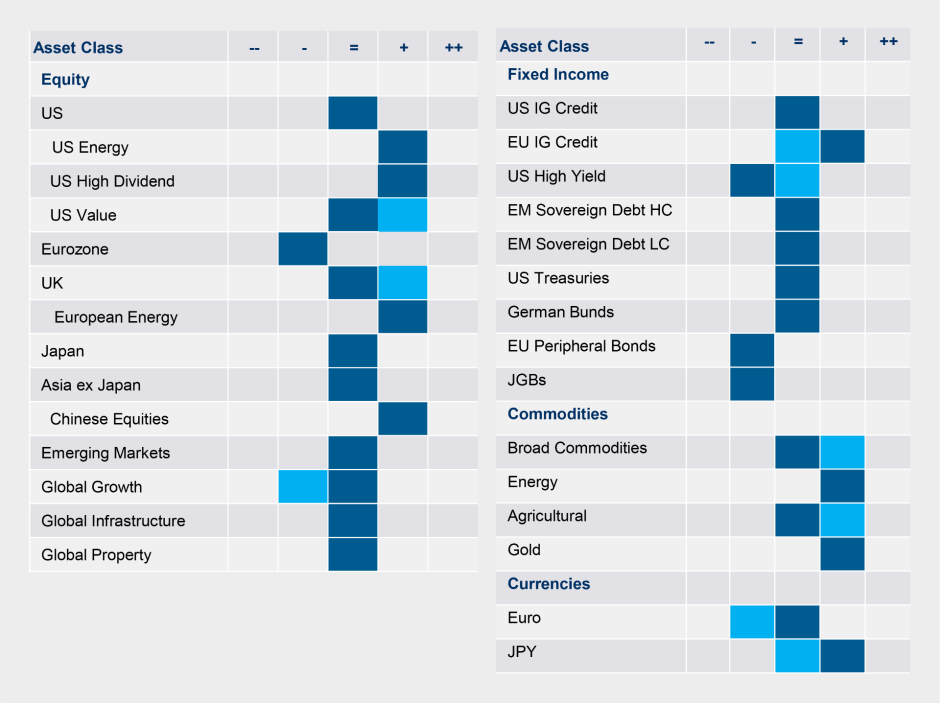

We remained defensive throughout the month, seeing earnings revision downgrades as the next major potential headwind for equities. Our overall fixed income exposure also remained unchanged, in an environment of high inflation, rising rates, continued geopolitical concerns and intensifying threats to global growth. However, within equities, commodities and fixed income, we made a number of tactical changes:

Energy

We reduced our overweight to energy. While supply constraints persist with U.S. producers, demand destruction is evident in the U.S.. As global growth continues to slow, cyclical headwinds will likely intensify, which should be negative for oil prices and the energy sector.

UK, Value and Growth Equities

We moved from overweight to neutral UK Equities, an overweight we had held since February 2022 and, likewise, moved from overweight to neutral Value Equities. For both, economic cycle dynamics warrant a reduction in cyclical exposure. Instead, we allocated to broad-based equities, to maintain stable equity exposure. For portfolios which have active funds, we continued to reduce allocations to growth-oriented active funds.

China A Equities

We added to our overweight China A, first implemented in June 2022, which we continue to believe should benefit from improving growth prospects and supportive policy backdrop, whilst the rest of the world experiences monetary tightening and slowing growth.

Broad Commodities

We moved overweight to neutral broad commodities due to slowing growth and signs of less supply-demand imbalance. We took profits on this position, held since the beginning of February 2022. This was initially an explicit hedge against escalating Russia-Ukraine tensions, which we held given the tight market.

Agriculture

First initiated in early May, we moved overweight to neutral agricultural commodities. Inventories are greater than expected, leading to less support for prices in the second half of the year.

Gold

We reduced our overweight to gold. Near-term upside potential is limited based on its long-held relationship with real yields and our view that real yields should stay in positive territory.

European Investment Grade Credit

We moved from neutral to overweight European Investment Grade Credit. Spreads appear already priced for material growth slowdown. This, coupled with slightly cheap Bund yields, should lead to a more favourable risk/reward set up, as the global economy is in the late stage of the cycle.

U.S. High Yield

We moved from neutral to underweight U.S. High Yield, given our cautious outlook on U.S. growth and consumption. We believe U.S. High Yield may suffer more from a potential economic shock over the coming months compared to higher quality credit.

Euro (EUR)

We moved from underweight to neutral, as the euro is pricing in bearish economic growth in the eurozone and we may have reached peak fear on Russian gas supply. Likely elevated energy prices should maintain pressure on the European Central Bank (ECB) to be hawkish in forthcoming months. This should support interest rate differentials, which are already inferring higher EUR/USD. With downside risks likely largely priced in the eurozone, the euro could start to revert to fundamentals in 2H 2022.

Japanese Yen (JPY)

We moved first from underweight to neutral, then to overweight, as the downside to JPY against the USD appears to become more and more limited. Interest rate differentials, oil prices and other fundamental drives indicate the JPY is undervalued.

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See Disclosure section for index definitions.

Source: MSIM GBaR team, as of 31 July 2022. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation or specific needs of any individual investor. The signals represent the GBaR team’s view on each asset class. A negative signal indicates a negative or underweight relative view, a positive signal indicates a positive or overweight relative view. Light blue indicates the tactical view before the change, with dark blue indicating the view as of 31 July 2022.

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: