UBS: May's gamble backfires

Theresa May's election gamble has backfired as the UK is heading towards a hung parliament. Her future as Prime Minister will no doubt come into question. Markets have been positioning for a Conservative victory in the days running up to the vote. We believe that an end of the political status quo will spook investors in the short term.

09.06.2017 | 14:56 Uhr

With over 580 of the 650 seats declared, Theresa May's election gamble has backfired as the UK is heading towards a hung parliament. The Conservatives are going to be the largest party, so we can only assume at this stage they will look to form a minority government. Theresa May's future as Prime Minister will no doubt come into question. Further uncertainty will come from questions about how long the new parliament can survive. Markets have been positioning for a Conservative victory in the days running up to the vote. We believe that an end of the political status quo will spook investors in the short term. The Brexit talks are scheduled to begin in 11 days' time. This will be an additional source of uncertainty that is likely to drive volatility higher.

Our view

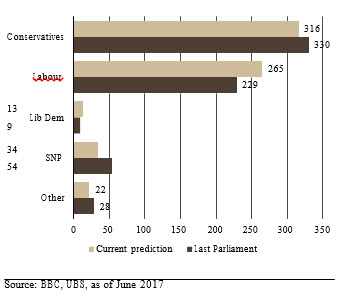

Theresa May's election gamble has backfired as the Conservatives have losttheir majority resulting in a hung parliament (fig. 1). At this stage, we believe that the Conservatives, as the largest party, will look to form a minority government. However, the immediate question is will Theresa May remain at the helm?

With the Brexit negotiations due to start on 19 June, whatever government emerges from this hung parliament will enter the talks in a severely weakened state. How this plays out in the early days of the talks remains to be seen, but our expectation is that the UK team will lack the authority to pursue any meaningful agreements.

Fig. 1: The UK is facing a hung parliament Projected seats in the House of Commons with 560 counted. 326 needed for a majority

Markets had broadly positioned for a clear Conservative victory, so this result will come as an unwanted surprise. The pound has fallen by around 1.6% but looks to have stabilized. Nevertheless, there is potential for volatility in sterling to rise further, especially as concerns over the forthcoming Brexit negotiations are likely to increase. Within our Tactical Asset Allocation we maintain an underweight position in UK equities and overweight in Eurozone stocks.

A hung parliament with the Brexit clock ticking

With the Brexit negotiations set to begin on June 19, a hung parliament is a far from an ideal situation. At this stage, given they are the largest party, we assume that the Conservatives will aim to form the next government with a minority of seats. A formal coalition looks unlikely as partners are going to be hard to find given the Conservative Party's stance on the EU negotiations. So, looking ahead to the Brexit talks, this suggests that the final goals for the talks will remain as leaving the single market and customs union, end the free movement of people, and leave the jurisdiction of the European Court of Justice (ECJ). However, the weakened state of the gov- ernment could throw this into doubt.

Nevertheless, this may all become irrelevant in light of the fact that a minority government is unlikely to last for very long, in our view. Our expec- tations is that the UK will be facing another general election sooner rather than later, which further complicates the Brexit negotiations.

Economy – uncertainty on the rise with the economy already slowing.

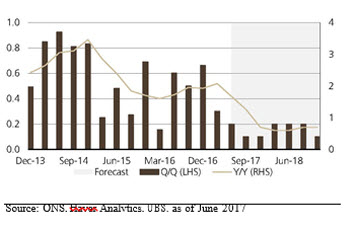

As we wait to see what government emerges from this election, it seems reasonable to assume that this surprise result, and the prospect of another general election, will hit consumer and business confidence. This will come as the established trends of rising inflation and weak growth in household incomes are already weighing on the economy. This leads us to conclude that the slowdown in the economy seen in the first quarter of this year is likely to persist for some time; if anything there is likely some downside risk to our already below-consensus forecasts (fig. 2).

Fig. 2: Economic growth is likely to slow Real GDP, %

Markets – volatility likely to rise

Uncertainty about the stability of the government, the outlook for domestic economic policy and its impact on growth, and crucially the direction of the Brexit negotiations are all likely to weigh on sentiment for the pound. In the first instance, it is likely that the pound gives up the bulk of its post-election announcement gains.

For equities, within our Tactical Asset Allocation we are underweight UK equities and overweight in Eurozone equities. Deteriorating economic data and falling commodity prices are likely to weigh on UK earnings. Mean- while, we think markets are likely to refocus on good Eurozone economic data and improving earnings growth, now that the immediate political risk has passed. However, the potential for a weaker pound would likely provide some support for the FTSE in the short term. For more information on our UK equity market views, please refer to our equity publications which will be updated in due course.

For the gilt market, rising uncertainty about the economic outlook, fiscal plans of the new government, and the Brexit negotiations, will likely see gilt market volatility rise.

Den vollständigen Artikel finden Sie hier.

Diesen Beitrag teilen: