NN IP: Less pressure on EM equities

The recent recovery in EM debt is encouraging for EM equities, while US protectionism could trigger an easier policy stance in China.

23.07.2018 | 13:49 Uhr

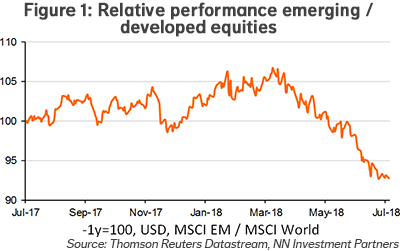

After the painful underperformance of EM equities in April, May and June (by some 12 percentage points in total), the category fared a bit better in July (see Figure 1). In the past weeks, EM has moved more or less in line with DM. Most emerging equity markets have benefited from a more benign global environment (with oil prices declining and the US dollar index depreciating a bit), in line with EM debt and EM FX. Weak Chinese and Korean equities are the reason the whole EM equity universe has not outperformed in July.

The explanation for the lagging Chinese and Korean markets probably lies in the ongoing trade noise created by the Trump administration. Sentiment surrounding this theme remains negative and China (as the direct focus of US protectionist action) and Korea (as one of the most open economies in Asia) are not illogical selling candidates if investors want to protect their portfolios against a possible trade conflict escalation. Nevertheless, we continue to believe that the eventual impact of US trade protectionism on EM growth will be manageable and that the theme affects sentiment more than fundamentals.

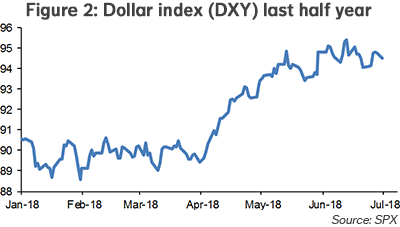

Fed expectations, the oil price and the US trade-weighted dollar are likely to remain more decisive factors driving EM assets, including equities. Fed expectations have not moved much in recent weeks, the oil price has declined by 10% in July and the trend in the dollar seems to have turned since the beginning of the month (see Figure 2). In this context, we consider it encouraging that both hard currency and local currency EM yields have declined for almost four weeks now. In addition, EM currencies have recovered somewhat, by about 2% in the first weeks of July. Normally, EM equities should also benefit in such an environment. Until now, the fear of trade wars has prevented EM equities from recovering in line with EM debt and currencies.

China holds the key to EM relative performance

If the sentiment surrounding global trade remains as negative as it has been in the past weeks, it might be difficult for EM equities to keep track with EM debt. Ultimately, EM equities are more sensitive to longer-term growth expectations than EM debt. And the potential negative impact from US protectionism on EM is via longer-term growth. The US president is unpredictable, and he might continue to look for persistent threats and escalation on the global trade front as a strategy to maximize votes in the November mid-term elections.

In this scenario, the US tariffs on another USD 200 billion of Chinese exports will be implemented from September. For Chinese policymakers, this would likely be the trigger for new policy easing to compensate for the damage of these tariffs on Chinese export growth. For the Chinese equity market, any credible sign of policy easing normally has a big positive impact. It might seem counterintuitive, but even in a negative global trade scenario, the Chinese market could be strong and help EM equities to outperform.

This is one of the reasons we are keeping South Korea at an underweight, but maintain a neutral position on China, with a bias to add when we are getting closer to policy easing.

For the EM equity category as a whole, we see clear opportunities emerging after the sharp underperformance in Q2. Indeed, the global environment has already cleared up a bit. The global trade risk remains relevant, but EM currencies have fallen back to multi-year lows, reflecting a more challenging trade environment. It is still early days, but the recent positive trend in EMD is clearly encouraging. For now, the market is still struggling with the negative impact on growth from the market turmoil. Our view on growth remains constructive (see EM section of the Economic Outlook in this newsletter). Once the Chinese market shows convincing signs of stabilising, we are likely to add to our EM equity positions.

Diesen Beitrag teilen: