NN IP: Rotation, rotation, rotation

The rising equity market hides a significant sector rotation driven by behavioural dynamics. Market fundamentals meanwhile remain very strong.

14.12.2017 | 13:32 Uhr

December started well for global equities, which have risen more than 1%. We observed nevertheless some rotation amongst sectors. Sectors like consumer staples and telecoms that have lagged this year outperformed, while the technology sector underperformed (last week this reversed again).

This has no fundamental justification. The explanation is to be found in the relative positioning. According to investor surveys and following an analysis of positioning data, these were exactly the sectors where the consensus was overwhelming. In addition, this consensus has worked very well this year, which gives investors an extra incentive to lock in some good profits.

The financial sector, on the other hand, did not suffer from its high consensus overweight. We see two reasons for this. First, there is little or no profit to be locked in from being overweight financials. Secondly, the regulatory environment is changing. In the US, deregulation of the sector is back on the table and the new Basel 4 rules are less strict on extra capital requirements than originally feared.

We think this sector rotation may run somewhat further until the end of the year, barring new developments in economic policy. This also explains why we have reduced our active bets in IT, financials and staples recently. However, as we consider that this is primarily a correction not based on fundamental changes, we will look to re-enter some of these trades over the coming period.

Over the week, we also had some positive news on the political and policy front. In Europe, the Brexit discussions finally cleared the first big hurdle. A deal was reached on the divorce payment, the status of non-UK citizens in the UK and vice versa, and the Irish border, even if this is not fully resolved yet but pushed forward. The second phase, in which a transitional deal will need to be worked out, can now start. This looks like a positive development for UK domestic assets as the chances of a soft Brexit have increased. The big, internationally oriented companies may face some headwinds in the market from a strengthening GBP following the deal. We are underweight the large cap-dominated MSCI UK, also because of the weakness in commodity prices and our more cautious short-term view on emerging markets. In addition, the position of Prime Minister May has weakened considerably over the past month, which will keep uncertainty around the Brexit process high.

A second development is the US tax plan. The chances are rising that there will be a tax plan before Christmas. Until recently, the consensus was for a plan to be approved sometime in Q1 2018. Although it may not help economic growth much, given the current high rate of activity, and may not spur a massive increase in corporate investments, it will be a positive for corporate earnings. A reduction of the headline corporate tax rate to 20% would, all else being equal, increase 2018 profits by ten percentage points. This is not yet fully priced in by the market. A deal could push the US stock market to new record highs in the short term. However, given the source and nature of the earnings increase, the market is unlikely to rise by the full amount of the increase in 2018 earnings. Investors know this is a one-off and will attribute a lower valuation metric to this. This is especially the case given the relatively high absolute PE (24x trailing) for the US market.

The global fundamentals have not really changed. For the coming year we expect strong economic growth and another double-digit rise in corporate earnings. Monetary policy looks very predictable at the current stage, with the ECB on automatic pilot until September 2018 and a Federal Reserve that will continue its policy of gradual tightening. We believe that both central banks will confirm these intentions when they meet this week. The gradual approach is warranted by the puzzling lack of inflation. Even in regions with very tight labour markets like Japan, the US and Germany, there are hardly any signs of wage pressures. Moreover, the latest data on the US labour market illustrated this, with wage growth actually slowing down! I leave it to macroeconomists to explain this phenomenon; what matters to us equity strategists is its impact on corporate margins and, longer term, on nominal earnings growth.

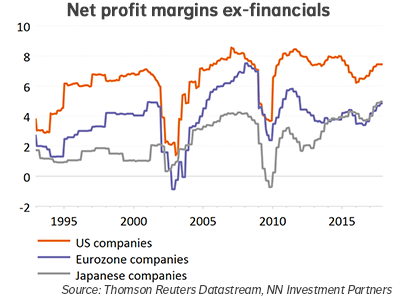

For margins, the low wage growth is positive. US margins are close to record highs and corporate margins in Japan, where investments in labour saving technologies are most advanced, are well above their record high.

However, we must not forget that it is the nominal revenue growth that will ultimately drive earnings and dividend growth. Should nominal global growth settle down to a lower pace due to low inflation, long-term earnings and dividend growth expectations would also need a downward revision.

Of course, it is also a matter of speed. Should inflation start to accelerate and impact monetary policy expectations, however unlikely that seems now, it would have a negative impact on the valuation metrics. I would already be surprised if in 12 months’ time absolute valuation metrics are above current levels. In case of a faster-than-expected monetary normalization I would be very, very surprised if valuations do not come down in all markets. This is the risk scenario for equities.

Diesen Beitrag teilen: