Schroders: Are emerging markets prepared for US rate hike?

This month we look at the potential impact on emerging market (EM) liquidity as the Federal Reserve looks to normalise monetary conditions. We consider the liquidity in EM from three angles: external, domestic and, to a lesser extent, equity positioning within EM.

28.07.2015 | 11:12 Uhr

After nearly seven years of record low interest rates in the US, we remain of the opinion that the Federal Reserve (Fed) will raise the Federal funds rate by the end of 2015. Such action poses a significant risk to emerging markets (EM) given the reliance on US dollar funding.

External liquidity

The rise in the issuance of local currency debt by EM countries has, in isolation, reduced reliance on external funding. EM Asia and Latin America (LatAm) gross external public debt issuance has decreased significantly in the aftermath of the Asian/EM financial crisis in the late 1990s. While the reliance of external debt has fallen, the currency breakdown of such debt has become more concentrated in the US dollar, relative to alternatives such as the yen, euro or sterling. Notably, over 70% of public external debt in LatAm and EM Asia is denominated in US dollars while EM Europe has greater external debt relative to GDP albeit with less US dollar reliance.

Looking at the major economies within EM, Turkey and South Africa are the most vulnerable to a removal of external liquidity given their relatively low foreign exchange reserves, negative current accounts and large amounts of maturing external debt. Malaysia, Indonesia and Mexico have become more vulnerable since the “Taper Tantrum” of 2013, while Brazil and India have seen some improvement (source: World Bank, 2013).

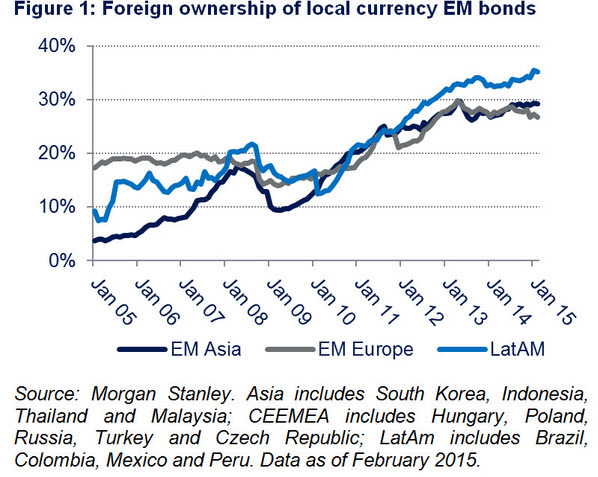

Aside from external debt, we also examined foreign ownership in local currency debt. While the rise of local currency debt is expected to reduce the vulnerability of EM countries to currency fluctuations associated with a Fed hike, the sizeable increase in foreign ownership represents significant vulnerability to external liquidity, as shown in Figure 1. In recent years, EM local currency fdebt markets have attracted flows as markets have opened to foreign investors. However, higher US interest rates improve the relative yield attractiveness of US government bonds and leave EM countries vulnerable to the flight of hot money from foreign investors seeking higher yields.

Domestic liquidity

Next, we examine the potential for EM countries to raise domestic liquidity. Most EM policymakers have the flexibility to lower interest rates with current levels above the lowest levels during past crises. Domestic and external liquidity are closely linked due to foreign investors’ positioning in the EM carry trade. Consequently, EM central banks will have to balance the need to reduce rates to provide domestic liquidity and support growth, while continuing to provide an attractive destination for foreign investors. Brazil and Turkey have the most flexibility to cut rates given current levels of 13.75% and 10.75% respectively, while South Africa is the most constrained given that the current 5.75% rate is just 0.75% above the lowest rate over the past 15 years (source: Bloomberg, Schroders July 2015).

While the debt dynamics of externally vulnerable economies give us cause for concern, there is scope for domestic liquidity injections via interest rate cuts albeit to a varying degree regionally. The Fed’s communication of a gradual hiking cycle is therefore essential to ensure that the more vulnerable EM economies are able to adjust monetary policies to balance growth without the risk of capital flight.

Equity positioning

Finally, we looked at EM equity positioning. Our analysis suggests that some of the most vulnerable countries are among the largest overweights in global EM portfolios, particularly India, Brazil, and to a lesser extent, Turkey. This could add strong negative selling to the otherwise uncertain fundamental position.

Diesen Beitrag teilen: