Morgan Stanley IM: In Like a Lion, Out Like a Lamb?

A weaker than expected non-farm payroll print was the catalyst to a risk-off panic that began the month. Markets were quick to price in a hard landing scenario, and there was even chatter of intermeeting rate cuts from the Fed.

23.09.2024 | 09:22 Uhr

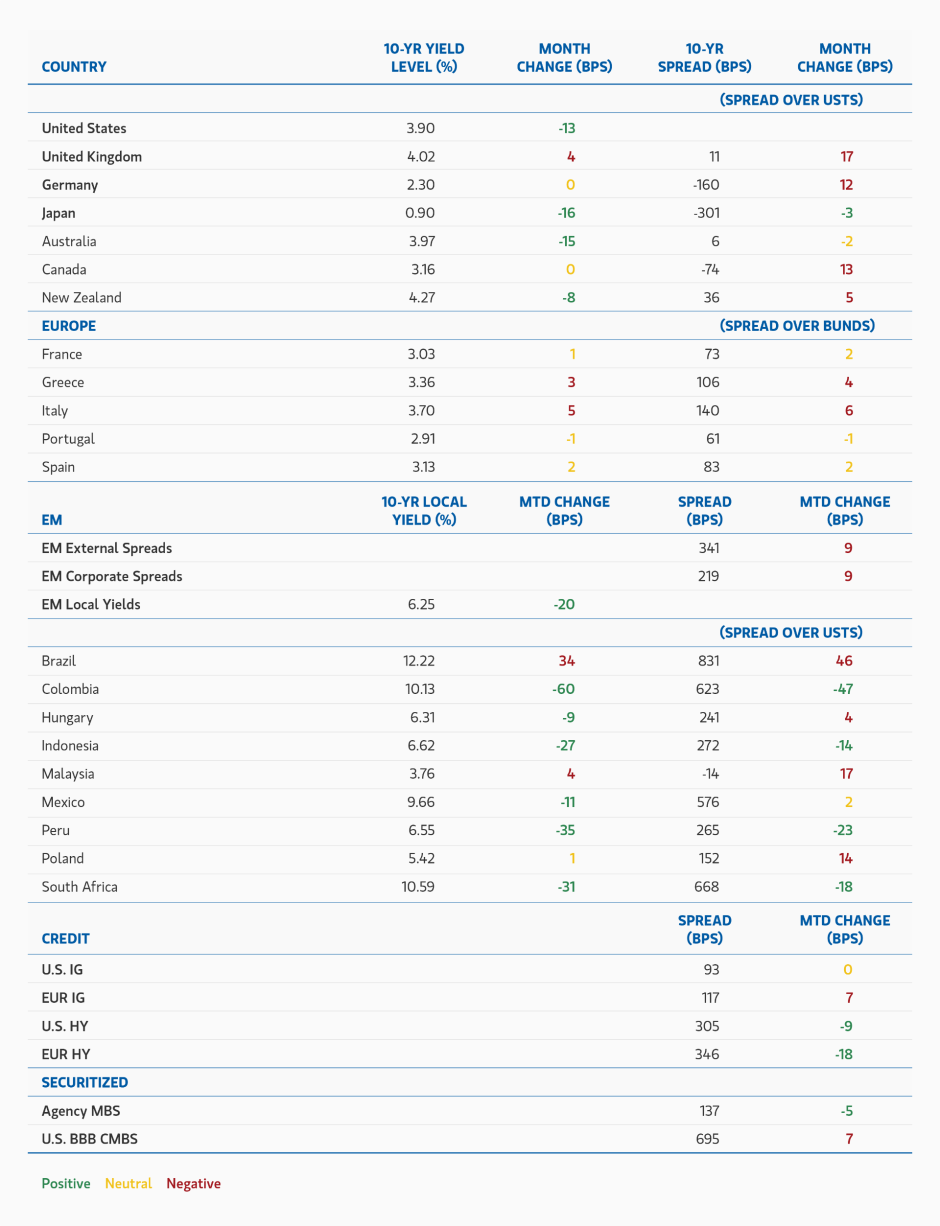

The intermeeting cuts didn’t materialize, but the slowing economic data, progressing inflation picture, and comments made by Fed Chairman Jerome Powell in Jackson Hole, all but solidified a September rate cut and begged the question of whether it would be 25 or 50 basis points (bps). Elsewhere, markets saw the USD depreciate +2% vs a basket of other currencies over the month as rate cuts became imminent. The Yen rallied at the beginning of the month as the Bank of Japan announced a surprise rate hike following their July meeting and investors witnessed an unwind of the popular carry trade. Within credit markets, spreads widened as risk assets sold off to begin the month but came around full circle and ended the month little changed. US Investment Grade (IG) spreads ended the month unchanged and Euro-area IG spreads widened 7bps. Spreads within the high yield markets tightened over the month, despite the volatility at the start. The Euro-area outperformed their U.S. counterparts. Securitized credit spreads also continued to grind tighter over the month.

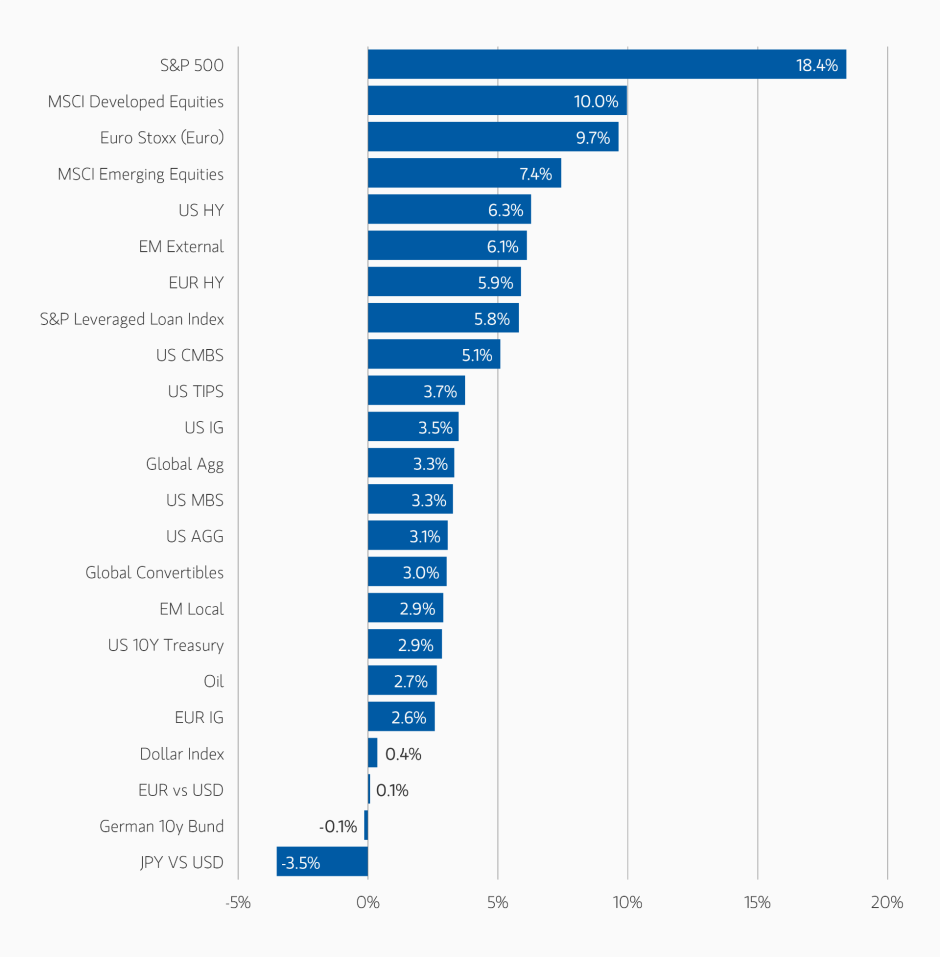

Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of August 31, 2024. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

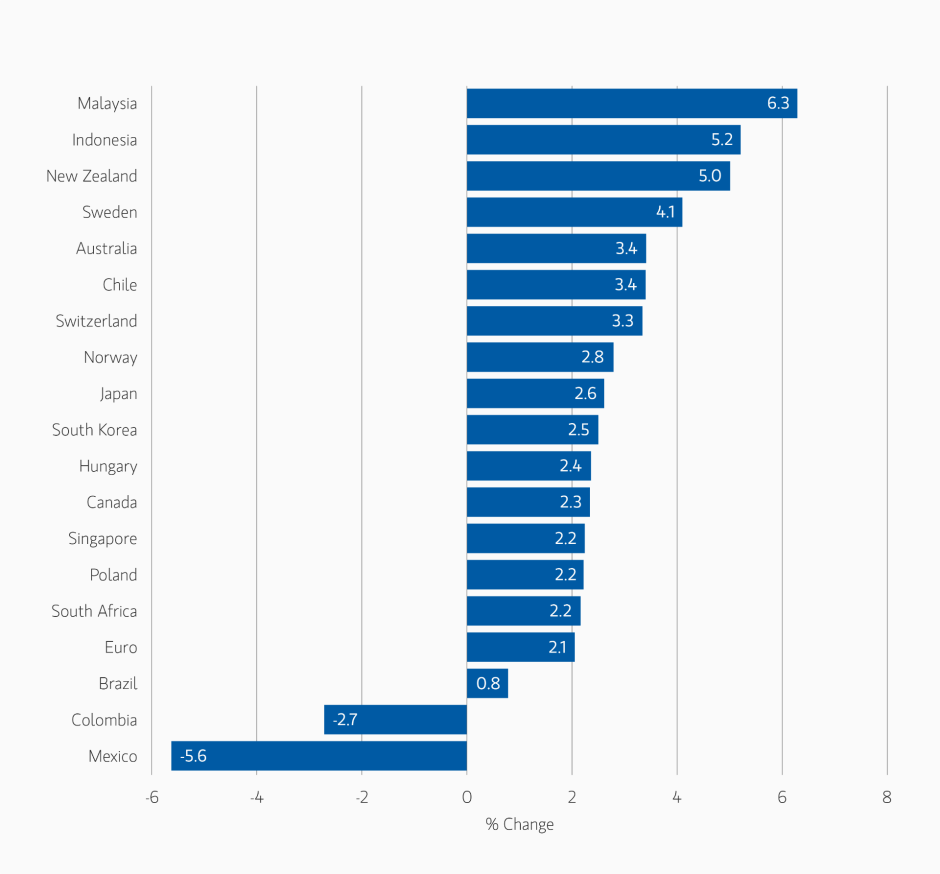

Currency Monthly Changes versus USD

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as August 31, 2024.

Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of August 31, 2024.

Fixed Income Outlook

Fixed income put in another solid performance in August despite unprecedented volatility in the first two weeks. Government bond yields generally moved lower again with U.S. Treasuries leading the way. Economic data continued to underwhelm, supporting the dovish central bank narrative, increasing confidence that rate cuts will continue to come in those countries that have begun the rate cutting cycle, but more importantly, the Fed will imminently embark on its easing cycle.

The surge in volatility seen in the first half of August was a result of a sea change in the narrative of the U.S. and global economy. A series of underwhelming U.S. data prints, concluding with a surprisingly weak July nonfarm payroll and a surprise Bank of Japan rate hike conspired to send volatility soaring. VIX, a standard measure of market volatility/anxiety, rose from 16.36 on July 31 to 38.57 on August 5 before retreating to 15 by August 15.1 This extreme volatility helped send U.S. Treasury yields sharply lower. Interestingly, despite significant underperformance over the first two weeks of the month, credit spreads ended the month unchanged or slightly lower and the S&P higher. But the surge in VIX reflected a sea change in the attitude about the risks of a recession and the likely trajectory of monetary policy.

Until August, markets had not been overly concerned with recession risks. Yes, U.S. growth looked to be slowing both in terms of output and in employment, but a soft landing, trend like growth, falling inflation, stable unemployment was the assumed most likely outcome. But weaker than expected data in the U.S., no signs of strength anywhere else in the world and worries that the AI-led equity rally was stalling, led markets to push bond yields lower and increase expectations of significant rate cuts, particularly in 2024. This was despite no overt signs of significant weakness in U.S. data. We believe U.S. growth will be weaker in 2024, but this was to be expected given its strong performance in 2023. However, a rising unemployment rate (faster than either we or the Fed expected) has changed the narrative. The Fed has a dual mandate: keep inflation low and employment high. The Fed and the bond market are now worried that signs of incipient weakness in the U.S. labor market will turn into something more sinister.

With U.S. inflation looking well contained, the outlook for the labor market is now the key factor in determining the timing and magnitude of rate cuts. With the rise already seen in the unemployment rate, the Fed will cut rates in September. Fed Chairman Powell has all but guaranteed a rate cut at the September FOMC meeting. This has led to a strong debate amongst market participants about how much and how fast rates will be cut.

Economic pessimists who worry that a recession is just around the corner think the Fed should cut aggressively, front loading 100 bps of rate cuts this year, with a 50 bps cut in September appropriate. More sanguine investors believe that although policy rates are too high given improvements in inflation and the growth outlook, it is premature given the still resilient state of the economy to cut rates aggressively. Currently, the pessimists have the upper hand in market pricing. Cuts are fully priced for September, November and December FOMC meetings as well as multiple cuts in 2025. Other central banks including the European Central Bank and Bank of Canada are also expected to cut rates significantly over the next 12 months. Effectively, the pessimistic scenario of a significant risk of recession or hard landing is discounted by market pricing. While this scenario is possible, as recent data flow has been going this way, this expected aggressive easing cycle is contingent on activity data slowing in the future. In fact, the size of rate cuts priced into bond markets usually only occur when a significant recession occurs. That said, policy rates are too high, and adjustments are coming. We continue to be worried that the pace and size of forecasted rate cuts are too high, but it is probably too early to fight the bull market. Indeed, long U.S. Treasury yields already discount a sub 4% policy rate.

Going forward, much is still unclear about the depth and pace of the global easing cycle. While we think bonds can continue to perform well in the near term, we remain cognizant that a sustained rally would require a material slowing of activity data to suggest a recession, and central banks globally to move away from the conservative approach they have embraced so far. Longer term, the level that U.S. and global 10-year yields will go depends on the extent of the easing cycle. For now a neutral-ish duration position seems appropriate, with U.S. Treasury yields looking a bit low relative to other countries who have weaker economic outlooks (UK, Canada, New Zealand).

As mentioned above, credit markets ended August having performed quite well given the rise in volatility and increased anxiety on the economic outlook, especially considering yield spreads on investment grade and high yield corporate bonds are at the low end of their historical ranges. We can certainly say that credit markets do not seem to exhibit signs of economic anxiety that exist in the rates markets, although, to be fair, that could be because credit markets do expect the Fed to come to the rescue and prevent serious economic damage.

Our stance on credit remains solidly unchanged. There is no reason to believe spreads will materially widen when economic growth is decent (and coming in around expectations) and central banks are beginning to engage in a modest rate cutting cycle. Yield-oriented buying should contain spread widening, but one factor we are paying close attention to is the level of all-in yields and their impact on demand for corporate bonds. It is possible that if yields fall further, buyer demand could begin to wane, and spreads could widen, especially under a rising recession probability scenario. This risk is offset, however, by central banks’ rate cutting bias which should serve to truncate spread widening risk. We remain modestly overweight credit in portfolios.

Emerging market (EM) local market returns were generally solid with several countries performing quite well. If a country has a solid economic outlook, decent growth, falling inflation, a central bank able and willing to cut rates, bonds can perform well. But as with corporate credit, when bad news hits or markets are disappointed, bonds and currencies can be hit badly. Performance varied, with positive returns from duration but mixed currency returns. In Latin America, Mexican and Brazilian bonds and currencies continue to struggle with domestic issues, overwhelming the benign backdrop the Fed is providing.2 We remain focused on idiosyncratic opportunities that feature favorable risk/reward characteristics.

Given global economic and policy uncertainty, we continue to find the best fixed income opportunities in mortgage-backed securities (MBS) and other securitized credit. U.S. households with prime credit ratings have strong balance sheets, and this should continue to be supportive of consumer credit and ancillary structures, especially as house prices remain firm. U.S. agency mortgages still have value compared to investment grade credit, at least in higher coupons, and they should outperform U.S. Treasuries.

In currency markets, the outlook for the U.S. dollar remains uncertain. It has weakened as U.S. rates have fallen relative to the rest of the world. The Fed’s employment mandate may continue this trend with the Fed responding to higher unemployment while other central banks, faced with stickier inflation cannot match Fed rate cuts. But the U.S. economy, even with a slowdown, is still growing faster than most other countries implying that rate cuts in the U.S. could eventually bolster the U.S. economy and currency. As of now, however, it remains unclear who will inherit the position of global growth leader. Europe and China are seeing lackluster cyclical data in addition to grappling with structural woes. Emerging markets continue to be confronted with idiosyncratic challenges (as well as opportunities). In the middle of the month, carry trades began to be unwind owing to a variety of catalysts including equity market volatility, intervention by Japanese authorities in the yen, a hawkish shift by the Bank of Japan, and political uncertainty in the U.S. We look mainly to capitalize on idiosyncratic mispricings where there are clear fundamental and value differences. For now, the dollar is likely to remain under pressure.

Developed Market Rate/Foreign Currency

Monthly Review

Developed market interest rates fell in August, and yield curves steepened as investors expected more interest rate cuts from central banks. The bull-steepening trend was most pronounced in the U.S., where a weak non-farm payrolls print led to increased fears of a recession. Over the month, the 2s10s U.S. Treasury Curve steepened 21 bps. Though worries about a sharp slowdown quickly abated with the strong ISM services and retail sales releases, the market continues to expect aggressive policy easing this year and next. Consequently, yields on shorter-maturity bonds have remained at low levels. In the Eurozone, data continues to highlight the divergence between the weak manufacturing sector and a relatively perky services sector, though the stronger than expected French services Purchasing Manager’s Index seems to reflect the one-off boost from the Paris Olympics. Reassuringly for the ECB, negotiated wage growth in the euro area slowed to 3.6% in Q2, suggesting some cooling in labor market conditions.

On foreign exchange, August saw a sharp drawdown in carry trades amid elevated volatility and growth concerns in high yielders (including the U.S. and Mexico). The U.S. dollar ended the month lower against G10 peers, as rate differentials narrowed between the U.S. and the rest of the world. Following a 7% gain in July, the Japanese yen strengthened another 2.5% against the dollar. The Antipodean and Scandinavian currencies also outperformed.3 We recently turned bearish on the euro vs the U.S. dollar given the currency’s appreciation and the region’s poorer economic outlook. We view the dollar as attractive given the still supportive interest rate differential, resilient U.S. data and the dollar’s likely outperformance in a risk-off environment.

Outlook:

We are modestly short duration in portfolios, mainly via U.S. Treasuries and Japanese government bonds. At the same time, we are overweight duration in New Zealand and Canada, where easing cycles have recently commenced, and the market pricing of cuts is more modest than it is in the U.S. Our view on the U.S. is that, for the Fed to move more aggressively than already priced, economic data will have to deteriorate significantly enough to suggest an imminent recession. While the U.S. labour market is clearly cooling from extremely tight levels, the economy is still creating jobs at a meaningful pace, and other activity data remains resilient. In Japan, although the central bank recently said it will not raise interest rates during periods of market volatility, developments in labour and goods markets continue to suggest domestic demand is strengthening.

Emerging Market Rate/Foreign Currency

Monthly Review

Performance was positive for the major segments of emerging markets debt (EMD) for the month of August. A dovish sentiment from the Fed following the Jackson Hole Economic Symposium has the market pricing in that September is time for the first rate cut of this cycle. The U.S. dollar weakened for most of the period which was a supportive macro environment for EM currencies broadly. Two outliers were the Mexican peso, which weakened in response to Mexico’s progress towards controversial judicial reforms, and the Turkish lira which suddenly fell towards the end of the month. The Czech central bank cut rates by 25% making this the sixth consecutive rate cut by the bank. Spreads compressed for both sovereign and corporate spreads. Outflows continued from both hard currency and local currency funds despite strong performance in both segments of the market.

Outlook:

Emerging markets debt performance has been strong year-to-date, and we expect this to continue as the macro environment becomes more supportive. EM currencies broadly strengthened during the period, and we expect local assets in particular to perform well as the Fed turns more dovish and starts its cutting cycle. EM local rates should also benefit from the Fed cutting rates because EM central banks are likely to continue with their ongoing cutting cycle further encouraged by the Fed dovishness. Credit spreads are near long terms averages as they compressed during the period, but spreads remain wide if you look beyond the benchmark. The global election year calendar continues with Sri Lanka’s presidential election and the team is closely monitoring the situation as that unfolds.

Corporate Credit

Monthly Review:

In what tends to be a seasonally quiet month, August was unusually volatile as softer than expected macro data early in the month questioned the ‘soft landing’ narrative. U.S. IG spreads tightened, outperforming European IG which widened slightly, and government bonds rallied.4 Sentiment was dominated by several factors: Firstly, the Non-Farm Payroll (NFP) print surprised markets early in the month as the 0.2% uptick in the unemployment rate was higher than consensus. Markets began to price in the probability of a ‘bumpier’ landing for the economy and that the FOMC may be late in ‘pivoting’ policy. Volatility increased with VIX spiking to 60 along with carry trades unwinding. Subsequent data prints however pushed back against the recession narrative. Secondly, the latest U.S. CPI print was in line with expectations while in the Eurozone, country-level August HICP data was generally weaker than expected. As a result, data continue to support a cut in September by both FOMC and ECB. Thirdly, corporate earnings continued to come in a bit more mixed, with signs of pricing power diminishing and consumers down trading across income brackets. Corporate fundamentals remain strong with healthy balance sheets. Banks are seeing limited stress with no pickup in NPLs and capital buffers remaining high. Finally, primary issuance in August came in much higher than expected at 45bn vs 27bn expected. Despite the higher than expected supply, investor demand for risk was strong with large new issue order books and limited new issue concessions.

August began with a violent start for the high yield market as the average spread jumped in the opening days of the month amid a sharp selloff in global risk assets. The global high yield market was orderly during the brief selloff as August’s opening shock was quickly erased and the average spread finished below its starting levels. The technical conditions in high yield were softer in August on the back of weaker demand. Outflows from retail investors surged early in the month before being offset by inflows for the remaining balance of the month, while net issuance remained light. Finally, August marked another quiet month for default and distressed exchange activity among high yield bond issuers and par-weighted default ended at a 20-month low.

Like other risk assets, August was a volatile month for global convertible bonds. The asset class sold off to start the month after weak manufacturing and employment data increased fears about a potential hard landing. However, global convertible bonds quickly recovered as fears subsided and the chances of a September interest rate cut from the Federal Reserve increased. Ultimately, global convertible bonds generated positive total returns during the month but trailed both global bonds and global equities.5 It was a typical, quiet month from a new issue perspective as only $3.6 billion priced during the month with a large majority coming from the United States. However, this brought year-to-date issuance to $72.8 billion, which is 40% higher than the similar time period in 2023.6

Outlook:

Looking forward our base case remains constructive for credit supported by expectations of a “soft landing” fiscal policy that remains supportive of growth/employment/consumption and strong corporate fundamentals. Lighter gross issuance in 2H24 coupled with strong demand for the “all-in” yield offered by IG credit is expected to create a supportive technical dynamic. When looking at credit spreads, we view the market as offering some value but see carry as the main driver of return. Given the uncertain medium term fundamental backdrop we have less confidence in material spread tightening.

Our outlook for the high yield market remains somewhat cautious as we progress through the third quarter. The high yield market is contending with increasing uncertainty and several likely sources of volatility over the intermediate term, with the ultimate question centering on the magnitude of the anticipated volatility. The key issues are central banks’ evolving monetary policy, economic conditions, the labor market and consumer health, and ultimately, the health of the corporate fundamentals of high yield issuers. High yield faces this uncertainty with historically attractive all-in yields and an average spread that, when excluding the distressed segment of the market, remains near all-time lows. Further inspection of valuations reveals a market with meaningful bifurcation by both sector and credit quality.

We continue to remain constructive on the global convertible bond market as we progress through the third quarter of 2024. We believe global convertible bonds currently offer their traditional balanced profile of upside equity participation and limited downside risk. New issuance in the first half of the year was strong and we expect issuance to continue to increase in the second half of the year as corporations continue to look to refinance existing convertible bonds as well as traditional debt in the convertible bond market given the relatively high interest rate environment. A more traditional asymmetric return profile coupled with an expectation of an increase in new supply continues to give us optimism for global convertible bonds as we progress through the year.

Securitized Products

Monthly Review:

U.S. agency MBS spreads tightened 5bps in August to 137bps above comparable duration U.S. Treasuries. Agency MBS spreads are now roughly flat YTD, while nearly all credit spreads have tightened materially. Lower coupon U.S. agency MBS passthroughs outperformed higher coupon MBS in August as interest rates fell, and lower coupons have longer rate and spread durations. The Fed’s MBS holdings shrank by $32 billion in August to $2.292 trillion and are now down $437 billion from its peak in 2022. U.S. banks’ MBS holdings rose by $24 billion to $2.61 trillion in August, resuming the trend of bank increases after a small decrease in March; however, bank MBS holdings are still down roughly $420 billion since early 2022.7 Securitized credit spreads were little changed in August, despite the mid-month widening that occurred across most sectors. Securitized new issuance slowed in August after a heavy issuance over the last few months; however the supply continues to be well absorbed and met with strong demand. Relative to other fixed income sectors, securitized credit sectors managed to perform largely in line with longer duration fixed income sectors given as the lower duration nature of securitized credit, was offset by the higher cash flow carry.

Outlook:

Despite some mid-month spread volatility, we believe that spreads have somewhat stabilized at current levels as spreads are near agency MBS spread levels given the differentiated performance over the past several months. Overall demand levels remain strong, but we believe it will be challenging to push spreads much tighter from current levels. Securitized credit sectors have been among the best-performing sectors in 2024, and we have seen performance to begin to normalize and believe that this will continue in the coming months. We also believe that rates will likely remain rangebound for much of 2024, and that returns will result primarily from cashflow carry in the coming months. We still believe that current rate levels remain stressful for many borrowers and will continue to erode household balance sheets, causing stress for some consumer ABS, particularly involving lower income borrowers. Commercial real estate also remains challenged by current financing rates, and some sectors may see declines in operating revenue in 2024. Residential mortgage credit opportunities remain our favorite sector currently and is the one sector where we remain comfortable going down the credit spectrum, as we remain more cautious regarding lower rated ABS and CMBS. We have moved from a neutral to a positive view on agency MBS valuations, which are one of the very few sectors that have cheapened up thus far YTD. They continue to remain attractive versus investment-grade corporate spreads and versus historical agency MBS spreads, but we believe that agency MBS spreads have stabilized.

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g., natural disasters, health crises, terrorism, conflicts, and social unrest) that affect markets, countries, companies, or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g., portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market, and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, and correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: