Morgan Stanley IM: Putting Income Back into Fixed Income

The bond market rout continued in September, which would have been even worse without a substantial rally over the last three days of the month.

14.11.2022 | 08:03 Uhr

Here you can find the complete article.

Bond market woes were caused by a litany of factors: better than expected U.S. employment, worse than expected inflation, the U.S. Federal Reserve (Fed) raising expected terminal rates meaningfully. These factors were compounded by the now infamous UK bond market meltdown over the second half of the month. Sovereign yields and credit spreads moved substantially higher in September. Credit markets were clearly impacted by the rise in yields, turmoil in the UK, and, maybe most importantly, the rising probability of a recession or hard landing. Also, not surprisingly, the U.S. dollar was strong once again, rising in value against almost all of the world’s currencies. That’s the bad news.

The good news is that yields across the fixed income universe reached levels that should provide decent protection against further rises in yields. For example, high quality 10-year investment grade financial debt now yields around 6%. Even if yields/spreads rise another 50-75 basis points (bps), total returns over 12-month periods should be positive—a major change from the beginning of the year. And, we believe, eventually the economy will soften, inflation pressures ameliorate and government bond yields will fall, further cushioning the impact of potentially wider spreads.

The news in September was generally negative for bonds.

Whether it was a U.S. labor market showing no imminent signs of softening, or

U.S. inflation (core CPI) rising from a 0.3% month-over-month change to a 0.6%

month-over-month change. News from Europe and elsewhere also remained poor on

the inflation front. It is likely. In our view, that Eurozone inflation will

stay in double digits into 2023 at least. And, with fiscal policy easing to

varying degrees, headwinds for monetary policy are likely to get a bit stronger

given additional fiscal support to households and businesses. It seems nowhere

in advanced economies is there optimism that central banks have hiked enough.

Even in Australia, where the central bank surprised markets by “only” raising

rates 25 bps rather than the expected 50 bps, the cumulative amount of

tightening the central bank expects to deliver remained unchanged.

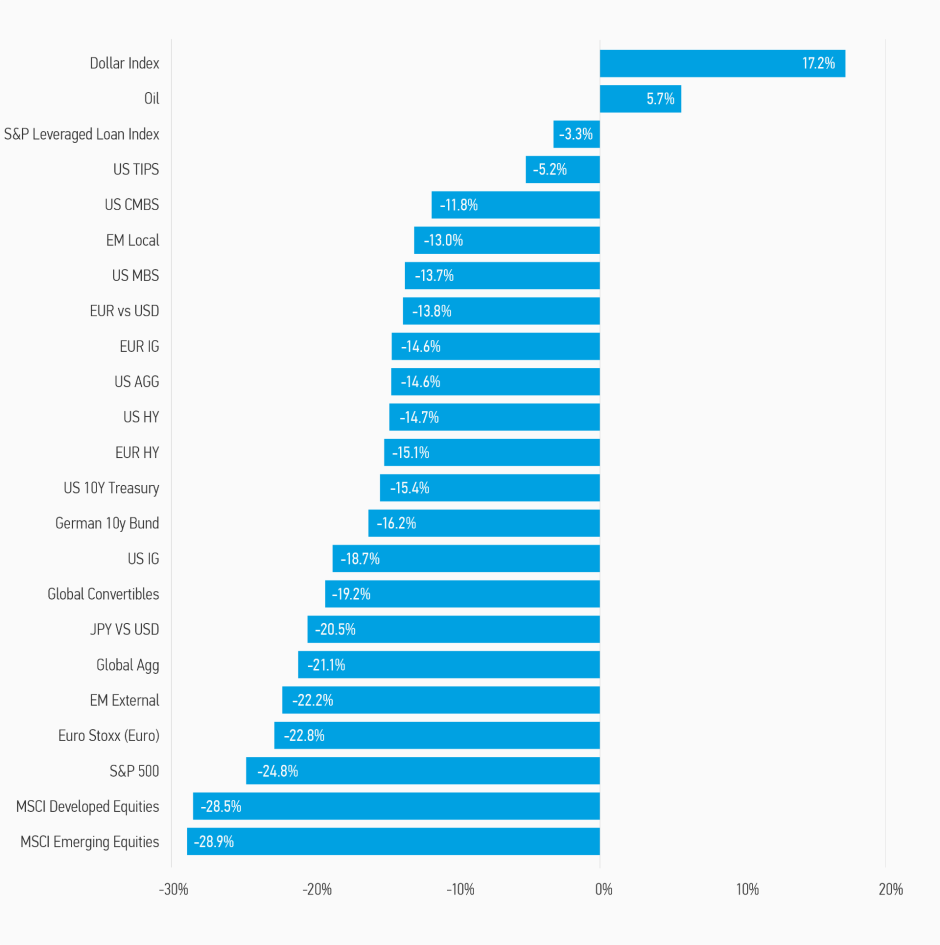

DISPLAY 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of September 30, 2022. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

The impact of poor inflation data was felt particularly hard on real yields. The U.S. 10-year real yield rose almost 100 bps in the month, an amount rarely seen in any one-month period. This of course implied that inflation expectations fell over the month (nominal 10-year yields did not rise as much, meaning 10-year breakeven inflation spreads fell). This suggests the Fed has gained credibility in its inflation fight. In other words, the market increasingly believes Fed rhetoric that it will raise rates to “whatever it takes” to bring inflation down to target (circa 2%). It also implies higher probability of a recession in 2023 or a long period of subpar growth as that is what it usually takes to push inflation meaningfully lower.

Markets were additionally challenged by events in the UK. An unprecedented wave of selling, first of long-dated UK government bonds and then other Euro and USD denominated bonds, led to wild gyrations in UK government yields and significant price deterioration in corporate and securitized bonds. For example, the UK 30-year government bond yield was rising steadily over the month until September 27/28, when it suddenly rose 94 bps, only to fall 105 bps on September 28, after the Bank of England (BoE) announced it would buy billions of pounds of long gilts to ensure financial stability. While it clearly worked to stabilize the market, subsequently, 30-year gilt yields are back up 46 bps as of October 7. The index linked gilt market, a large market mostly used by UK insurance companies and pension funds, had even worse volatility. This episode was the first example of something “breaking” from the rapid rise in yields in 2022. Of course, it does seem leverage was the trigger, as it usually is during financial crises. Whether or not there are other skeletons lurking in investors’ closets remains to be seen.

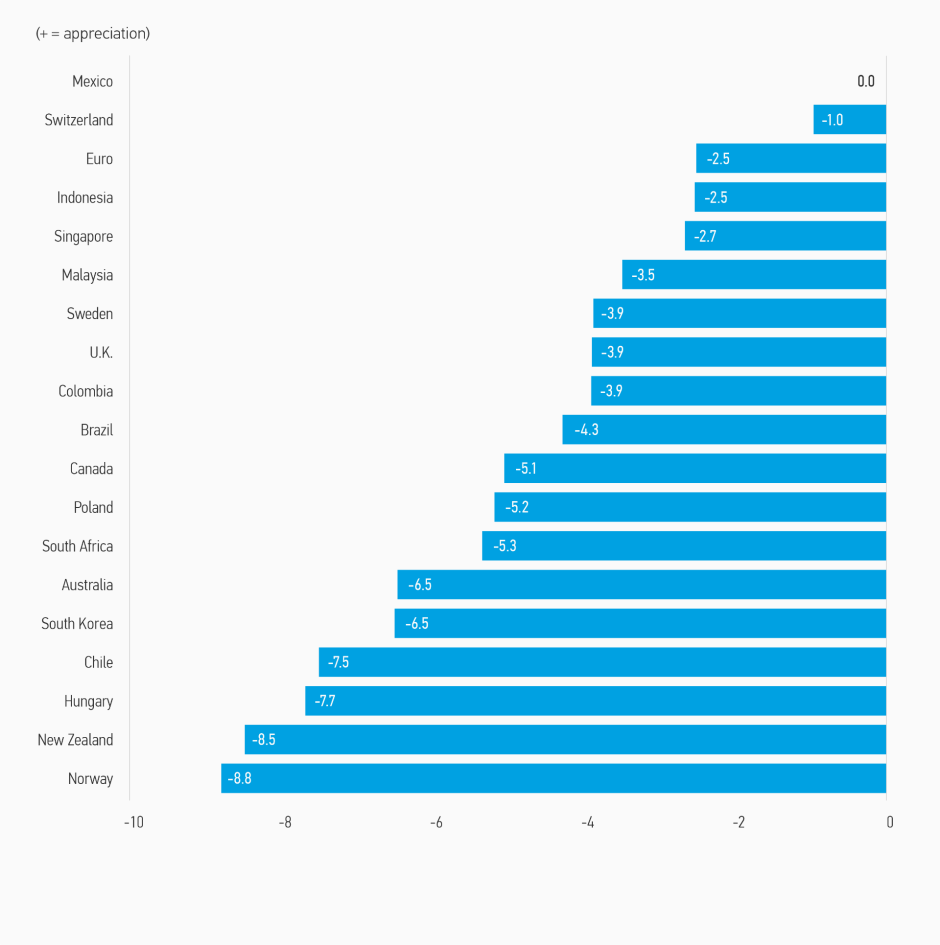

DISPLAY 2: Currency Monthly Changes Versus U.S. Dollar

Diesen Beitrag teilen: