Morgan Stanley IM: Unintended Consequences - The Economic and Corporate Trade-Offs of Tariffs

What are the economic and corporate consequences of higher tariffs? In this insight, our Broad Markets Fixed Income team explores the potential trade-offs and knock-on effects of raising tariff rates.

04.11.2024 | 05:50 Uhr

KEY TAKEAWAYS:

- A debate is unfolding in the U.S. over proposed tariffs, focusing on the possible benefits for U.S. industry and the budget versus potential macroeconomic and corporate costs.

- According to research estimates, higher tariffs would boost government revenues in the short-term, albeit at the expense of slower long-term growth.

- While the knock-on effects to inflation, global currencies and trade-dependent sectors are complex, history shows that corporate bond spreads have widened following tariff increases.

Tariffs have long been used by governments as a tool to protect domestic industries and increase government revenue, but their broader economic impact is complex and far-reaching. Recently, discussions around significant tariffs on imports from China and other countries have stirred debate on how these policies would affect inflation, economic growth and supply chains. In this insight, we explore the proposed tariff’s macroeconomic and broader implications on corporate sectors.

Price and FX effects

The immediate impact of tariffs is often felt in inflation. The

imposition of tariffs raises the cost of imported goods, increasing the

overall price level. According to a report done by Morgan Stanley

Research, if the U.S. were to impose a 60% tariff on Chinese imports and

a broader 10% tariff on all other imports, inflation could spike by

approximately 0.9%. The bulk of this increase would stem from higher

prices for imported goods, particularly from China, whose products would

see the largest price increase. The Fed’s reaction to this immediate

increase in inflation would be uncertain and we believe they could look

through this one-off inflation shock and react more to the slower

projected long-term growth.

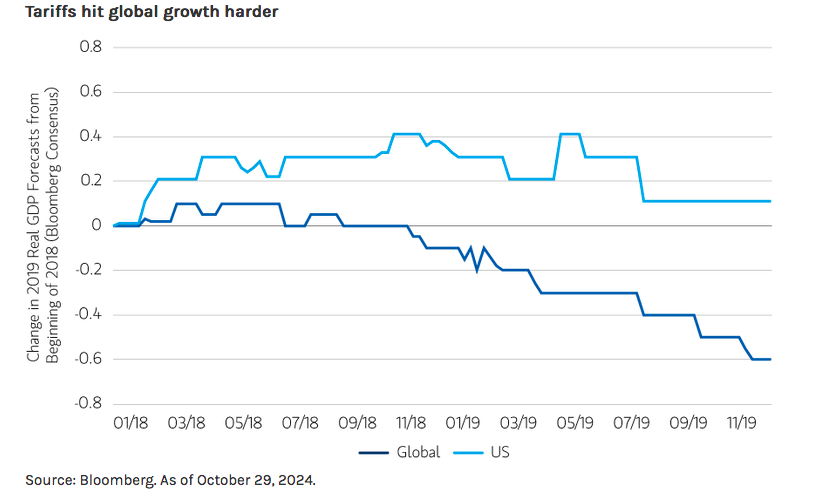

Tariffs also have a significant impact on FX markets, with the USD often emerging stronger. As tariffs slow global growth, more severely than they do in the U.S. (see chart below), other countries may respond by devaluing their currencies to offset the impact of higher tariffs. As seen by the depreciation of the Chinese renminbi throughout 2018 to 2019. The CNY followed in lockstep with the increase in tariffs over the same period.

In effect, a devaluation in other currencies can push the USD higher as it becomes relatively more attractive to investors. While this might benefit U.S. consumers buying imported goods, it can also harm U.S. exporters, whose products become more expensive for foreign buyers, creating potential imbalances in trade.

Higher tariffs, lower growth

In terms of economic growth, it is estimated that these proposed

tariffs from above could drag down U.S. real GDP growth by 1.4%.1

Consumer spending, particularly on goods, would take the hardest hit,

shrinking by 5.5% as higher prices reduce purchasing power. While

services consumption would see a smaller decline of 1.8%. Investment

would also suffer as businesses face increased uncertainty and higher

input costs.

On the other hand, tariffs can also generate significant revenues for governments. Estimates suggest that between 2025 and 2034, gross tariff revenues in the U.S. could rise by $3.7 trillion, resulting in a net increase of $2.8 trillion after accounting for reduced tax receipts due to slower growth.2 This revenue could lower the U.S. budget deficit, with the 2025 deficit projected to decrease by about 10%, or $200 billion. While this fiscal boost might seem attractive, it would come at the cost of likely weaker consumer spending and investment, ultimately making it a trade-off between short-term revenue gains and long-term economic growth.

Corporate considerations

Corporate sectors experience varied effects based on how tariffs

influence their specific cost structures and geographic footprints. In

general, market spreads for corporate bonds tend to widen following

tariff increases, particularly in higher-yield sectors. For instance,

following the 2018 tariff increases, U.S. investment grade spreads

increased by an average of 4 basis points, while U.S. high yield spreads

widened by 9 basis points per a recent HSBC 2018-19 event study.3

Additionally, industries with higher reliance on Chinese imports, such as electronics and consumer goods, would be especially vulnerable, as profitability would shrink under the weight of higher input costs. While Chinese imports have lowered consumer prices in the past during periods of low tariffs, that came at the cost of jobs leaving the U.S. and reducing long-term competitiveness of key industries such as manufacturing, renewables, and semiconductors. As the U.S. economy evolves to meet new challenges of our time, as it relates to controlling inflation and decreasing reliance, corporate profitability will remain volatile given higher input costs from higher tariffs. These sectors could also see a greater need for cost-cutting measures or price adjustments, which could lead to layoffs or higher prices for consumers depending on pricing power.

Bottom line: While tariffs are often seen as a means to protect domestic industries and raise government revenue, they carry significant risks for inflation, economic growth, and corporate profitability. The proposed tariffs would likely lead to higher prices, reduced consumer spending and a slower-growing economy. While the U.S. might see a temporary reduction in its federal deficit, the long-term effects on investment, corporate health, and the global supply chain could outweigh the short-term fiscal gains.

Diesen Beitrag teilen: