Morgan Stanley: The Song Remains the Same

July was another good month for financial markets. The strong performance of credit, emerging markets and equities was somewhat surprisingly joined by government bonds. And, lo and behold, the U.S. dollar finally depreciated, something market consensus had been expecting for some time.

02.09.2020 | 08:00 Uhr

Here you can find the complete article

Normally government bond yields do not fall when credit and equities rally. Is someone wrong? Not necessarily. The rally in credit and emerging markets has been built on confidence that the Fed (and central banks more generally around the world) would continue to provide exceptionally strong support for the economy through unprecedentedly easy monetary policy in conjunction with expansionary fiscal policy. The rally in government bonds in July reflects market confidence that monetary policy will indeed continue to be supportive indefinitely into the future. This is likely to be correct.

There was additional good news on the global fiscal policy front. The EU’s agreement to the creation of a €750 billion European Recovery Fund was a strong signal that fiscal policy was going to be deployed at the EU level to combat the recession, augmenting the ECB’s monetary policy efforts. Moreover, the ECB upsized its Pandemic Emergency Asset Purchase Program (PEPP) from €750 billion to €1.35 trillion.1 The creation of the Recovery Fund is likely to be a game changer in terms of improving confidence in the outlook for European growth; reducing fiscal risks in southern Europe, particularly Italy; and increasing the attractiveness of the Euro. Lastly, the Fed extended all of its Emergency Funding Programs, including its small business loan program (PPP) and TALF, for another three months, until the end of December.

While economic data continued to surprise to the upside, news about the pandemic and U.S. fiscal cliff was not so positive. Outbreaks in several U.S. states were worrisome as was news about new outbreaks in the rest of the world. But this was balanced with the good news on the virus front: the growing possibility that a vaccine might be available by the end of the year. A widely available vaccine is of course the game changer. Markets need to discount this probability as well as the probability that the pandemic is not under control, or not as much under control as the world had thought. So it is not surprising that markets can rally despite bad news on economic re-openings and potential second waves. Although the U.S. is facing the end of temporary fiscal support by the end of the month, this did not seem to affect market confidence as the only reasonable outcome of congressional negotiations appears to be passage of a Phase IV stimulus package. While this is not yet accomplished, no one realistically believes that it is in the interests of either party to allow previous legislation to completely lapse, particularly with elections looming in November. We expect a deal to be cut in August, which will keep money flowing to those hurt most by the pandemic. Any meaningful delays could undercut progress made in consumer confidence and spending.

Despite the good news on the policy front, challenges remain. U.S./China political and economic battles have escalated, the U.S. fiscal cliff is still alive and well, U.S. elections loom, virus outbreaks have been growing, vaccines remain a hope rather than a reality, and economic data is likely to improve at a slower rate going forward. We remain optimistic that economic lockdowns will not recur in mass and that incremental improvements of data will continue, although not necessarily linearly. The song remains the same.

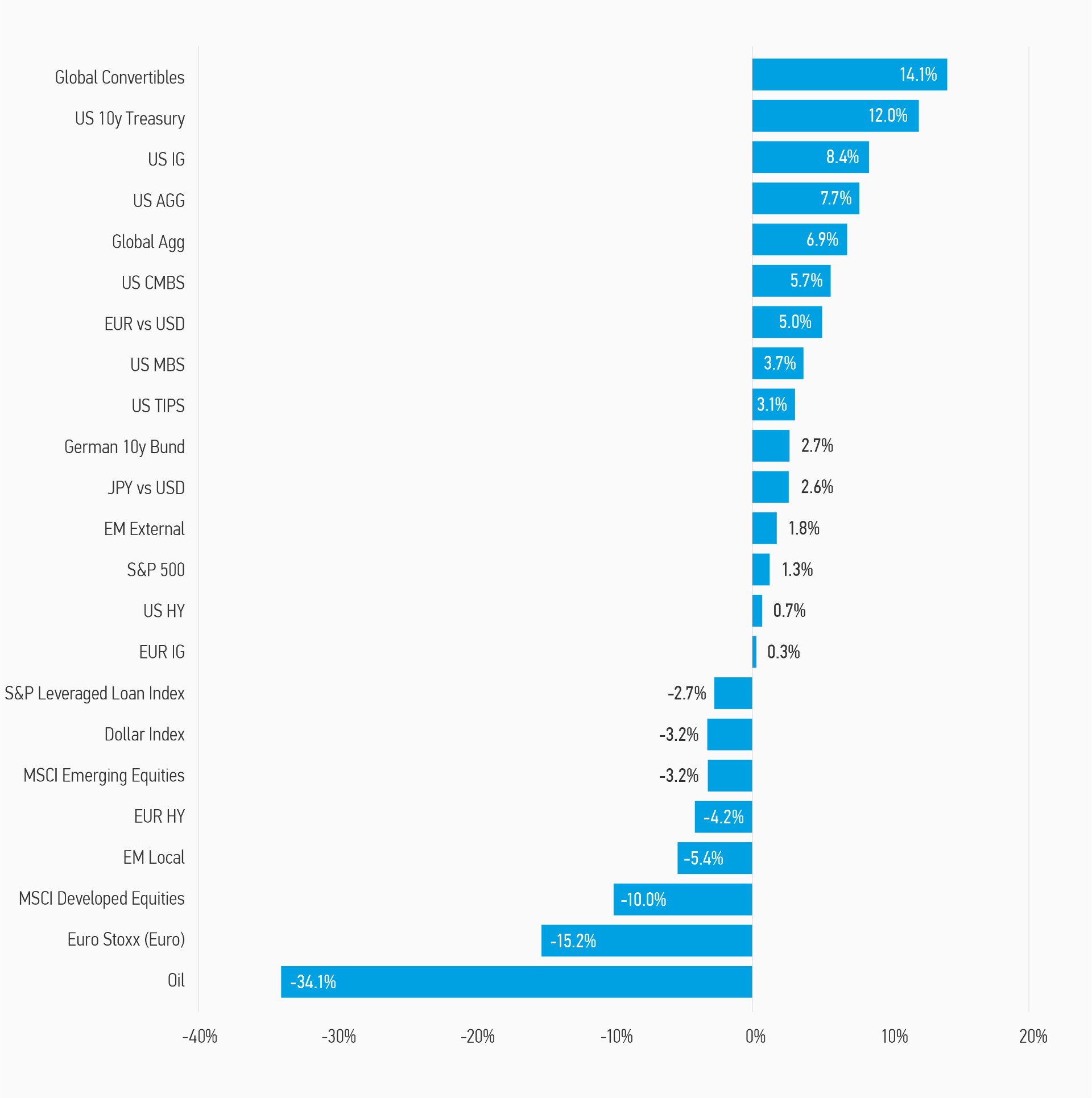

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of July 31, 2020. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

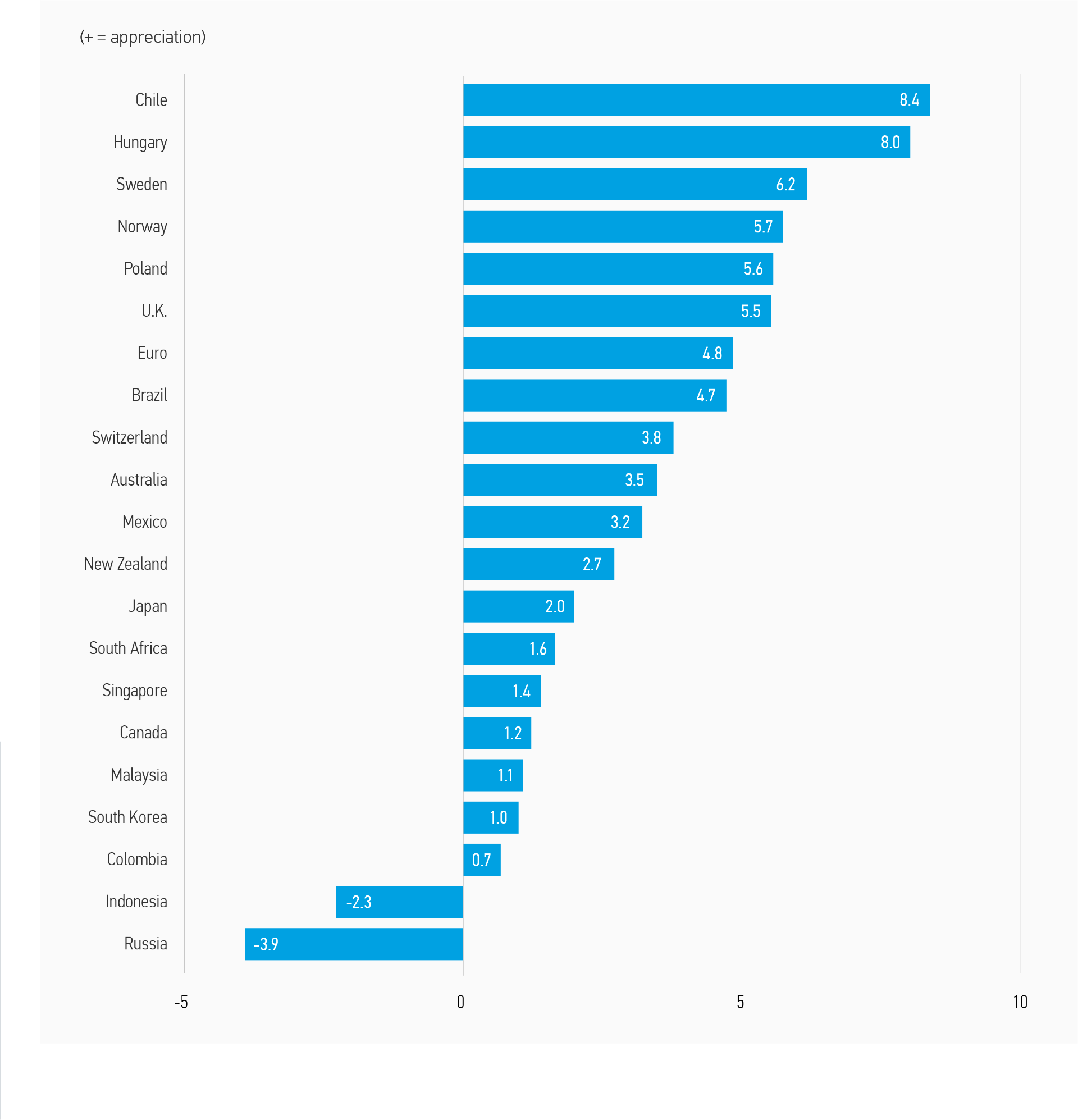

Display 2: Currency Monthly Changes Versus USD

Source: Bloomberg. Data as of July 31, 2020. Note: Positive change means appreciation of the currency against the USD.

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JP Morgan. Data as of July 31, 2020.

Fixed Income Outlook

Our fixed income outlook continues to be cautiously bullish. Valuations have richened as markets have rallied, but the information flow has been net positive, supporting rising asset prices. Despite setbacks on the economic reopening front, we do not see the trend reversing and are thus optimistic that economies will continue reopening in the months ahead. Positive headlines on new treatments and vaccines could also boost sentiment further, with the scope for a positive surprise being sizable, given the robust pipeline of vaccine candidates and a potentially expedited approval process. That said, there is a risk of a correction if markets become disappointed with the news flow considering that valuations are now more demanding.

The economic recovery continued in July, supporting the optimistic narrative. Labor markets strengthened, output rose and business confidence in both manufacturing and service sectors improved. However, the strong economic bounces (V-shaped) seen so far are likely to slow as growth trajectories flatten out. This is not a bad thing, just something that needs to be calibrated into asset prices, which are now meaningfully higher. Lastly, we notice potential risks in the form of a bungled reopening of economies amid a worse-than-expected second wave of infections, as well as heightened U.S.-China tensions (Hong Kong and trade issues) and geopolitical noise in other regions (Russia/India vs. China) weighing on risk sentiment.

Recent developments on the policy front are on balance positive, but delays in extending fiscal support in the United States risk undermining hard-won investor confidence. We believe a positive compromise will be found this month, but a risk of no-deal remains. This is counterbalanced by the news from Europe, where the EU agreed to a large-scale pan-EU fiscal response to the crisis, which can be seen as a first step towards fiscal mutualization. This is very good news for the economic outlook, EU systemic risk, and the Euro. Additionally, we expect monetary policy globally to remain in “do whatever it takes” mode and low/stable government bond yields to reflect this growing confidence. The Fed is expected to announce the results of their monetary policy strategic review in September, which should support market confidence that the Fed will indeed keep interest rates very low far into the future and continue to grow its balance sheet.

While there has been a bit of market consternation and hand-wringing about low and declining government bond yields, we are not worried. Exceptionally low yields are part of the solution to the world’s economic woes. With fiscal deficits and corporate borrowing at record highs, low and stable interest rates are a necessity. One might even call it the fiscalization (public and private) of monetary policy, e.g., central bank financing of deficits. While yields could certainly rise modestly, we do not see a good reason to be bearish on risk-free rates. But could U.S. yields fall much further? The example, of Europe and Japan suggest yes. In both cases, central banks initiated negative interest rate policies. If the Fed does not rule this out, the market needs to price in the probability of its occurring. Today it looks unlikely that the Fed will resort to negative interest rates or even yield-curve targeting. A scientific breakthrough ending the pandemic and the need for emergency monetary policy would risk higher yields.

We remain cautiously constructive on EM debt on the back of still attractive but less compelling valuations and enormous policy support coming both from the developed world and emerging countries. Despite the sharp rally in the last quarter, we think EM debt still offers value, mainly in high-yield hard-currency debt, and to a lesser extent, local currencies, as the weakening dollar trend appears to reach its limit and growth differentials with DM have shown no material improvement. However, risks abound, including policy failures in emerging markets.

Credit markets continue to perform well. This trend is unlikely to change, although, like the economic data, the pace will moderate. As spreads get closer and closer to historical averages, or in some cases through them, it will be difficult to tighten further without additional improvement in fundamentals (or technical support from central bank buying). We think policy support will continue as corporate behavior is positive (with default risk reduced through cash hoarding, asset sales, dividend cuts and reduced capex) and supply is expected to diminish as corporate cash needs fall. Most of the economic losses should prove transitory, and as such will not be meaningfully negative for corporate valuations overall. As economies improve, we expect corporate performance to improve meaningfully, with short-term corporate losses and higher leverage being less important, though important nonetheless, for differentiating outperforming businesses. Barring any jarring negative economic and pandemic news, spreads on both investment grade and high-yield bonds should grind tighter over the remainder of the year although, after the recent rally, some consolidation should be expected.

Securitized credit also continued its strong performance in July. Opportunities continue to be bifurcated. There appears to be limited upside in AAA spreads as they have now retraced 80-90% of the COVID spread widening. On the other hand, AAA spreads are also unlikely to widen materially given the lower issuance volumes and $100 billion of TALF money poised to take advantage of any spread widening. Alternatively, lower-rated classes, particularly BBBs and BBs, still have significant room to tighten further. While we have seen some recovery over the past three months, lower-rated securitized spreads remain much wider than February levels and have lagged the recoveries experienced by the corporate credit sectors. Fundamental data remains critical, and the markets are closely watching for signs of material credit deterioration due to an increase in joblessness. However, so far, the performance deterioration has been very mild for most sectors and far better than expectations. We remain overweight.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

In July, economic data generally continued to improve, rebounding strongly from previous months and in nearly all cases beating analysts’ expectations. However, while the change in growth may have been very positive, the absolute level of economic activity is still far below normal. This was evident in the second quarter GDP data, with the U.S. and Eurozone experiencing the biggest quarterly contraction in history due to the coronavirus. So while economies may be recovering quicker from COVID-induced lockdowns, it is not back to business as usual yet. Despite the better-than-expected data, 10-year government bond yields fell across the developed markets over the month as central banks remained accommodative and signaled their continued willingness to provide additional support if needed. The U.S. dollar weakened against all G-10 currencies as liquidity and risk premia associated with it declined. Investors appear to have turned to precious metals instead as a liquid store of value.

Outlook

We continue to expect monetary policy to remain accommodative and risk assets to be well-supported across developed markets in the coming months in order to support the continued stabilization of the global economy and financial markets. Having eased aggressively in prior months, most central banks are now closely monitoring incoming economic data and looking at additional fiscal policy response options. Incoming data has generally been better-than-expected, but with inflationary pressures very weak and economies hit by a severe exogenous shock, there is every reason to believe central banks will be ready to ease further, most likely through unconventional policy measures (e.g., QE and liquidity provision measures).

Emerging Market (EM) Rate/FX

Monthly Review

Similar to other areas of Fixed Income, EM yields continued to fall and spreads tightened as global liquidity pushed valuations towards pre-COVID levels. Economic growth continued to improve in July, but at a slower rate, as Markit Manufacturing PMIs moved into expansionary territory at 51.4, while the Services PMIs fell just shy of the expansion number (50) at 49.2.2 The continued optimism also aided commodities as energy, metal, and agriculture prices broadly gained in the month, with notable exceptions in corn and soybean prices. Dollar-denominated sovereign debt led the market with the investment-grade segment outperforming high yield, helped by falling U.S. Treasury yields.3 Domestic debt followed dollar sovereigns as EM currencies, euro-linked currencies in particular, strengthened versus the dollar and local bonds posted positive returns. Corporates trailed sovereigns in the month, partially due to their lower duration profile, and returns were evenly split between IG and HY. From a sector perspective, companies in the oil and gas, infrastructure, and metals and mining sectors led the market, while those in the transport, financial, diversified, and real estate underperformed.4

Outlook

We remain cautiously constructive on EM debt in the near-term, on the back of less compelling valuations, setbacks on fighting the pandemic in certain countries (primarily, the U.S. and several EM economies) and heightened political uncertainty as the U.S. elections approach. Overall, we think that the global reopening trend is likely to continue in the months ahead, with flare-ups being addressed in a more targeted fashion, thus limiting the downside on global economic activity. Despite the sharp rally in risk assets in the last quarter, we think EM debt still offers value, mainly in high-yield hard-currency debt, and to a lesser extent local currencies, as the weakening dollar trend appears to reach its limit and growth differentials with DM have shown no material improvement. Additionally, risks abound, including a bungled reopening of economies, heightened U.S.-China tensions (trade and technology issues/geopolitics) inflamed by the proximity of U.S. elections, and geopolitical conflicts elsewhere (Russia-Ukraine, India-China, Libya, etc.), weighing on risk sentiment.

Credit

Monthly Review

Spreads were tighter in July both in the U.S. and in Europe. The key drivers of tighter credit spreads in July were a combination of:

- Economic activity continuing to pick up, supported by further relaxation of lockdown rules across the globe (optimism somewhat tapered towards the end of the month as some countries halted further easing of restrictions due to the rise in the number of new COVID cases).

- A positive technical backdrop for credit markets (strong demand for credit evidenced by inflows into credit funds and central banks continuing to buy bonds, against a backdrop of limited primary supply, as we moved into a typically quiet summer period and companies entered Q2 earnings blackout periods).

- No major unexpected themes or negative surprises from Q2 earnings season (thus far).

Market Outlook

Corporates have responded to the Coronavirus by focusing on cash and improving liquidity. This has resulted in a combination of strategies including equity raises, corporate debt issuance, dividend reductions and lower capex expenditure. This is a rational management response to the uncertainty over the economic outlook, although it has not been uniform across all sectors, with the more cyclical sectors responding more given the greater business risks they face.

Securitized Products

Mothly Review

July was essentially a repeat of June in the securitized markets as the securities continued to recover, with consumer credit, office-backed commercial real estate and housing-related sectors all experiencing spread tightening. However, sectors most directly impacted by COVID-19, such as hotel and retail shopping commercial-backed securities (CMBS), continued to perform poorly during the month. U.S. economic conditions remain weak, even if they are improving, with more than 50 million people continuing to claim unemployment benefits and unemployment remaining above 11%.

Outlook

As AAA spreads have now retraced 80-90% of the COVID spread widening, we believe it’s unlikely they’ll tighten materially further given current credit conditions. On the other hand, AAA spreads are also unlikely to widen materially given the lower issuance volumes and $100 billion of TALF money poised to take advantage of any spread widening. By contrast, lower-rated classes, particularly BBBs and BBs, still have significant room to tighten further. While we have seen some spread recovery over the past three months, lower-rated securitized spreads remain much wider than February levels and have lagged the recoveries experienced by the corporate credit sectors. Fundamental data remains critical, and the markets are closely watching for signs of material credit deterioration resulting from increased joblessness, but so far the performance deterioration has been very mild for most sectors and far better than expectations.

1 Source: The European Central Bank, as of July 31, 2020 July 31, 2020

2 Source: Bloomberg, as of July 31, 2020

3 Source: JP Morgan, as of July 31, 2020

4 Source: JP Morgan, as of July 31, 2020

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: