Schroders: Is the Second Great Depression approaching?

In the first of a two-part debate between Schroders’ economists, Emerging Markets Economist Craig Botham presents the case that the global outlook is bleak and that we are on the verge of a deep depression akin to that which hit in 1929.

14.07.2015 | 11:08 Uhr

Are we on the cusp of another Great Depression?

The question might seem risible; after all,the US economy is evidently full of health, even if the data are somewhat volatile. However, the Great Depression was signalled well before the US began to slow in 1929. It was visible in Australia as early as 1927, and began spreading through the periphery (today’s emerging markets and commodity producers) in 1928 and from there into the global economic core.

The cause of the first Great Depression, though, is still debated. The esteemed economists Milton Friedman and Anna Schwartz blamed monetary policy, Charles Kindleberger attributed it to systemic instability, Alvin Hansen saw it as a case of secular stagnation, and others blamed the Gold Standard. There are parallels and similarities to many of these arguments today. As the saying goes, "history does not repeat, but it does rhyme".

Blaming the Fed

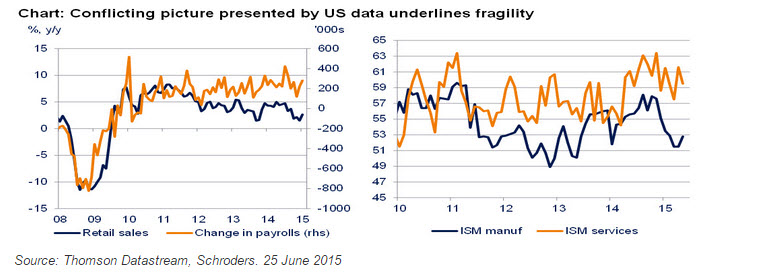

A relevant starting point, given current focus on the Federal Reserve (Fed), is the monetary policy explanation. Friedman and Schwartz argued in A Monetary History of the United States that a policy mistake by the Fed was to blame: Fed tightening from 1928 generated a recession as it came in response not to a stronger economy, but rather to contain financial speculation. The economy was too weak to bear the burden and collapsed, taking the world with it. Today, the Fed is at least focusing on real variables, but the risk is that it tightens in response to the wrong one, focusing on strength in one part of the economy while ignoring weakness elsewhere (chart).

However, the Friedman-Schwartz interpretation has problems; not least that other economies began slowing before the US. Further, the degree of tightening (350 bps from the start of the cycle in spring 1928 to 1929) seems at odds with the severity of the downturn. Barry Eichengreen in "Viewpoint: Understanding the Great Depression" (Canadian Journal of Economics, 2004) resolves this with two factors: the Gold Standard and high capital mobility. With fixed exchange rates, countries had no choice but to hike rates in line with the US, or face reserve losses. Of course, the Gold Standard doesn’t exist today, so a parallel here is harder to draw. However, a number of countries still track the dollar; the IMF - in its 2014 Annual Report on Exchange Arrangement and Exchange Restrictions - estimates that 54 countries maintain some form of peg versus the dollar.

Emerging markets (EM) especially still feel compelled to defend their currencies through rate hikes and foreign exchange intervention, in part because of the problem of dollar-denominated debt. US tightening could still prompt global tightening, given the scale of vulnerabilities in EM. We need only look to the so-called “Taper Tantrum” in 2013 to see an example.

Whacked by the greenback: reliance on the dollar still poses risks

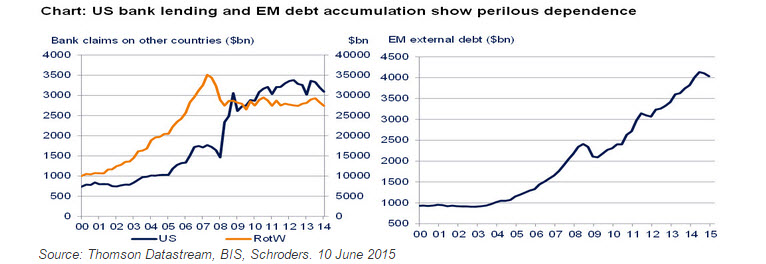

It is useful at this point to consider the historical example; post-war lending by the US reached sizeable amounts in 1922 and hit new highs of over $900 million in 1924. Today, we have seen US bank claims on the rest of the world rise considerably since the financial crisis, and EM corporates have become more reliant on foreign debt (chart). In the 1920s, this coincided with inventory accumulations of commodities, market bubbles, and political tensions. As today, growth put only modest pressure on resources; wages grew slowly and commodity prices fell from 1926 to 1929.

It does not take a great boom to generate a Great Depression.

The economies first hit in the 1920s were typically those which had been engaged in large scale capital importing to finance a trade imbalance. There was a high reliance on US capital loans, something which finds a parallel today in the importance of dollar liquidity. In the summer of 1928, roughly a year before the US slowdown, the Fed tightened policy, choking off US foreign lending. Net portfolio lending by the US, $1 billion in 1927, turned negative in 1929. Debtors were forced by the Gold Standard to move from a current account deficit to surplus, requiring tighter policy to restrict demand. Though we no longer have the Gold Standard (so currency depreciation should help correct deficits), we need only look at central bank actions around the world to see that there are few, if any, non-managed currencies, and plenty of current account deficits. So called “excessive” weakness is combated, regardless of the impact on the current account. The world is not so very different after all.

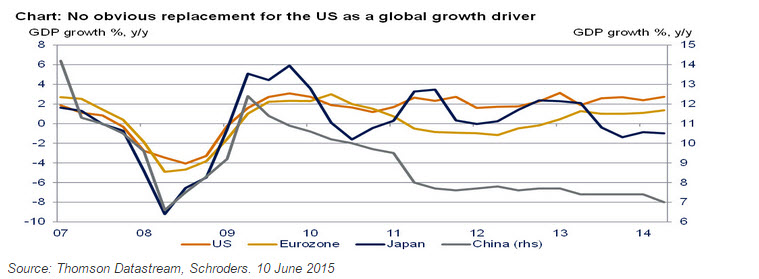

Of course, another parallel with the above is economic weakness elsewhere. The eurozone, Japan, and much of EM are struggling for growth. Even China is slowing (chart below). The US is left as the only global growth motor – a position the IMF recently warned is highly risky. For the US, as in the 1920s, a sudden downturn in fortunes now could precipitate a rapid decline; output cannot be sustained by shifting to foreign demand. The weakness elsewhere will also act as a drag on US growth, not only through weaker trade but also through the exporting of deflation to the US via deliberate devaluations.

Manufacturing deflation: commodity overproduction

A common and seemingly perverse response to lower commodity prices was, and is, higher production. This can reduce average costs, but the end result is that prices fall further as all commodity producers ramp up production. Often this is even government sanctioned; Australia’s “Grow More Wheat” campaign in 1930 in response to a collapse in wool and wheat prices saw acreage duly increased from 18 to 21 million acres. Today, the latest example (in addition to existing subsidies) is China’s 60% tax cut for its iron ore miners, three quarters of whom are losing money at current prices, which have fallen some 70% since February 2011 (Financial Times, April 9 2015). Assistance is also being provided to coal and aluminium producers.

Overproduction saw the prices of commodities relative to manufactured goods fall steadily from their 1925 peak, and collapse dramatically in 1929 as demand plummeted. Some economists argue that a depression in agriculture helped cause the 1929 crisis; farm failures weakened parts of the financial system, leading to tightening credit conditions for commodity producers, which were then forced to draw down overseas balances to defend their currencies and finance economic activity. Alongside falling export earnings, this prompted currency devaluation, exporting the deflation elsewhere. A similar pattern is playing out today in the metals and energy sector, with default risk rising.

The deflationary impact for the world is easy to see. Alongside falling commodity prices, producer price indices (PPIs) have turned negative in a number of economies while headline consumer price inflation (CPI) rates have been depressed, thanks in part to falling import costs resulting from cheaper commodities but also currency weakness in trade partners.

Lower commodity prices should provide a positive income effect, but this was not the experience of the 1920s (nor, it seems, of today). While deflation prompts an immediate response in the country with falling prices - which devalues and restricts trade - the beneficiaries take longer to react. Their spending takes time to increase.

Further, currency depreciation in a deflationary world adds to the problem. The pressure on prices weakens exposed financial corporates, spreading deflation. The impact depends in part on the importance of the cheaper goods; in 1929, commodities accounted for approximately 3/5 of world trade. This share has declined but remains significant, at 1/3 of merchandise trade in 2011.

Holding out for a hero: who leads?

The magnitude of the Great Depression, argued Kindleberger, was because of “British inability and United States unwillingness” to assume economic leadership. We again find ourselves in a multipolar world, where the US, much like Britain in the 1920s, is no longer able to provide global leadership, and its rival – now China, then the US – remains unwilling to do so. Hence we have a lack of co-ordination on policy across the globe and massive current account surpluses in certain countries that refuse to provide demand stimulus to the rest of the world by spending them, and correspondingly large deficits in other countries which look vulnerable to correction. Protectionism, though less noticeable, is still evident: reports point to the persistence of old trade barriers and growth in anti-dumping measures, localisation barriers and other restrictive measures. A World Trade Organization report noted 934 new trade restrictions since the crisis . The overall effect is to increase unemployment and reduce markets for distressed goods, as in the 1920s.

Summing up

The parallels between today and the 1920s are manifold. Weak growth in most of the world, with the US as the sole – and stuttering – motor; great reliance globally on US lending and dollar liquidity at a time when that liquidity looks set to tighten; a global monetary system that ensures the importing of US monetary policy by a significant proportion of countries as measured by their share of global GDP; overproduction and price collapse in the commodities markets; competitive devaluations as economies try to export their deflation; and a lack of global leadership and co-ordination to resolve the problem. Further, policymakers have little ammunition to fight a recession on this scale. Interest rates are near the zero bound in most major economies, and fiscal space is very limited globally. Though not our base case, there seems a real risk that the global economy could take another tumble.

Please check back onto Schroders Talking Point tomorrow when Chief Economist and Strategist Keith Wade will put forward the counterargument.

Diesen Beitrag teilen: