Morgan Stanley: CAR-T Therapy

Welcome to the Edge. Morgan Stanley Investment Management’s Counterpoint Global shares their proprietary views on a big idea that has the potential to trigger far-reaching consequences—ideas such as blockchain, autonomous vehicles, machine learning and gene editing.

01.09.2020 | 08:50 Uhr

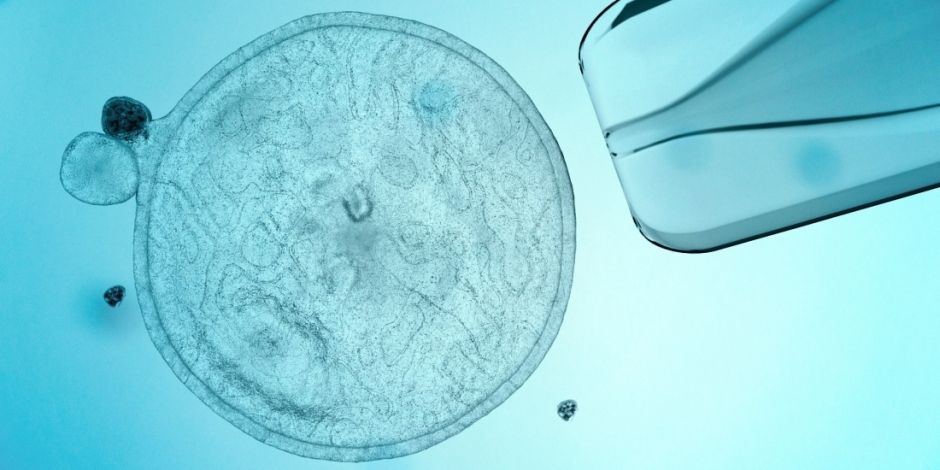

- While first generation chimeric antigen receptor T (CAR-T) cell therapy has shown impressive results curing blood cancers at significantly higher rates than previous therapies, issues such as high costs, complexity of treatment, and potential life threatening side effects have limited their use.

- Next generation CAR-T cell therapy made using pluripotent stem cells seeks to maintain first generation CAR-T cell therapy’s efficacy while reducing the issues that have limited adoption.

- If successful, these advances in stem cell based CAR-T cell therapy could boost adoption and expand the addressable market for CAR-T therapies into earlier line therapies and even into solid tumors while reducing the financial burden of the treatment and improving its safety.

Click on the PDF to read the full report.

RISK CONSIDERATIONS

There is no assurance that a

Portfolio will achieve its investment objective. Portfolios are subject

to market risk, which is the possibility that the market values of

securities owned by the Portfolio will decline and that the value of

Portfolio shares may therefore be less than what you paid for them.

Accordingly, you can lose money investing in this Portfolio. Please be

aware that this Portfolio may be subject to certain additional risks. In

general, equities securities’ values also fluctuate in response to

activities specific to a company. Investments in foreign markets entail

special risks such as currency, political, economic, market and

liquidity risks. The risks of investing in emerging market countries are

greater than risks associated with investments in foreign developed

countries. Privately placed and restricted securities may be subject to

resale restrictions as well as a lack of publicly available information,

which will increase their illiquidity and could adversely affect the

ability to value and sell them (liquidity risk). Derivative instruments

may disproportionately increase losses and have a significant impact on

performance. They also may be subject to counterparty, liquidity,

valuation, correlation and market risks. Illiquid securities may be more

difficult to sell and value than public traded securities (liquidity

risk).

Diesen Beitrag teilen: