Schroders: Rising rates to leave property prospects undimmed

As the UK economic recovery goes from strength to strength, the path and timing of interest rate rises assumes greater importance for financial assets.

16.09.2014 | 13:36 Uhr

Broadly speaking, fixed income assets appear to be the most vulnerable to an increase in rates, while growth assets, underpinned by earnings, appear to be better placed.

For those with an exposure to bonds, a key question is how to reduce their portfolio’s sensitivity to rising interest rates. One asset they might wish to consider is commercial property. Property has both fixed income and equity characteristics so while exposed to interest rate movements; it is also responsive to improvements in the general economy. In our view, the commercial property market seems fairly priced.

UK commercial property at fair value

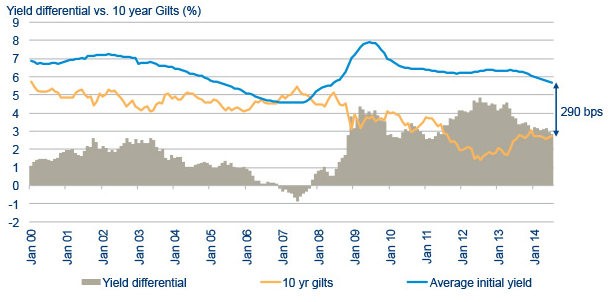

Broadly speaking, UK commercial property appears to be well positioned to absorb a small rise in interest rates. We take comfort from the fact that in contrast to most other financial assets, property yields have not re-priced to adjust to the current and very low interest rate environment. As an example, the spread over 10 year gilts is currently around 3%, well above the long-term average yield gap of 2% (see chart 1).

Chart 1: Property appears to be sensibly priced relative to gilts

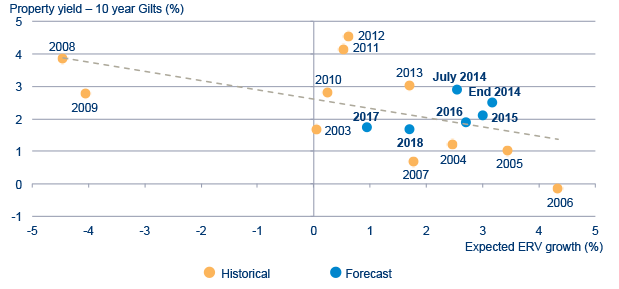

Chart 2: Rental growth should temper the impact of rising gilts

Note: The long term average yield gap between property and gilts is calculated over 15 years.

Source: FT, IPD, Bloomberg, Schroders, August 2014.

As property yields fall, this spread may narrow. However, the long term average suggests property values are able to absorb a 1% contraction in the spread, even with the possibility of rising interest rates. In any case, when factoring interest rates, the long-term correlation between property yields and long-dated gilts remains weak (0.02%)* . Investment grade corporate bonds, an insurer’s default asset, by contrast are 0.60% correlated to gilts**.

The importance of rental income growth expectations

Property has fixed income cash flow characteristics – i.e. the fixed rental income the tenant pays to the landlord. Importantly, it is also a growth asset, with owners of property able to increase the level of income they receive.

In normal circumstances, property income rises as interest rates rise. This is partly due to the property rental cycle, which coincides with the broader economic cycle. As occupiers become more profitable and demand for commercial floor space increases, the open market rental value of properties usually rise. During periods of strong economic growth, property investors are often prepared to tolerate a lower yield spread over gilts because they are confident that the rental income on which the yield comparison is made will grow, adding to returns. This is opposed to corporate bonds, whose fixed coupons decline as yields rise.

We illustrate the importance of rental growth expectations to property valuations in chart 2 above. We compare the spread between property and bonds, relative to rental growth expectations (based on estimated rental growth in the preceding 12 months and the forecast rental growth for the next 12 months). The two main explanatory variables for property pricing are the spread over the risk free rate and rental growth expectations, therefore the line of best fit should provide a good guide of fair value.

In this chart, history illustrates that the relationship between property yields and bond yields is weak. As mentioned, investors generally tolerate lower property yields in periods when rental values are strongly rising (typically when the economy is strong, interest rates and bond yields rise) and require higher yields when they are not (that is, when economies are weak and interest rates and bond yields falling). It shows that property looked expensively priced in 2006 notwithstanding strong rental growth, with average property yields below long-dated gilts. Despite the rapid re-pricing we saw in 2007 and 2008, the spread over gilts was still not sufficient to tempt investors back, largely because rents were still falling by approximately 4% per annum. Property prices started to look attractive in 2011/12 when rents started to stabilise and the spread over gilts rose to over 4%, more than twice the long-run average.

Our analysis suggests that even factoring in further yield compression in 2014 and 2015, given the simultaneous appreciation that is forecast in rental values, property will continue to look fairly priced.

A positive outlook for rental growth

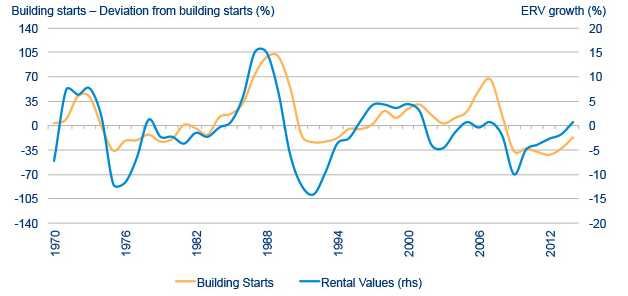

Firstly, a number of indicators suggest that the UK economy will continue to grow at trend levels over the coming 2-3 years, which should underpin rental income. Secondly, supply and demand dynamics remain supportive, and we are unlikely to see an oversupply of floor space in the coming years. As chart 3 shows, levels of new development have not recovered since their dramatic cut following the onset of the global financial crisis in 2007. We would not discount a supply response from 2017 as developers respond to the pick up in rental growth, however the current pipeline would suggest this remains subdued. Combining low levels of supply with an improving macro-economic picture, we forecast rental growth of 2-3% over the next five years.

Chart 3: Open market rental values reflect the balance between demand and supply

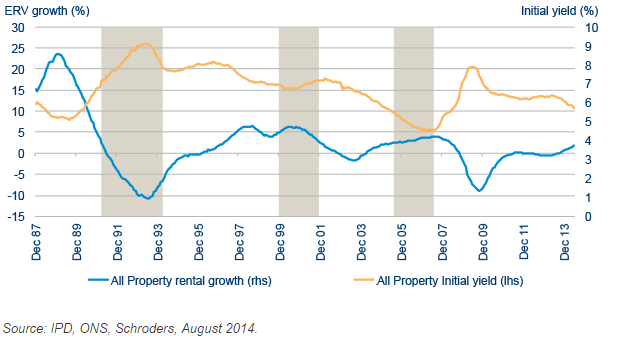

Chart 4: Inverse relationship between rising property yields and rental values

Source: IPD, ONS, Schroders, August 2014.

As chart 4 shows, there is a pronounced inverse relationship between rental growth and yields. Typically, significant upward corrections in property yields (falling prices) occur alongside significant downward corrections in rental income.

The shaded bars highlight the three major yield corrections that we have seen over the past 26 years, all of which have been accompanied by a large fall in open market rental values. The cause of these pronounced corrections have been major economic shocks, implying that the outlook for the growth component of property investment (rental appreciation) is little influenced by the relative valuation of bonds and property or the spread between the two. As we do not anticipate a major economic downturn, there appears to be little reason to expect a pronounced upward move in property yields (fall in prices). The outlook for bonds at this juncture, on the other hand, is more circumspect.

A selective approach to property investing

Although we think the UK commercial property market as a whole looks well placed to withstand a rise in interest rates, some areas of the property market look more vulnerable than others. In particular, we hold concerns in low-yielding, income-secure real estate. A number of these assets were acquired as bond substitutes, and benefited from the move to lower bond yields. We consider this area of the market to be more vulnerable to a rise in interest rates and as such, seek to avoid them.

The potential re-pricing of long-lease assets as long dated bond yields rise is a further area of concern. However, our research suggests increasing long dated bond yields are likely to have only a relatively small impact on property yields because of the buffer property assets have as well as the likely increases in rental income on the back of economic growth.

We believe that commercial property is an attractive investment proposition in this low and rising interest rate environment. It is fairly valued and in addition to its bond-like series of contractual cashflows and its low correlation to gilt yields, future returns look well supported by strong rental growth prospects.

* IPD monthly equivalent yields v UK Government 10 year yields, August 2014

** Bank of America Merrill Lynch BBB corporate bond yields v UK Government 10 year yields, August 2014

Diesen Beitrag teilen: