BNP Paribas AM: Plans for the US tax reform become clearer

The first week of November did not bring many surprises, as global equities continue to climb and reach historically high valuations. The House of Representatives approved a draft tax reform that should stimulate the economy with a series of tax cuts and simplify the tax code.

08.11.2017 | 12:22 Uhr

Global equities clinging to a rising trend and progressing to historically high valuations, not unlike the latest iPhone by Apple. Shares in the Californian company actually did well thanks to the release of the new phone and supported the performance of the S&P 500 index. Robust earnings reports also contributed to the positive momentum in Europe and Japan, with many figures exceeding market expectations and amid reports of double-digit earnings growth.

In commodities, crude oil prices continued to rise. This was fuelled by news that the crown prince of Saudi Arabia launched a series of anti-corruption arrests firming his grip on power, but also risking what some analysts see as political instability in the largest OPEC producing nation. Brent was trading at above USD 60 a barrel at the time of writing.

The volatility indices have remained low: in Europe, the V2X hovered at around 12 and in the US, the VIX finished the week at below 10. Several events could have injected a dose of volatility into the markets, but failed to do so. In the US, the House of Representatives agreed on a draft bill on tax reform aimed at slashing corporate tax to 20%. President Trump announced his pick for the next chair of the Federal Reserve: Fed governor Jerome Powell will replace Janet Yellen next February. In Europe, the Bank of England raised interest rates for the first time in a decade. Meanwhile, the turmoil over Catalonia’s quest for independence is not over as a Spanish judge issued a European arrest warrant for regional president Puigdemont who fled to Belgium.

BANK OF ENGLAND: CREDIBILITY ISSUES OVER FIRST RATE RISE IN 10 YEARS

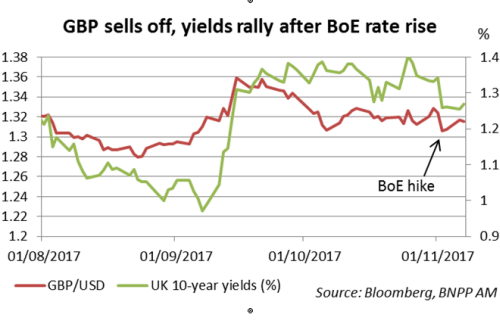

As telegraphed, the Bank of England raised interest rates for the first time in a decade and while the decision did not surprise markets, the central bank’s cautious tone and the fact that two out of seven policymakers opposed the decision was thought-provoking for many market participants.

Indeed, the previously hawkish tone of the BoE had induced many investors to price in not only one rate rise, but a whole tightening cycle running into 2018. As a result, the market reaction was the opposite of what a rate rise usually implies: the gilt market rallied and sterling sold off. That said, as our Macro Team notes, the BoE still managed to tighten financial conditions compared to August levels.

Even though UK inflation has picked up, we still think, along with our Macro Team, that this rate rise is a mistake. Firstly, we believe that most of the current inflation stems from a weaker sterling pushing up import prices. This currency pass-through effect is temporary and should not be sustainable. What counts is domestically generated inflation (DGI), which has remained weak.

Looking at unit labour costs or unit wage costs as a proxy for DGI, the pressure appears to be quite muted. As pointed out by the two BoE committee members who opposed the increase: “Recent experience suggested that wage growth could continue to be less responsive to falling unemployment than past experience would suggest”. Moreover, Brexit-related uncertainties would favour cautious rather than precipitated financial tightening. All in all, we believe the BoE’s credibility in terms of pursuing a proper tightening cycle has been hit. Market participants have started to reprice assets, reflecting what looks like a ‘one and done’ rate rise.

US TAX REFORM: PLANS ARE BECOMING CLEARER

The House of Representatives agreed on a draft tax reform proposal seeking to stimulate the economy with a series of tax cuts, while simplifying the tax code. Key measures include lower taxes on companies, households and pass-through entities. The Senate will present its own version of the bill this week.

Several controversial points are expected to be fiercely debated. Measures such as the repeal of the state and local tax deduction or the cap reduction of mortgage interest deduction on new home sales will require great negotiation skills to gain passage, even within the Republican party. Lobbies usually on the Republican side do not support these plans. The National Federation of Independent Business contends that the tax cut on pass-through entities would favour only the wealthiest and not small businesses. Pass-through entities allow business owners to have business profits taxed as personal income, so the proposed reduction would benefit only those who are currently in the highest tax bracket.

Other powerful lobby groups in Washington, such as the National Association of Homebuilders, oppose the bill as it would reduce the incentive to own a home and hurt developers. When it comes to the reconciliation process, we believe the final bill will have to include ways to fund the reform without widening the deficit. Although the Wall Street Journal reported that the tax law changes would be permanent, our Macro Team believes that they will need to include expiry in 10 years’ time for them to make it through the reconciliation process.

ASSET ALLOCATION:

LONG AUD BONDS VERSUS US TREASURIES NOW FULLY CLOSED

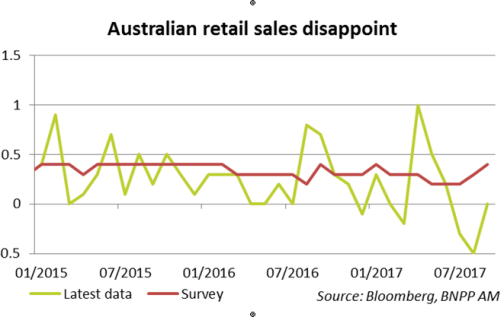

We took profits on the remaining half of our long Australian government bonds versus US Treasuries trade. As a reminder, we had opened this position in anticipation of yield convergence. On the one hand, we had expected Australian yields to fall since most of the positive economic news had already been priced in. On the other, we assumed that the US market had discounted any bad news, with sluggish inflation and a dovish Fed leaving room for an upside surprise in yields. Yields continued to converge, notably driven by news of disappointing retail sales in Australia in September (flat versus an anticipated rise of 0.4% MoM). This position is now fully closed.

We are underweight duration, particularly in European bonds, as we expect the ECB to be one of the first major central banks to place greater emphasis on prudent management of financial markets.

In currencies, we remain long USD versus EUR. Over the medium to long term, we see the USD strengthening, especially once the Trump administration starts implementing reforms and as the Fed proceeds with its monetary policy normalisation plan.

On real estate, European stocks have rallied significantly this year, while US real estate has lagged. This encourages us to maintain our overweight in US real estate as we expect this divergence to reverse over the coming months amid a pick-up in demand for US real estate.

Diesen Beitrag teilen: